Achieving value for money through procurement Part 1: DFID’s management of its supplier market

1. Purpose, scope and rationale

This review is the first in a series of three planned reviews of DFID’s procurement of goods and services for the aid programme. This first review concerns DFID’s management of its supplier market, and how its decisions influence the pool of suppliers able to bid successfully for DFID contracts. The second review will assess whether DFID maximises value for money through its tenders, looking at the quality of DFID’s tendering processes and how it maintains a fair and competitive process securing best value from suppliers. The third review will examine whether Payment by Results in procurement increases value for money.

This will be a performance review, exploring how well DFID ensures value for money in the management of its supplier pool. We have chosen to conduct a performance review because procurement is a core business process that is central to DFID’s commitment to achieving value for money from its aid investments.

The review will provide Parliament and the public with an assessment of DFID’s ability to attract the best suppliers with the required skills at competitive prices, whether it achieves an appropriate level of diversity amongst its suppliers in terms of geographical spread, size and type, and whether it ensures that its large suppliers are accountable. It will also consider whether DFID’s approach to its suppliers promotes its cross-cutting policy objectives in areas such as environmental standards, anti-corruption, transparency and ‘leaving no one behind’,1 and whether DFID captures and uses learning and knowledge from its interactions with suppliers to improve its use of suppliers and its management of its supplier market over time.

The review will look at the management of the market of potential suppliers (including firms and non-governmental organisations (NGOs)) for DFID bilateral aid. It will analyse DFID’s procurement in recent years, to identify trends and patterns in contract size, the suppliers to which contracts are awarded, and, so far as data permit, the sub-contractors used by these contractors in delivering their contracts. The review will focus mainly on the procurement of services in relation to aid programmes where the value of the services is above the threshold at which the UK public procurement regulations and European Union Procurement Directives2 apply (currently £106,047 – see Box 1). The review will also examine trends in the supplier market for smaller contracts and the opportunities for smaller suppliers to contribute to the delivery of contracts above the threshold, for example through consortia or as sub-contractors.

The second review will examine the conduct of tender exercises, so this will not be covered in this first review. Nor will this review cover delivery through multilateral international organisations, which was examined by ICAI in 2015;3 the procurement of goods and equipment for DFID’s own use; or the choice of delivery mechanism (i.e. procurement vs other options), except to the extent that the factors determining such choices may be an input to DFID’s management of the supplier market.

The review is timely because DFID spending via contracts represents 13% of its total spend4 and equates to some £1.34 billion a year.5 This review will follow up ICAI’s 2013 report, DFID’s Use of Contractors to Deliver Aid Programmes.6 It will also take into account findings of the recent inquiry by the International Development Committee (IDC)7 and internal review work currently underway in DFID itself.

2. Background

In 2015, DFID spent just under £9.8 billion on Official Development Assistance (ODA), 80.5% of the UK’s total ODA spending in that year (£12.1 billion).8 Around 60% was bilateral aid through a range of delivery channels,9 which included current spending of some £1.34 billion a year through contractors.

DFID uses contractors for many purposes. These include providing operational support to DFID managed projects, the design and delivery of projects, and advisory work, such as evaluating development projects. In some cases contractors also manage funds on DFID’s behalf, disbursing funds to third parties such as NGOs.

ICAI’s 2013 report, DFID’s Use of Contractors to Deliver Aid Programmes, reported that the proportion of DFID spending through contractors had varied between 7.4% and 11.9% over the previous seven years. The current proportion has increased since then to 13%, and in cash terms, due to the increase in total DFID spending, spending through contractors has roughly doubled over this period.

The growth of expenditure has been accompanied by expressions of concern on a number of topics, as noted by the IDC.10 The concerns raised include the level of contractors’ costs and profits, contractors’ ethical conduct, the large share of the market taken by a small number of large suppliers, and the small proportion of contracts won by contractors based in the developing world.11 In December 2016, the Secretary of State told the IDC that she had instructed her officials to undertake a review of the Department’s relationship with, and expectations of, its suppliers. The Committee itself has undertaken an inquiry into the Department’s use of contractors, publishing its report in April 2017.12 In addition, in February 2017, it published a report on the conduct of one of DFID’s largest contractors.13

DFID works within a legal and policy framework common to UK government departments (Box 1). In recent years, DFID has introduced a number of innovations in the management of its supplier market. It now has in place five framework agreements to provide simplified procurement arrangements for commonly procured services, and has access to a sixth framework managed by the Foreign and Commonwealth Office. It has established a programme of Key Supplier Management, under which selected major suppliers receive focused management by the Department across their portfolio of contracts. It currently includes 13 suppliers, who collectively represent just over half of the Department’s spending with suppliers.14 The Department has also articulated a ‘Procurement and Commercial Vision’, which focuses on three main themes: supporting DFID delivery through a first-class procurement and commercial service within DFID; maximising and shaping markets; and strengthening its commercial influence and impact on the wider sector.

Box 1: The legal and policy framework governing DFID procurement

All procurement of services above the ‘EU Threshold’ (currently, £106,04715) is managed by DFID’s Procurement and Commercial Department. It is governed by UK public procurement regulations and European Union Procurement Directives.16 These rules require fair, open and transparent international competition. Crown Commercial Services has produced a range of guidance to support implementation of these regulations,17 while the Government Commercial Function aims to increase the commercial capabilities of the Civil Service and has published Commercial operating standards for Government.18 The value for money principles applicable to public procurement are set out in two HM Treasury documents: Managing public money and The Green Book.19 DFID has set out additional principles to guide procurement in its Smart Rules, its Procurement and Commercial Vision and its code of conduct for suppliers.20

3. Review questions

The review is built around the evaluation criteria of relevance and effectiveness.21 It will address the following questions and sub-questions:

Table 1: Our review questions

| Review criteria and questions | Sub-questions |

|---|---|

| 1. Relevance: Does DFID's approach to managing its supplier market support the objectives and priorities of the aid programme? |

|

| 2. Effectiveness: Does DFID's management of its supplier market support value for money? |

|

| 3. Effectiveness (Learning): Does DFID capture and use learning and knowledge from its interactions with suppliers to improve its use of suppliers and its management of its supplier market over time? |

|

4. Methodology

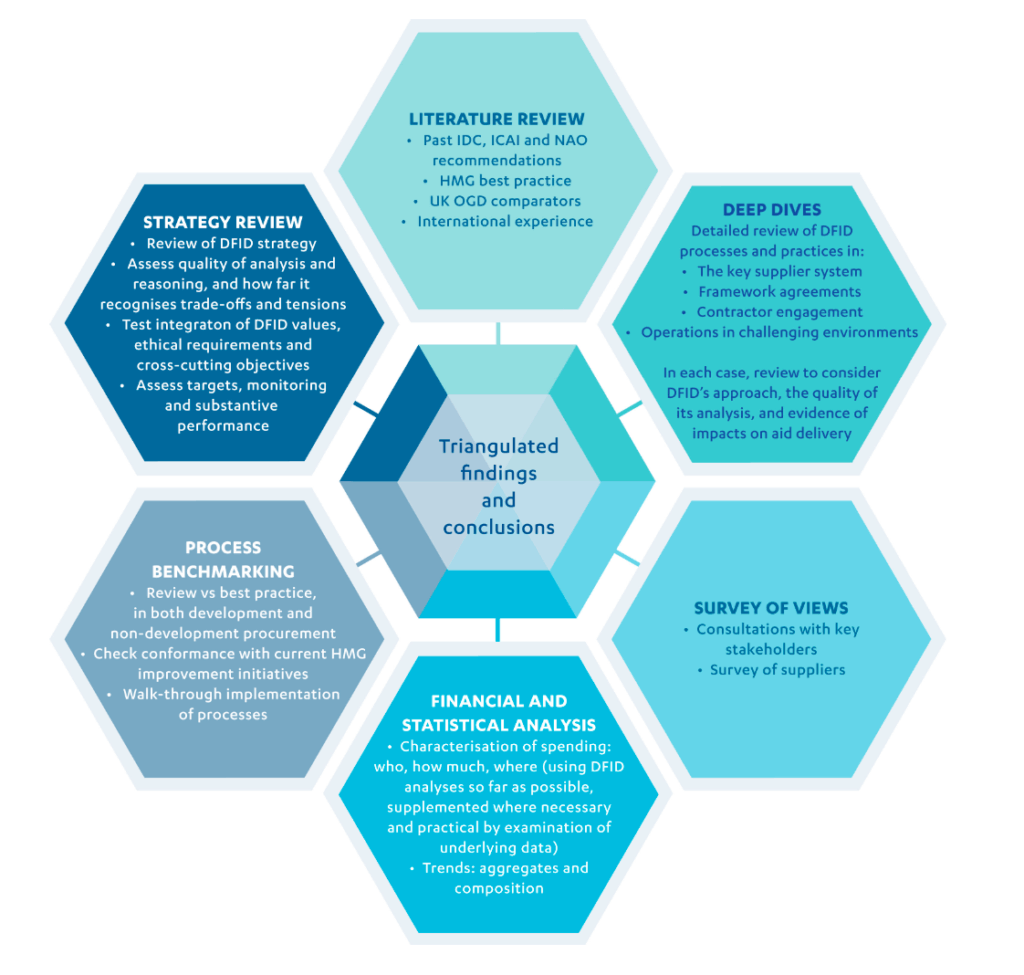

Our methodology will consist of a series of mutually reinforcing components as illustrated in Figure 1.

Components 1 and 2: Strategy review and process benchmarking. The review will look at DFID’s supplier management system and processes, including supplier selection and contract management, to consider their relevance and effectiveness. In addition to considering the efficacy of DFID supplier and contract management capabilities, the review will consider:

- use of direct and framework contracts for procurement in sectors and thematic areas

- management and oversight of key suppliers

- ensuring compliance with the cross-cutting obligations of the DFID supply chain, including conformation with DFID’s code of conduct and assessment/monitoring for any cartel or similar activity

- efforts to ensure diversity in the supply chain and preserve access for small and medium-sized enterprises (SMEs), NGOs and suppliers from developing countries

- how well the departmental supplier management and programme delivery functions work together

- how well DFID captures learning and lessons from wider best practice, including across other government departments, and adapts its processes in response.

Component 3: Financial and statistical analysis. Analysis of DFID’s contract data to identify patterns and trends over recent years, for example in the size of contracts and supplier profiles; and analysis of market trends, for example in market concentration and unit costs of suppliers’ inputs (e.g. hourly fee rates for experts) and outputs. We will build on DFID monitoring in these areas, supplemented by our own additional analysis of underlying data.

Component 4: Survey of views. Our consultations will include private sector and civil society organisations. Our sample will include suppliers who are: a) UK-based; b) from other member countries of the Organisation for Economic Co-operation and Development (OECD); and c) from developing countries. We will solicit input from DFID’s existing suppliers and framework holders. This will include key suppliers, and small and micro suppliers. We aim to include suppliers with longstanding relationships with DFID, suppliers who are seeking to win work with DFID for the first time, and suppliers that have bid unsuccessfully for DFID work to the extent that details of these entities are available from DFID. Entities will be categorised by type of organisation, location and size of their DFID portfolio. In consulting suppliers, we will take a two-stage approach: a short web-based survey across the whole group to provide fully representative data, followed up by more detailed interviews with a purposive sample of suppliers to probe selected issues in depth.

Component 5: Deep dives. We will supplement the high-level strategy review and process benchmarking with detailed review of DFID process and practice in the selected areas below. In each case, the review will consider DFID’s approach, the quality of its analysis and any evidence available of the impact of DFID’s approach on the delivery of aid. The selected areas are:

- The key supplier system. Review of DFID’s strategies and objectives for the key supplier programmes and of supplier selection in accordance with the objectives. The Cabinet Office Crown Representative system provides a model for how government intends to manage its strategic supplier relationships.22 We will examine high-level monitoring of the programme to assess quality of monitoring and substantive progress against DFID’s objectives. We will follow this up with a more detailed review of DFID’s interactions with selected suppliers to assess the quality of the interaction and whether changes in supplier performance sought by DFID are being achieved. Our survey of supplier views under component 4 will include interviews with both a selection of key suppliers and with significant suppliers that are not part of the key supplier programme (three in each group).

- Framework agreements. Review of DFID’s strategies and objectives for its framework agreements, and examination of high-level monitoring of the programme to assess quality of monitoring and substantive progress against objectives. We will consider whether the frameworks are being used effectively and are providing the benefits expected when they were put in place. To do so, we will use DFID management information where possible but, if necessary, we will supplement this with examination of a sample of items of work commissioned using the frameworks. Our survey of suppliers’ views under component 4 will seek views on suppliers’ experience of the frameworks – both amongst suppliers included within the agreements and others.

- Analysis of contractor engagement. Examination of DFID’s engagement and communication with both its supplier pool and the wider market for potential suppliers, and how this is reflected in the strength of competition that DFID is achieving in its procurements.

- Operations in challenging environments. One of the commitments in the UK Aid Strategy is to allocate 50% of DFID’s spending to fragile states and regions.23 Working in such states poses a range of practical challenges, including a limited choice of suppliers, ensuring the safety of staff and delivering in a volatile environment. The delivery of aid in humanitarian emergencies often poses similar challenges. We will examine DFID’s general approach to using contracting in challenging environments to assess the extent to which DFID’s expectations of suppliers reflect the challenges that suppliers face and whether its risk transfer practices are appropriate to this context. ICAI’s 2016 report DFID’s approach to managing fiduciary risk in conflict-affected environments found that transferring risk to contractors may have the effect of increasing costs, such as when contractors charge higher fees to take on additional risk or to cover the cost of insurance. We will also conduct brief case studies of DFID’s approach to managing its suppliers in two fragile states and/or humanitarian emergencies, using desk reviews and interviews with the relevant DFID offices to assess the impact on the supplier market of the demands of working in challenging environments and assess DFID’s learning from this. We will also take account of relevant findings from ICAI’s Somalia review.

Component 6: Literature review. Our methodological approach will include a brief review of the available literature to identify best practice in supplier management. This will include National Audit Office (NAO), IDC and ICAI reports in relation to procurement and supplier management. We will also survey Her Majesty’s Government (HMG) and OECD publications on procurement approaches. Our literature review will look at the main methods used by other major international donors to manage their supplier markets, and we will seek views directly from at least two bilateral donors and one multilateral agency. We will use the findings of our literature review to interrogate how DFID is learning from and integrating best practice approaches into its supplier management policies and practices.

5. Sampling approach

The main focus of the review will be at the strategic level, looking at DFID’s overall supplier management approach and associated business processes. Sampling will therefore not be a major aspect of the methodology, as we will use, so far as possible, aggregates and management information drawn across the whole of the relevant population. Some sampling will be used to identify suppliers for in-depth interviews; this will be on the basis of factors such as supplier size and the potential to shed light on systemic issues. The response rate to our survey will be monitored by category of respondent and, if necessary, a sample of non-responses will be followed up to assess the risk of response bias affecting our findings. No in-country field research is planned.

The timeframe covered in the review will be the period since ICAI’s 2013 report DFID’s Use of Contractors to Deliver Aid Programmes,24 although we may trace the evolution of DFID’s approach over a longer period.

6. Limitations to the methodology

Because this review is one of a series on procurement, it does not seek to provide a comprehensive assessment of value for money through the whole of the procurement process. Its aim instead is to assess the extent to which DFID’s supplier management is contributing to value for money and a culture of continuous improvement, judged by the test of how far this part of the procurement process is achieving the aims and objectives appropriate to it.

7. Risk management

| Risk | Mitigation and management actions |

|---|---|

| The House of Commons IDC has recently published a report on, and DFID is currently carrying out, reviews of DFID's procurement process. There is a risk that DFID may lack the capacity to respond satisfactorily to our work in addition to these reviews. | We are following the progress of both reviews closely. We will seek to avoid placing unnecessary demands on DFID's capacity where this is possible, for example by adjusting the timing of elements of our work. |

| Commercial sensitivity issues restrict access to data. | Team to work in accordance with DFID requirements on information security. |

| Findings cannot be published for commercial sensitivity reasons. | Use of aggregated data and anonymization to limit sensitivity of published information. |

| Individuals working on the review are perceived as having a conflict of interest, damaging its credibility. | Introduction of a peer review panel (see section 8). |

8. Quality assurance

The review will be carried out under the guidance of ICAI Lead Commissioner Alison Evans, with support from the ICAI Secretariat.

ICAI recognises that individuals involved with the review might be perceived as having a conflict of interest, as potential participants in the DFID supplier market. To mitigate against this risk, the review team has been engaged outside of ICAI’s regular Service Provider consortium by Agulhas Applied Knowledge, which is not a supplier for DFID. Other firms in the consortium will not have any input into the review or access to data collected for the review. Furthermore, an independent review panel has been appointed, to assess the methodology and the final report for both quality and independence. The members of the panel will be Annamaria La Chimia (Associate Professor, School of Law, University of Nottingham), Mike Noronha (former Head of Internal Audit at DFID) and Chris Bedford (former Director at the National Audit Office).

9. Timing and deliverables

The review will be executed within four months starting from April 2017.

| Phase and deliverables | Timing |

|---|---|

| Inception phase | January-March 2017 |

| Desk and UK-based research | March-April 2017 |

| Analysis and evidence pack | May 2017 |

| Emerging findings presentation | May 2017 |

| Report drafting | June-July 2017 |

| Publication and dissemination | July-August 2017 |

Footnotes

- Leaving no one behind: Our promise, DFID, January 2017 update, link.

- Public Contracts Regulations 2015, link, of which the most relevant is Directive 2014/24/EU on Public Procurement, 26 February 2014, link.

- How DFID works with multilateral agencies to achieve impact, ICAI, 2015, link. ICAI will publish information on developments since that review in its Follow-Up report in mid-2017, link, and will also consider how DFID decides on allocations between multilaterals in its forthcoming review on DFID’s Approach to Value for Money in Portfolio and Programme Management, link.

- DFID oral evidence to International Development Committee inquiry, 20 February 2017, link.

- House of Commons, Overseas Aid, Written question 65689, link, answered 8 March 2017, link.

- DFID’s Use of Contractors to Deliver Aid Programmes, ICAI, 2013, link.

- International Development Committee, DFID’s use of contractors inquiry, link.

- Statistics on International Development 2016, Table 3, link.

- Ibid, Figure 2.

- DFID’s use of contractors: Call for evidence, International Development Committee, 27 April 2016, link.

- DFID’s Annual Reports and Accounts for 2014–15 reported that British companies had won over 90% of contracts awarded by DFID (section 3.34), link.

- International Development Committee 8th Report of Session 2016–17, DFID’s use of private sector contractors, link.

- International Development Committee 7th Special Report of Session 2016–17, Conduct of Adam Smith International, link.

- DFID written evidence to International Development Committee inquiry, DUC006, link.

- Official Journal of the European Union: EU Procurement Thresholds, link.

- Public Contracts Regulations 2015, link; of which the most relevant is Directive 2014/24/EU on Public Procurement, 26 February 2014, link.

- EU procurement directives and the UK regulations, Cabinet Office and Crown Commercial Services, 2 November 2016 update, link.

- Government Commercial Function, Gov.uk, link; Commercial operating standards for Government, Gov.uk, 2016, link.

- Managing public money, HM Treasury, August 2015 update, link; The Green Book: Appraisal and Evaluation in Central Government, HM Treasury, July 2011 edition, link.

- DFID’s Procurement and Commercial Vision, DFID, April 2016, link; DFID Statement of Priorities and Expectations for DFID’s Supplier and Partner Relationships (including Suppliers; Private Sector Partners, NGOs), DFID, March 2016, link.

- Based on the OECD DAC Evaluation criteria. See OECD DAC 1991, Principles for Evaluation of Development Assistance, link.

- Crown representatives and key suppliers, Cabinet Office, 28 February 2017, link.

- UK aid: tackling global challenges in the national interest, Gov.uk, 2015, link.

- DFID’s Use of Contractors to Deliver Aid Programmes, ICAI, 2013, link.