Mapping the UK’s approach to tackling corruption and illicit financial flows

Executive summary

Purpose, scope and structure

This information note was commissioned in 2019 by the International Development Committee (IDC) to support their inquiry into UK efforts to support Sustainable Development Goal 16. It reviews corruption as a development challenge and does not consider fraud within the UK aid programme, which is a separate issue that ICAI will review in another study.

The note focuses on the period since the 2016 Anti-Corruption Summit hosted by the then prime minister, David Cameron, and maps the UK’s bilateral, international and domestic efforts to tackle corruption and illicit financial flows for the benefit of developing countries. It does not reach evaluative judgments on any specific aid programmes, nor does it seek to conclude if particular interventions are relevant or effective. It does not score the work of the government or provide policy recommendations.

It describes how corruption poses a serious hindrance to development and maps the UK government’s strategies and activities aimed at tackling corruption and illicit financial flows, including a short case study of UK bilateral work in Ghana. Instead of recommendations, the note summarises future lines of enquiry that warrant further consideration.

The international development context

Corruption and illicit financial flows are globally pervasive problems that require sustained and coordinated international action to address them. Corruption refers to the misuse of resources or entrusted power for private gain. It incorporates several related issues including bribery, embezzlement, fraud, collusion, money laundering, extortion and patronage/clientelism. Grand corruption involves top-level officials and business people where the corrupt acts have greater consequences. Illicit financial flows describes money that is illegally earned, transferred or utilised. While illicit financial flows can originate from a range of sources, this information note is principally concerned with flows derived from the proceeds of bribery and theft by corrupt government officials.

The scale of this problem should not be underestimated. Corruption is developmentally damaging to the fabric of society domestically, whether limiting economic growth or access to basic services. We also know corruption and illicit financial flows damage efforts to tackle huge global issues – both developmental objectives such as poverty reduction and the fight against climate change, to global scandals in sports. The impact can be even more nefarious – dictators, arms smugglers and warlords rely on corruption to maintain power and fund violence.

Despite corruption and illicit financial flows being so closely linked, the two challenges were until recently to a large extent addressed separately by international actors. To provide context, in this note we present five broad areas of interventions currently being pursued to tackle corruption and illicit financial flows directly. (1) Prevention and deterrence by strengthening governance and rules, including support to government institutions, and local and global accountability mechanisms. (2) Identification, tracing and asset recovery, including anti-money laundering, financial investigation, social accountability and asset recovery. The process to recover illegally obtained finances is normally a complex, multi-government process. (3) Fostering an enabling environment and normative change, including fostering a rules-based enabling environment for the private sector, tackling bribery, fraud and collusion, and supporting global norms on transparency, openness and accountability. (4) Sanctioning, including penalties for corrupt and illicit financial practices. (5) Evidence generation, which is a necessary component for all of these areas of intervention in order to understand what works to tackle corruption and the underlying drivers of corruption.

UK government efforts

UK aid, through the Department for International Development (DFID), has a long history of working with developing countries to improve their anti-corruption laws and institutions, strengthen public financial management and empower civil society and local communities to hold government representatives to account. The UK also has an important role to play in supporting international initiatives and building global norms, especially given London’s position as one of the world’s leading financial centres and a major provider of corporate services.

In May 2016 the then prime minister, David Cameron, hosted a landmark international anti-corruption summit in London, intending to galvanise a global response to corruption. On the back of this summit, the UK launched its Anti-Corruption Strategy 2017-2022, which describes corruption as a threat to security and prosperity both for the UK and for developing countries. The strategy recognises (i) that politically informed approaches to anti-corruption are needed to tackle underlying incentives, and (ii) that corruption in developing countries is enabled by weaknesses in the global financial system.

To achieve its objectives for the benefit of developing countries, the UK government works at three levels. Domestically – within the UK – the aim is to ensure that the UK is not a safe haven for money stolen from developing countries. This work is largely funded by non-official development assistance (non-ODA), with some exceptions. At the international and transnational level, the UK coordinates its anti-corruption efforts with international bodies, and works to strengthen and change international norms, rules and institutions. This is funded through a blend of ODA and non-ODA. Finally, the UK government works at the bilateral level to tackle corruption in individual developing countries, working with the local host government, civil society and the private sector. This is primarily ODA-funded.

Our summary lines of enquiry

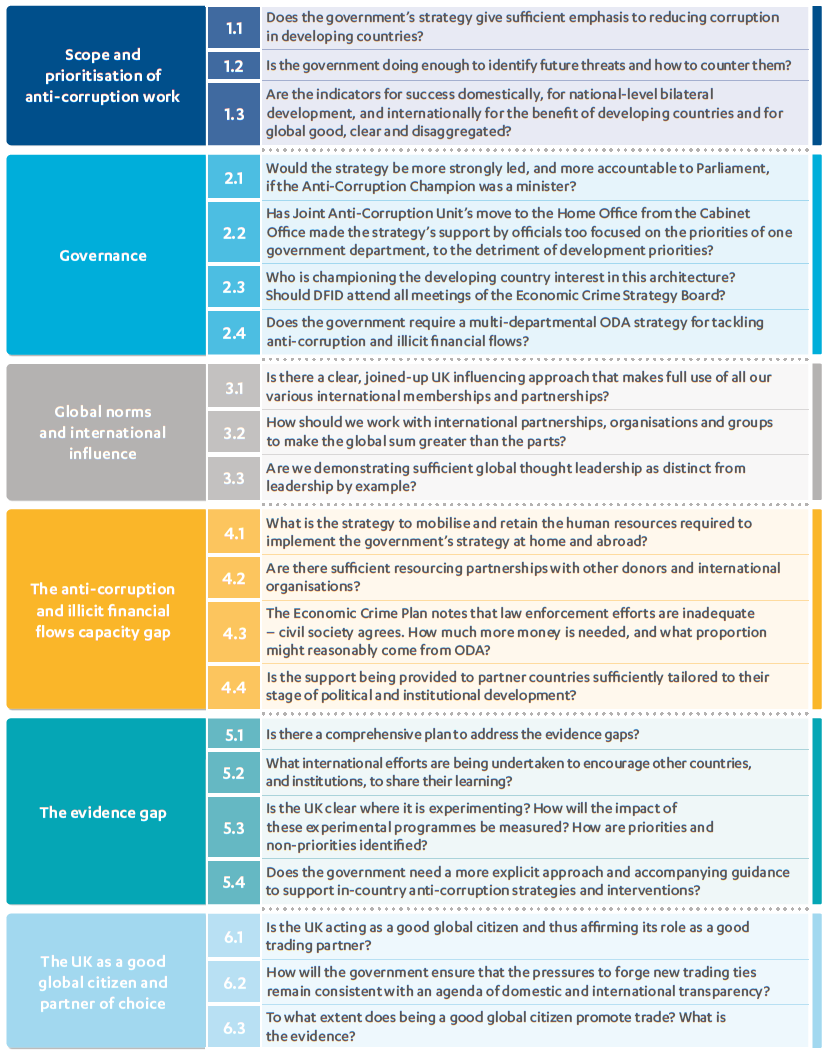

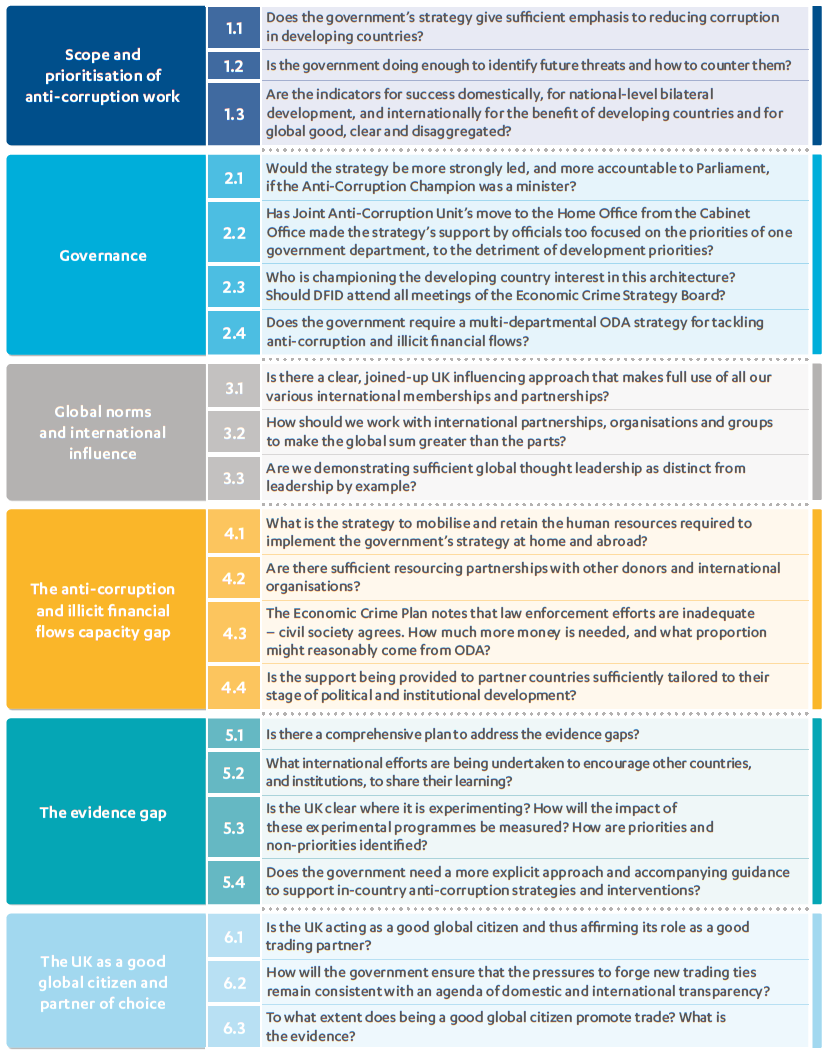

Tackling corruption and illicit financial flows is a complex and difficult endeavour. Our research for this note opened up further lines of enquiry that the IDC, ICAI or other interested parties may want to pursue. We grouped these under six themes: (i) how to delineate the scope of anti-corruption work and make prioritisations, (ii) how the complex sphere of UK anti-corruption strategies and activities fit together and are governed, (iii) what level of resources are required to effectively tackle corruption and illicit financial flows, (iv) how the UK can maximise its approach to influencing and leveraging global partners, (v) how the UK is using and building evidence for this field of work, and (vi) how the UK can best act as a good global citizen and a global partner of choice.

Table 1: Recommended lines of enquiry

Introduction

Corruption and illicit financial flows are globally pervasive problems that are frequently transnational in nature and require sustained and coordinated international action to address them. Corruption is defined as the abuse of entrusted power for private gain, while illicit financial flows relate to money that is illegally earned, transferred or utilised. While illicit financial flows can originate from a range of sources, this information note is principally concerned with flows derived from the proceeds of bribery and theft by corrupt government officials.

Corruption and illicit financial flows are major obstacles to tackling national and international development challenges, whether the fight against climate change or the pursuit of sustainable peace and security – as dictators, arms smugglers and warlords rely on corruption to fund violence. Corruption inhibits inclusive growth and jobs and damages the fabric of society by reducing trust and denying citizens’ access to essential services – whether inflating the price of pharmaceuticals beyond the reach of new mothers and infants or reducing crop prices for independent farmers.

Sustainable Development Goal (SDG) 16 has among its targets to reduce illicit financial flows, bribery and corruption and develop accountable and transparent institutions. Tackling corruption and illicit financial flows is also key to achieving other SDG 16 targets, such as promoting the rule of law and justice for all, strengthening the inclusion and effectiveness of institutions, and ensuring public access to information. With its ambition to “promote peaceful and inclusive societies for sustainable development”, the targets of SDG 16 are central to the achievement of other SDGs.

Figure 1: SDG 16 and the targets most directly related to corruption and illicit financial flows

Measuring the extent of corruption and illicit financial flows is complicated due to the illicit nature of activities, the speed and technological sophistication of the displacement of funds, and the often significant resources of perpetrators.

Globalisation has both intensified the problem of illicit financial flows and created greater opportunities to counter misconduct. Global governance mechanisms including the United Nations Convention against Corruption and the Financial Action Task Force oblige signatories of developed and developing countries to abide by globally established norms and work with one another to prosecute misconduct and assist with the return of stolen assets.

UK aid, through the Department for International Development (DFID), has a long history of working with developing countries to improve their anti-corruption laws and institutions, strengthen public financial management and empower civil society and local communities to hold government representatives to account. In recent years, there has been a growing recognition that such efforts need to be supported by international and UK-facing interventions. In May 2016 the then prime minister, David Cameron, hosted a landmark international anti-corruption summit in London, intending to galvanise a global response to corruption.

Following the summit, the UK launched its Anti-Corruption Strategy 2017-2022, which describes corruption as a threat to security and prosperity both for the UK and for developing countries. The strategy commits to joined-up work across the government and in close collaboration with UK and overseas civil society, the private sector, law enforcement and other partners. The UK and other developed countries are increasingly being called upon to take action at domestic and international levels on money laundering, corporate and individual tax evasion and other illicit financial flows. This is in recognition of (i) the need for politically informed approaches to anti-corruption that tackle underlying incentives and (ii) the fact that corruption in developing countries is enabled by weaknesses in the global financial system.

Purpose and scope of this information note

This information note was commissioned in 2019 by the International Development Committee to support their inquiry into UK efforts to support SDG 16, and is correct as of October 2019. It reviews corruption as a topic and does not consider fraud within the UK aid programme. The latter is a separate issue which ICAI has reviewed as part of its fiduciary risk review and will cover in its upcoming review on protecting UK development aid from fraud. The note focuses on the period since the 2016 summit and will:

- Map UK bilateral, international and domestic efforts to tackle corruption and illicit financial flows for the benefit of developing countries.

- Use the UK’s portfolio of bilateral anti-corruption activity in Ghana as a case study to give an example of UK government work at country level.

- Provide factual information on key trends, opportunities and risks.

- Provide recommended lines of enquiry for the IDC, ICAI or other interested parties on issues that warrant future consideration.

As highlighted throughout the note, the question of which programming and expenditure contributes to the objective of tackling corruption and illicit financial flows for the benefit of developing countries is a matter of significant debate. The government’s work in this area is not delineated along ODA/non-ODA lines. Departments other than DFID are also increasingly engaging on this agenda. As part of the current spending review, the National Crime Agency and the Department for International Trade (DIT) are seeking to increase the ODA part of their budgets to tackle corruption and/or illicit financial flows.

In mapping UK government efforts to tackle corruption and illicit financial flows for the benefit of developing countries, we have applied the following criteria:

- The activities or interventions are being undertaken with ODA.

- The activities or interventions fall under the Anti-Corruption Strategy.

- The activities or interventions which do not fulfil the above two criteria are believed by government representatives to be undertaken for the direct benefit of developing countries or the global public good.

In addition to the 2017-2022 Anti-Corruption Strategy, the UK has produced three relevant cross-government documents: the International Illicit Finance Strategy, the Serious and Organised Crime Strategy, and the Economic Crime Plan. We have largely not focused on the activities falling under these three documents (except where the criteria in the previous paragraph apply), although we have considered how these new strategies link into the governance structures for the government’s Anti-Corruption Strategy.

This note does not reach evaluative judgments on specific aid programmes, nor does it seek to conclude if particular interventions are relevant or effective. It does not score the work of the government or provide recommendations. Instead it highlights recommended lines of enquiry that merit further exploration. These lines of enquiry are drawn from the risks and opportunities identified in the review.

Box 1: Methodology

This information note is based on the following methodology:

- A review of UK government policy documents and guidance, expert literature, and previous ICAI reviews.

- A review of a sample of notable and priority programmes, selected based on evidence provided by UK government representatives.

- Interviews with 29 staff including from DFID, DIT, the Foreign Office, the Home Office, the Joint Anti-Corruption Unit, HM Treasury and the Joint Funds Unit.

- A descriptive mapping of current UK government efforts to tackle corruption and illicit financial flows for the benefit of developing countries and a focused case study mapping of an in-country portfolio.

- Three focus group discussions with a total of 16 participants: two focus group discussions with government staff (eight participants), and one with civil society, the private sector and academia (eight participants).

- An annotated bibliography of literature on tackling corruption and illicit financial flows for the benefit of developing countries.

The note was independently peer-reviewed by a UK academic expert.

Research challenges:

- Data for this note was collected during the 2019 Spending Round and in a period of considerable uncertainty in the UK political context in the lead-up to the planned departure from the European Union, so may date quickly.

- Anti-corruption and international financial flows is not currently a defined portfolio of work under the UK aid programme (at the time of writing).

- There is significant debate around the boundaries of what work being undertaken in these areas is for the direct benefit of developing countries, the mutual benefit of developing countries and the UK, or for global good.

Anti-corruption and illicit financial flows: The international development context

Defining corruption and illicit financial flows and why they matter to development

The term ‘corruption’ refers to the misuse of resources or entrusted power for private gain. Corruption is linked to many forms of malfeasance, including bribery, embezzlement, fraud, collusion, money laundering, extortion, patronage/clientelism and/or nepotism.

Corruption can take place at different levels:

- Petty (or administrative) corruption refers to everyday transactions at the bottom of the chain, where the civil servant interacts with the citizen. It often involves smaller sums of money but can have significant impact on citizens’ access to basic services such as health, education, jobs or housing.

- Grand corruption involves top-level officials and business people. Bribes and financial benefits are bigger and spoils from the corrupt act have greater consequences. It may include tailoring laws and regulations to the advantage of public corporations, other states or companies, or granting large public contracts to specific firms in return for bribes and kick-backs.

- Systemic corruption is when petty and grand corruption is pervasive and entrenched across the political, social and economic system and routinely affects citizens’ lives.

“There is a reciprocal causality between illicit financial flows and corruption. Corruption is a source of illicit flows and an enabler of money laundering, and money laundering allows for the proceeds of corruption to be hidden away and used. The possibility of moving capital illicitly makes corruption easier to engage in.”

Addressing illicit financial flows for anti-corruption at country level, Maria Helena Meyer Dolve and Saul Mullard, U4 Anti-Corruption Resource Centre, 2019

Illicit financial flows are when money or capital is illegally earned, utilised, or transferred between countries. Like corruption, illicit financial flows can involve an array of actors at different levels – across both developing and wealthier countries. Developing countries rich in natural resources, as well as those with high volumes of trade with advanced economies, show particularly high levels of illicit outflows. Financial flows are considered illicit if they originate from legal activities but are transferred illegally, as in the case of tax evasion. Another example is that of proceeds illegally obtained, such as through corruption or organised crime, and transferred into foreign banks, legitimate businesses or high-value assets such as London property. This process is commonly referred to as money laundering.

Identifying illicit financial flows is difficult because they depend on secrecy in the jurisdictions that hide the funds from authorities. A separate, secondary issue is the definitional challenge of determining whether or not an international transfer is ‘illicit’, for example transfer pricing and some more aggressive forms of tax avoidance. In many developing countries, legislation may not be in place or enforced and authorities may have limited capacity to investigate. Furthermore, the relationship between corruption and illicit flows is symbiotic and mutually reinforcing. Corruption causes illicit flows and enables money laundering, which can further drive corruption. Given their scale, a large proportion of illicit financial flows, in particular from developing countries, are derived from grand corruption.

Corruption is widely acknowledged to undermine the development of a country. It affects the quality and provision of public services as individuals illicitly enrich themselves and move proceeds illicitly abroad. This weakens tax revenues and reduces public spending and domestic investment. According to Global Financial Integrity, approximately 20% of each dollar that flows illicitly across borders would otherwise have been paid as import, export or corporate tax revenue to the state. While these figures are estimates, they suggest that of the billions of dollars which illicitly leave developing countries each year, hundreds of millions are lost tax revenues that could have been used to reduce poverty, create, jobs, address climate change, etc. This has a disproportionate effect on marginalised and vulnerable groups and fuels inequality.

Both corruption and illicit financial flows benefit powerful national and international actors and interests across different countries and territories in ways that profoundly undermine the quality of democratic governance and legitimacy and trust in public institutions. The illicit financing of political leaders, political parties and political systems is a major challenge in many developing countries.

Corruption and, with this, illicit flows are likely to thrive in conditions where accountability and checks and balances are weak, and the shared expectation is that others will be corrupt (so there is little to be gained by opting out of such behaviour). It is this systemic form of corruption that is so entrenched and difficult to address. As the example of the UK and other developed countries suggests, building and maintaining effective, accountable and resilient institutions has been a long-term process which has taken decades, and still requires constant renewal and vigilance. It is important to be realistic about what anti-corruption interventions can achieve in the developing world, especially within short timeframes.

Tackling corruption and illicit financial flows

Despite the fact that corruption and illicit financial flows are so closely linked, they have to a large extent been addressed separately by international actors and in individual countries. This twin-track approach has similarly been employed in the developing world, but the outcomes have fallen short of expectations. It is increasingly recognised that there is value in employing a joined-up policy approach at the domestic and international level, involving a multitude of public and private actors (such as national authorities, business and civil society) in addressing illicit financial flows in order to curb corruption and boost tax revenues. The UK is well placed to contribute to such an approach because of its key role in international development and London’s central position in international finance. The following paragraphs set out five broad areas of intervention currently pursued to tackle corruption and illicit financial flows directly.

(1) Prevention and deterrence by strengthening governance and rules: This focuses on public financial management interventions, targeting reform of key government processes, such as procurement, revenue and customs, as well as e-government development. It also includes standard-setting exercises both at the national level in developing countries and internationally. Key among the public financial management interventions are efforts to increase oversight, openness and accountability. For instance, the Open Government Partnership, a multilateral initiative with DFID as the largest donor and strong UK support, aims to secure concrete commitments from national and subnational governments to promote open government, empower citizens and fight corruption.

Deterring illicit financial flows requires strengthening institutions in developing countries and overcoming the capacity constraints, particularly within national tax authorities, to identify, investigate, prosecute and recover assets. A key initiative from civil society supporting capacity development in this area is the Basel Institute on Governance, which through its International Centre for Asset Recovery plays a key role in supporting public authorities.

Supporting oversight authorities, such as audit institutions and anti-corruption agencies, has long been a conventional in-country intervention. At the international level this is usually focused on standard-setting rather than institutional support. This can take place, for instance, through developing Organisation for Economic Co-operation and Development (OECD) guidelines (such as on transfer pricing as well as anti-corruption in general), or be in the form of more comprehensive peer pressure enforcement mechanisms, such as the Financial Action Task Force (FATF). This initially focused on money laundering, and in recent years has further toughened its standards on corruption and tax fraud, and also extended its coverage to terrorism financing and proliferation financing.

(2) Identification, tracing and asset recovery: Anti-money laundering and counter-terrorism financing regimes are effective tools to prevent illicit money from being managed, received and transferred by major financial institutions. These efforts rely on the international standards and recommendations of the FATF, but their effectiveness depends on individual countries complying with FATF requirements such as collecting beneficial ownership information (in other words determining who enjoys the benefits of ownership even if the title to the property or asset is not in their name). Financial investigations undertaken by law enforcement agencies (LEAs) is, in some jurisdictions, also supported by social accountability including national watchdogs and the media.

Asset recovery is normally a multi-government process. In support of authorities, powers can be introduced to recover illegally obtained finances and work within the international system to return stolen assets. Such interventions have a mixed record. Repatriation of stolen assets, moved abroad through illicit financial flows, has proven slow and inefficient, particularly in systems that require conviction-based forfeiture. Non-conviction-based systems and civil prosecutions show more results. The main challenge in asset recovery is linking the asset to criminal conduct, thus allowing for it to be seized and repatriated.

(3) Fostering an enabling environment and normative change: As well as preventing and deterring corruption, it is important to create an enabling environment for the private sector to operate and succeed lawfully. Tackling bribery as a source and use for illicit financial flows relies on international rules set out in the OECD Anti-Bribery Convention. Its strength lies in criminalising bribe payers outside of developing countries, allowing the prosecution of corruptors regardless of where the bribe has been paid. There has been an increase in prosecutions of bribe payers and sanctions have been strengthened, but the level of implementation of the convention differs widely between countries.

A range of activities are taking place to drive normative and behavioural change on anti-bribery. At a national level, this includes transactional interventions such as improving transparency of ownership of corporate entities and trusts, and creating a ‘new national identity’. In Rwanda, part of President Paul Kagame’s anti-corruption policy framed corruption in the bigger picture of how a Rwandan should be defined, whereby being corrupt is seen as going against that which it is to be a Rwandan. Internationally, the aim is to reform international accounting standards and cooperation on tax matters, as well as reforming offshore financial centres.

(4) Sanctioning: Mainly the use of economic and financial sanctions to disincentivise corrupt and illicit financial practices, including the involvement of financial investigations, and promotion of the rule of law targeted at senior business leaders or politicians. These can be employed nationally together with a target jurisdiction, or internationally by external parties as leverage to influence compliance with global laws or standards. An example of this at an international level is the United Nations’ approach to conflict resources where global norms have dictated the development of the Kimberly Process Certification Scheme. This global certification process for rough diamonds has led to the application of sanctions in several African countries which mine diamonds.

(5) Evidence generation: All four of the areas of intervention described above rely on strong mechanisms for evidence generation, given the complexity and rapidly evolving nature of the problem. Of critical concern is generating a context-specific understanding of the different types of corruption threats facing a given country. Such analysis would include identifying sector-specific threats, what works to tackle the underlying drivers of corruption, and what works to close down opportunities for illicit financial flows and access to safe havens for the gains made through corrupt practices. As the evidence base develops, there is a need to work out what indicators should be used to understand the progress being made.

Mapping the UK government’s work

This section provides a brief history of UK aid spending on anti-corruption activities, followed by a mapping of the UK’s current cross-government efforts to tackle corruption and illicit financial flows. It concludes with a case study of Ghana to provide an illustration of the UK’s bilateral work with a developing country partner.

A short history of tackling corruption and illicit financial flows with UK aid

Corruption emerged as a critical issue for aid agencies and non-governmental organisations (NGOs) in the mid-1990s, with increasing consensus on the damage caused by corruption to developing countries. Over the past 20 years, there have been significant changes in the international and domestic legal and conceptual frameworks to tackle corruption, and corruption has become a significant focus of overall donor efforts.

2000-05 saw the negotiation and passing of the United Nations Convention against Corruption (UNCAC). UNCAC recognised the importance of both preventive and punitive measures and addresses the cross-border nature of corruption and illicit financial flows. The UK was one of the first to sign and ratify UNCAC in 2003. In addition to promoting international legislation, the UK played a key role in the creation and management of international bodies such as the International Anti-Counterfeiting Coalition (IACC), the Financial Action Task Force (FATF) and the Extractives Industries Transparency Initiative (EITI). These agencies improve international coordination and cooperation to promote anti-corruption global norms and reduce opportunities for corruption and illicit financial flows.

2005-2012 was a period of building on this foundation. In 2006, Hilary Benn was appointed as the first government anti-corruption champion. The Bribery Act was passed in 2010. It was a key breakthrough, setting out that transnational bribery is illegal, in terms which are compliant with the OECD and UNCAC conventions. The Act was ambitious in its scope, covering offences committed by UK citizens in the world, and including significant corporate responsibility provisions. There was increased focus from law enforcement on politically exposed persons (in other words, someone who has a high-status political role or function), tax havens and tax transparency.

Recognising the significance of illicit financial flows for developing countries, DFID brought together the Metropolitan Police, the City of London Police, the Crown Prosecution Service and the Serious Organised Crime Agency in a Proceeds of Corruption Unit. The objective was to provide a coherent law enforcement platform, to tackle cases involving money laundering in the UK resulting from corruption of officials in developing countries, bribery involving UK-based companies or nationals with an international element, and cross-border bribery where there is a link to the UK. A landmark case for the unit was the conviction in 2012 by a London court of James Ibori, a former state governor in Nigeria, for embezzling at least £50 million of government funds. Since the start of this programme, 30 people and companies have been convicted, and nearly £800 million of assets from developing countries confiscated or returned. This work has now transferred to the International Corruption Unit, sitting within the National Crime Agency.

This period also saw the intensification of DFID-led activities to tackle corruption in developing countries. Examples included funding for justice sector reform and support to anti-corruption organisations and institutions in Nigeria, support to the Arab region to effectively implement UNCAC, and analysis of corruption in Kosovo. DFID also funded work closer to home, including a compliance assessment of the Crown Dependencies and the Overseas Territories with UNCAC and the OECD Convention.

2012-19 has been a period of significant UK-facing activity to tackle corruption. The then prime minister, David Cameron, organised the Anti-Corruption Summit in 2016 to bring together the global community to galvanise a response against corruption. UK commitments made at the summit informed the Anti-Corruption Strategy. There is increased awareness of the need for a coherent response in the UK and internationally, resulting in the cross-Whitehall Joint Anti-Corruption Unit (JACU) to coordinate the government response. Recognising that there had been no overarching strategy or cross-government alignment on cross-cutting international illicit finance, the Home Office, HM Treasury, the Foreign Office (FCO) and DFID endorsed a joint cross-government strategy on international illicit finance in 2019. In addition, the cross-government Serious and Organised Crime Strategy was published in 2018 and the Economic Crime Plan in 2019.

There is increasing recognition that corruption is both a political and a law enforcement challenge which cannot be addressed by purely technical interventions. The UK has invested in improving the evidence base for anti-corruption interventions, but the evidence of what works remains relatively small. There is a concerted effort to build our understanding of what works, and develop evidence cognisant of the political context. The DFID funded Anti-Corruption Evidence programme aims to identify high-impact anti-corruption strategies.

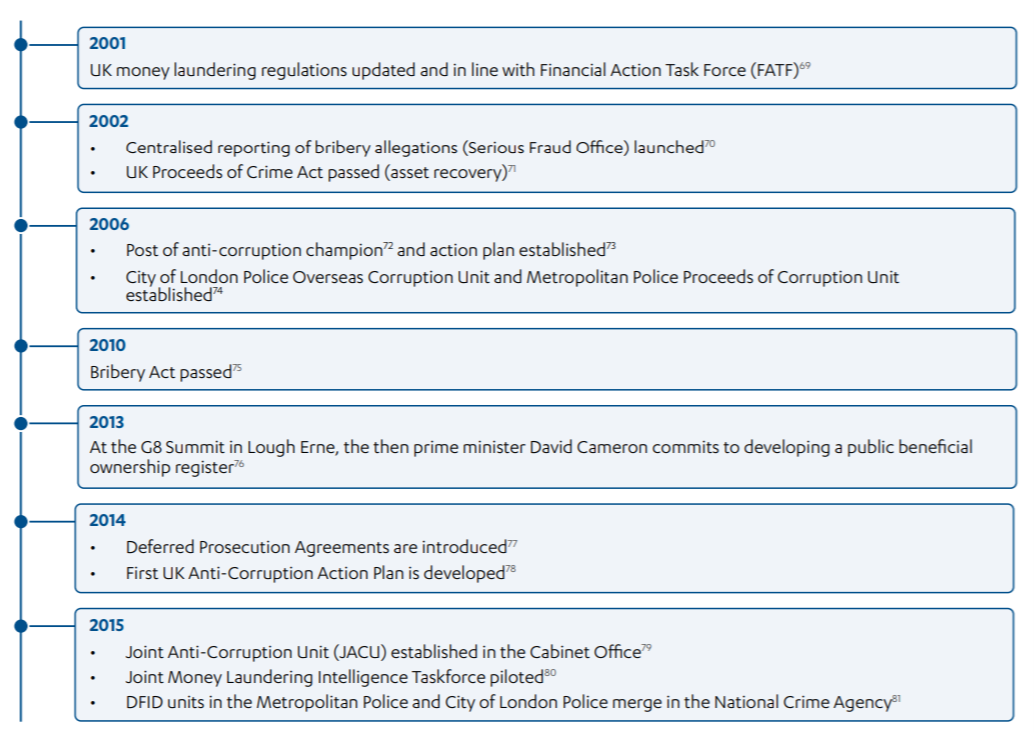

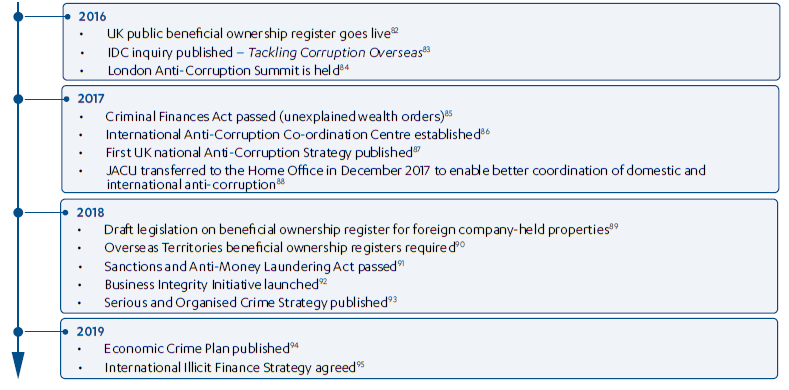

The timeline below sets out key developments in UK policies and strategies to tackle corruption and illicit financial flows.

Figure 2: Timeline of key developments in UK policies and strategies to tackle corruption and illicit financial flows

Mapping the strategies

The Anti-Corruption Strategy 2017-2022 aims to combat corruption in order to contribute towards reduced threat to national security, increased prosperity at home and abroad and enhanced public confidence in the UK’s domestic and international institutions. The strategy contains six priorities, a number of which are particularly relevant to developing countries (see box 2 – those which are particularly relevant to developing countries are in bold). The strategy reiterates the importance of strong cross-government collaboration, and has ambitions to tackle the core drivers of corruption, including those within the UK. The strategy also includes a priority to tackle illicit financial flows, change international rules and norms, and make the UK more hostile to corruption and bribery. In addition, the strategy commits to working with other countries, including developing countries, to combat corruption. Tackling corruption is expected to lead to improvements in the investment climate in developing countries, which is vital for job creation and poverty reduction. Promotion of the international rules based system governing international financial flows is expected to halt illicit financial flows from developing countries so that they can instead be invested in development.

Box 2: Anti-Corruption Strategy six priorities:

- Reduce the insider threat from corrupt officials in high-risk domestic sectors such as UK borders, prisons and ports

- Strengthen the integrity of the UK as an international financial centre

- Promote integrity across the public and private sectors

- Reduce corruption in public procurement and grants

- Improve the business environment globally

- Work with other countries to combat corruption.

There are three other key strategies supporting the UK’s work to tackle corruption. The Economic Crime Plan 2019–2022 sets out the UK’s intention to enable the public and private sectors to deliver a comprehensive plan that defends the UK against economic crime, prevents harm to society and individuals, protects the integrity of the UK economy, and supports legitimate growth and prosperity. The International Illicit Finance Strategy sets out the UK’s ambition to enhance security, prosperity and the UK’s global influence through strengthening international standards, conventions and norms, reducing the threat of illicit finance and supporting sustainable development. The Serious and Organised Crime Strategy sets out the UK’s aim to protect UK citizens and prosperity by leaving no safe space for serious and organised criminals to operate within the UK and overseas, online and offline. All strategies and plans have both strong domestic and international strands.

The strategies note the importance of targeting and prioritisation. The Anti-Corruption Strategy commits to improving our understanding of corruption to ensure we are able to effectively target our effort and resources. The International Illicit Finance Strategy notes that much of the strategy is deliverable at the basic level with available resources, but higher ambition delivery will require additional resources, and a balance between meeting domestic and international priorities.

There are clear synergies and links across the four documents. The documents acknowledge that underpinning all strategies are a range of activities undertaken by government and law enforcement, to build the political will and capability required to tackle corruption and illicit finance both domestically and overseas. JACU, the International Corruption Unit and the International Anti-Corruption Coordination Centre work across both the anti-corruption and International Illicit Finance Strategy. All strategies include planned activities for the benefit of developing countries. There is no separate ODA strategy for tackling corruption and illicit financial flows.

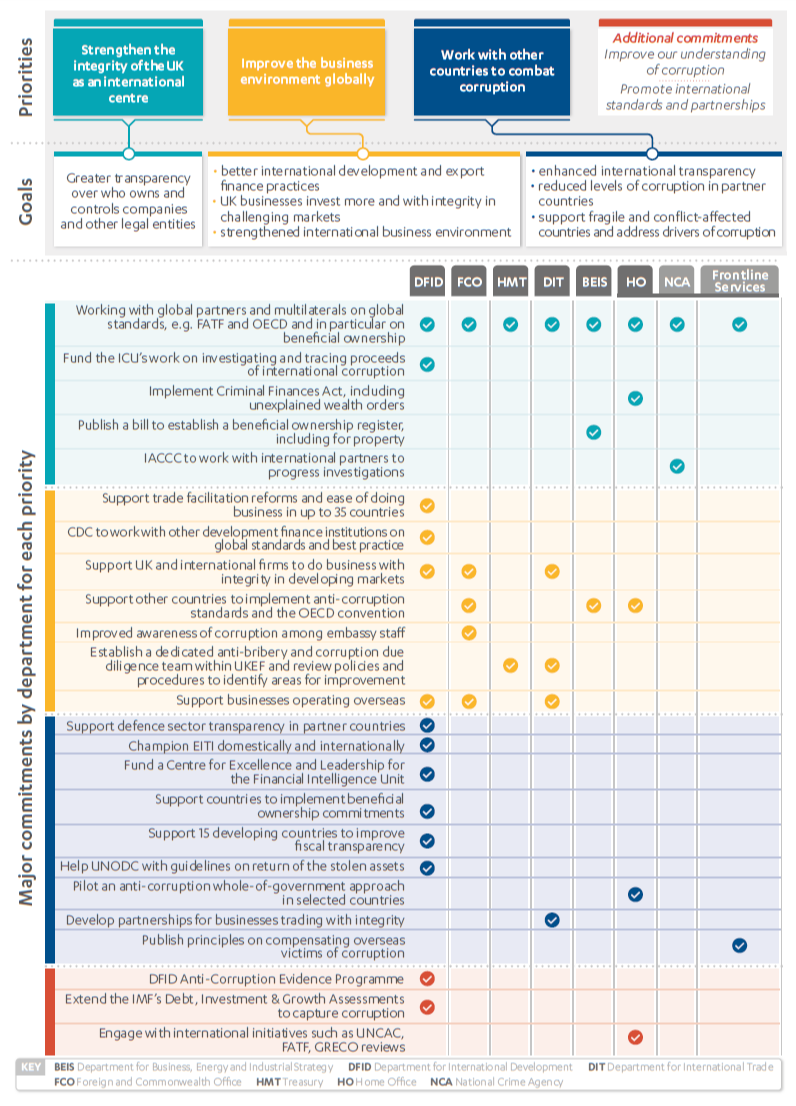

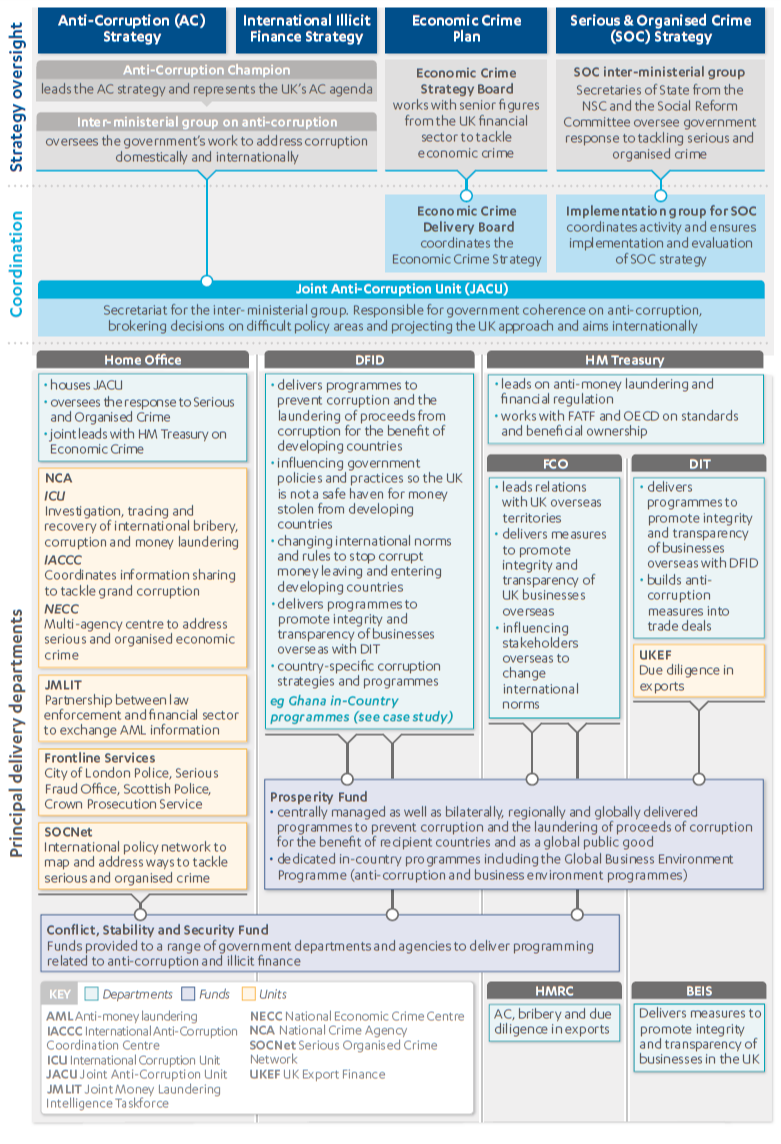

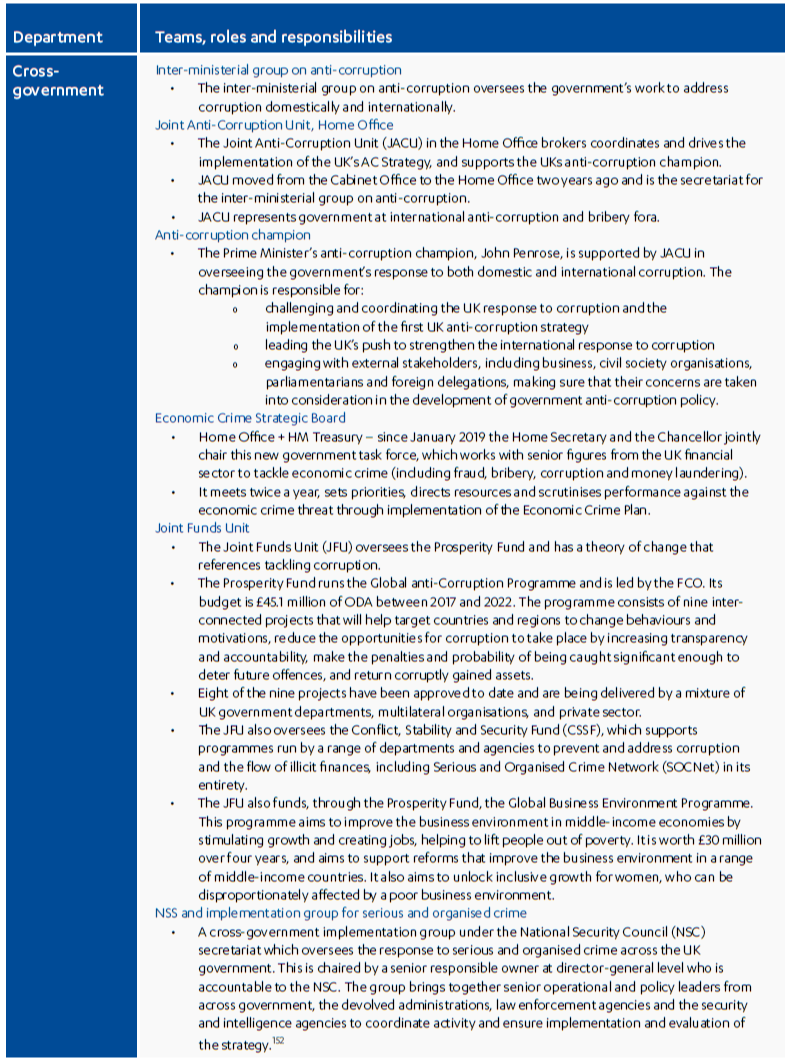

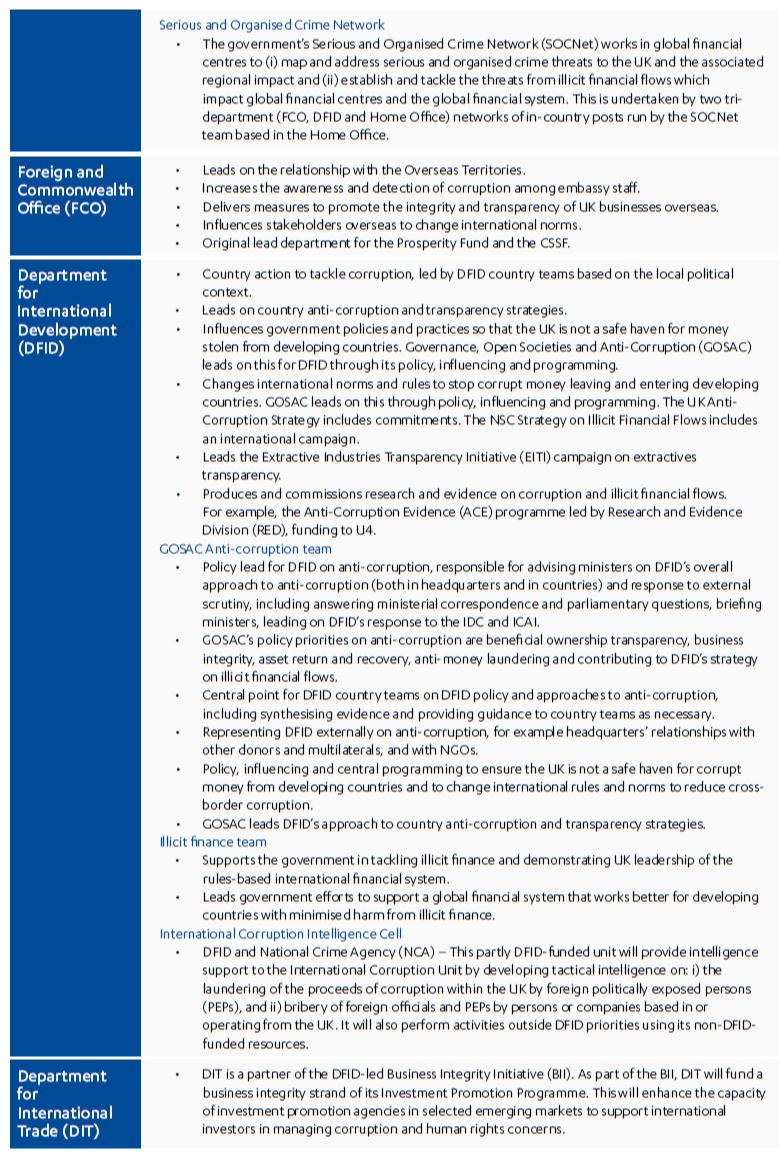

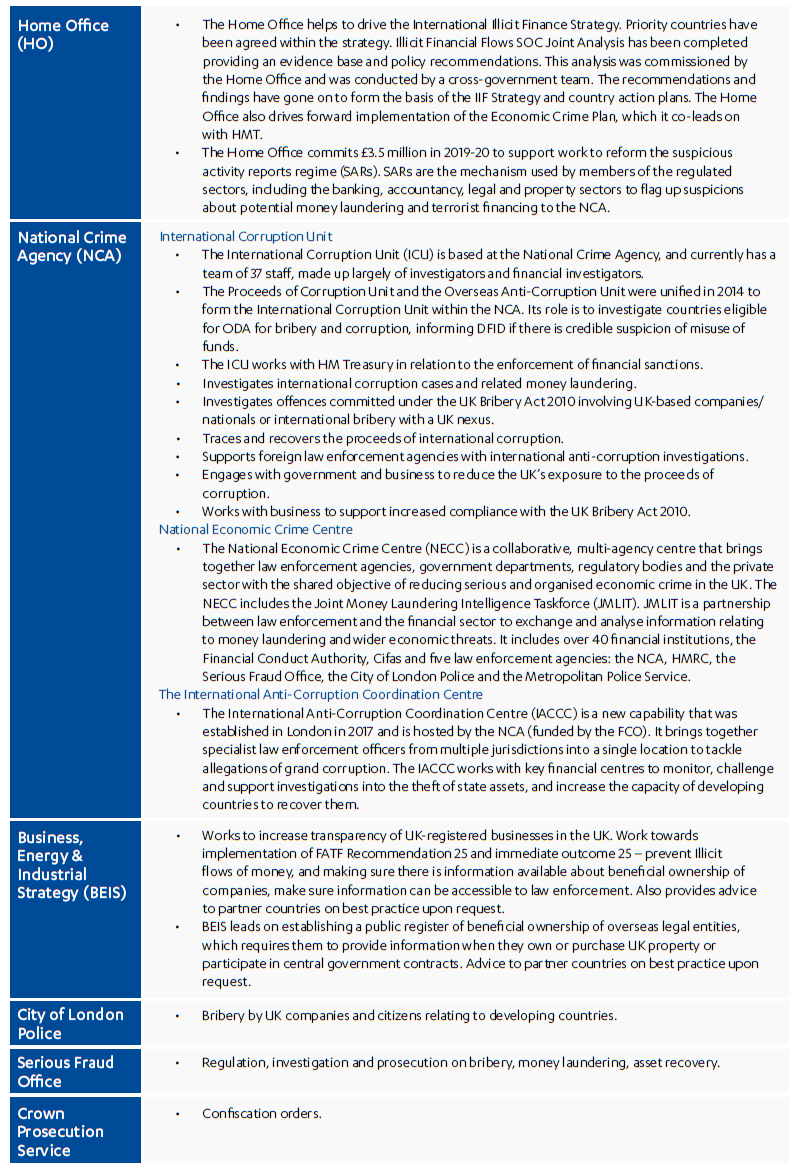

The diagrams below are illustrative maps of the major delivery departments and their activity under the Anti-Corruption Strategy. Map 1 sets out some of the major goals and commitments of the Anti-Corruption Strategy relevant to developing countries and the lead departments responsible for delivering these commitments. Although the lead departments have been identified, it should be noted that many of the commitments are in practice delivered across several departments. Map 2 illustrates the governance structure and coordination mechanisms of the UK’s anti-corruption work. The annexes to this report contain a more detailed narrative mapping of UK government roles and responsibilities (Annex 1) and the strategy, goals and commitments by department (Annex 2).

The maps do not include all departments and agencies involved in the UK’s efforts to tackle corruption and illicit financial flows, but only those working directly for the benefit of developing countries, in line with our scope. We recognise that the relationship between UK government objectives and how they benefit developing countries is complex. Many initiatives have both primary and secondary benefits, and tackling corruption and illicit financial flows (for the benefit of developing countries) is often a secondary benefit of many programmes. We have identified this as a significant line of enquiry to merit further consideration.

Map 1: Highlighted Anti-Corruption Strategy priorities, key goals and commitments

Map 2: Governance, coordination structures and delivery departments

Programmes and activities

Tackling corruption and illicit financial flows for the benefit of developing countries requires a coherent response domestically in the UK, internationally, and bilaterally with developing countries. The UK strategy is not, and should not be, wholly funded by ODA, because many of the benefits are intended to accrue to the UK and other developed countries. Domestically, it is important to ‘get our house in order’ and prevent the UK from being a recipient of illicit financial flows from developing countries. Internationally, the UK has an important role to play in supporting international initiatives and building global norms, especially given the fact that it is home to one of the world’s largest financial centres and a major provider of corporate services. In developing countries, the UK is an important donor supporting countries to tackle corruption and illicit financial flows.

To achieve its objectives for the benefit of developing countries, the UK is therefore working at all three levels, using both ODA and non-ODA funds.

Domestic action: The UK has introduced domestic legislation and created new agencies, such as the National Economic Crime Centre in 2018, to coordinate its response to economic crime. This is primarily non-ODA funded, though certain components are funded through ODA.

Legislation allowing for tools such as the unexplained wealth orders (policy implementation led by the Home Office) and the Beneficial Ownership Registers (led by the Department of Business, Energy and Industrial Strategy (BEIS)) seeks to increase transparency, as well as serving the purpose of aiding financial crime investigations, led by HM Treasury and the Financial Conduct Authority, and prosecution, led by the Crown Prosecution Service.

Box 3: Beneficial ownership

In 2013, at the Lough Erne G8 Summit, the UK committed to improving corporate transparency and reducing the scope to use anonymous companies for money laundering and corruption. The government is also running an international campaign to create a global norm by 2023 to promote company beneficial ownership transparency. Significant progress has been made in the UK:

- The UK’s public register of company beneficial ownership, the People with Significant Control (PSC) register, went live in 2016.

- In July 2018, the UK government published the draft Registration of Overseas Entities Bill, which requires overseas entities to register the details of their beneficial owners with Companies House should they wish to purchase UK property. If passed into law it will create a public register by 2021.

BEIS carried out a post-implementation review of the PSC in 2019. The review found that law enforcement organisations were using the PSC register to inform criminal investigations. All the surveyed civil society organisations, most law enforcement organisations and some financial institutions felt that the PSC register enabled their work, by making it quicker and easier to obtain information about beneficial ownership.

There is some evidence that the PSC register also appears to have had an impact in terms of dissuading those seeking to launder criminal and corrupt funds from using UK incorporation as a secrecy vehicle. Scottish Limited Partnerships (SLPs) were widely known to be associated with corruption, organised crime and tax evasion. As of 2011, the rates of incorporation for SLPs grew until June 2017, when SLPs were brought into the scope of the UK’s beneficial ownership transparency rules.

Finally, the Business Integrity Initiative provides support to UK and international businesses on issues of integrity when operating in developing markets. DFID subsidises guidance for eligible small and medium enterprises, in areas of anti-corruption, human rights compliance and corruption and bribery prevention.

International and transnational action: This includes coordination with international bodies to change international norms and rules, to stop corrupt money leaving and entering developing countries and to prosecute companies that pay bribes overseas. This is funded through a blend of ODA and non-ODA.

The UK also works internationally to strengthen global resilience to illicit finance in existing and emerging regional and global financial centres, including Dubai and Singapore. DFID is working to establish a new network in regional and emerging financial centres through its new illicit finance network. The UK government’s Serious and Organised Crime Network (SOCNet) works in global financial centres to (i) map and address serious and organised crime threats to the UK and the associated regional impact, and (ii) establish and tackle the threats from illicit financial flows which impact global financial centres and the global financial system. This is undertaken by two cross-department (FCO, DFID and Home Office) networks of in-country posts run by the SOCNet team based in the Home Office.

The UK has been criticised for its international and domestic role in enabling illicit financial flows, for example through enabling ‘tax havens’. According to the Corporate Tax Haven Index published by the Tax Justice Network, the UK and its “corporate tax haven network” is the world’s greatest enabler of corporate tax avoidance. As of 2019, British territories and dependencies made up four of the ten places that have done the most to “proliferate corporate tax avoidance” on the corporate tax haven index. The UK is seeking to build a better understanding of global illicit finance, the flows most harmful to the UK and developing countries, and the role played by other jurisdictions, and how this can be addressed. This includes activities with the Crown Dependencies and Overseas Territories to improve transparency, engage with economic crime enforcement investigations and support their compliance with international norms. This work is being delivered by DFID, the FCO, HM Treasury and the Home Office (including the Joint Anti-Corruption Unit).

In-country action: This involves primarily ODA-funded activities in developing countries to tackle corruption, including both direct and indirect anti-corruption efforts. It includes a range of support to anti-corruption commissions, as well as broader governance, public finance management and investment climate support. There has been growing recognition that political engagement is needed to complement technical capacity development.

A number of centrally managed programmes are being delivered across a range of countries, with the primary objective of reducing corruption. For example, the Good Governance Fund, a Conflict, Stability and Security Fund-funded programme led by the FCO and DFID, is working on institutional reform and civil society building, such as strengthening media independence, to improve transparency and discourage corrupt practices in the Balkans. Additionally, a number of programmes provide anti-corruption support through secondary objectives. For example, the Department for International Trade’s (DIT) Investment Promotion Programme aims to promote inclusive economic growth in partner countries by stimulating foreign direct investment in those markets. DIT’s intention is that this will be achieved by providing regional investment promotion agencies with technical assistance, including the promotion of transparency and integrity in business. There are also country-specific programmes being delivered to tackle governance problems.

Following an earlier ICAI review, DFID sought to develop country-specific anti-corruption strategies. However, this is now discretionary for country offices to update. A growing imperative as highlighted in a government select committee on DFID’s anti-corruption work is for country anti-corruption strategies to be whole-of-government strategies, to ensure coherence between government activities in country, as ODA is increasingly being delivered by other departments.

Ghana as an example of UK efforts to support in-country efforts to fight corruption

Ghana has been included as a case study to offer an illustrative example of the UK government’s bilateral in-country activity.

Box 4: The context in Ghana

In a 2017 poll, Ghanaian respondents rated the following Ghanaian public institutions as extremely corrupt: police (92%), judiciary (71%), political parties (76%) and public officials and civil service (59%), indicating that political and grand corruption are not the only types of corruption within Ghana. Over a third of the 1,400 Ghanaian citizens interviewed reported that they paid a bribe during 2017.

In Ghana, political elites are capturing public policy processes and excluding large sections of the population from governance. Corruption in its many shapes is seen as the most extreme form of political capture and as representing a “deep failing in the accountability and governance of political and public institutions”. When Ghana became an oil-exporting economy in 2010 after the discovery of the Jubilee Field in 2007, the government itself sought support on anti-corruption, keen to avoid becoming an embodiment of the resource curse where countries rich in resources can suffer from worse developmental outcomes than those less rich in resources.

The anti-corruption legislative context in Ghana has been challenging but is progressing. The recent change to public procurement law aims to improve accountability, value for money, transparency and efficient use of public funds. In addition, in March 2019 the government passed the Right to Information Bill, which aims to increase transparency by providing greater access to public information. Ghana is keen to be a leader in West Africa on international anti-corruption, including on beneficial ownership and information exchange on international tax. The UK government has responded to this ambition with significant technical support.

DFID began to explicitly support anti-corruption initiatives in Ghana in 2015-16, which opportunely timed with the London Anti-Corruption Summit (2016), hosted by the former prime minister, David Cameron. The then Ghanaian president, John Dramani Mahama, made several commitments at the summit to tackle corruption, including statements on beneficial ownership, asset recovery and reforming public procurement. This agenda was taken up by the new president, Nana Akufu-Addo, when he took office in January 2017.

On anti-corruption the UK works mainly through three key DFID programmes: Strengthening Action Against Corruption (STAAC, 2015-19), Ghana Oil and Gas for Inclusive Growth (GOGIG, 2014-19) and Strengthening Transparency, Accountability and Responsiveness in Ghana (STAR, 2015-21). However, in order to respond to broader contextual factors driving corruption and illicit financial flows, the UK effort includes support from other government departments and DFID centrally managed programmes relevant to anti-corruption.

Strengthening Action Against Corruption (STAAC) 2015-19: This programme was established in an effort to move away from conventional institutionalist approaches and focus on policy entrepreneurs, advocacy coalitions and contentious politics. It has taken a comprehensive approach, operating across agencies that work in detection, investigation, prosecution and adjudication, and aims to bridge the gap between supply-side and demand-side interventions. The programme tackles four key areas across the anti-corruption chain: (1) policy reform, (2) institutional strengthening, (3) collective action and (4) behavioural change. Within each of these components there has been some collaboration with DFID centrally managed programmes and with other UK government departments. For example, under the policy reform component, there is a Beneficial Ownership Transparency workstream. This draws on DFID’s International Action Against Corruption centrally managed programme to strengthen the expertise of Ghana’s Registrar-General’s office to collect and verify information as well as maintain the beneficial ownership register. Under the Institutional Strengthening component, the programme has ensured joined-up working with the National Crime Agency.

Ghana Oil and Gas for Inclusive Growth (GOGIG) 2014-19: The objective of the programme is to enable the Ghanaian government’s effective management of its oil and gas resources to support the country’s inclusive economic growth and poverty reduction. Specifically on anti-corruption the programme works to enhance governance, rules and the enabling environment through better regulation and policy coherence, improve oversight of revenue management, and support public engagement by supporting and strengthening social accountability through civil society and the media, to enable them to hold the other stakeholders to account.

Strengthening Transparency, Accountability and Responsiveness in Ghana (STAR Ghana) 2015-2021: This programme aims to develop a vibrant, well-informed and assertive civil society that is able to contribute to national development and foster inclusive access to high-quality and accountable public services for Ghanaian citizens. One element of STAR-Ghana’s focus is to catalyse the efforts of citizens towards systematic change on specific issues including corruption. For example, STAR is supporting the League of Youth Coalition to empower citizens and communities to tackle locally relevant corruption issues. There are also small pilots being tested using digital communication technology to enable citizens to raise issues related to corruption. In addition, work is being done through the Forum for Actions on Inclusion, Transparency and Harmony (FAITH) to shift citizens’ perception of corruption and empower them to take action. The FAITH Forum is working with schools to provide lesson plans and activities aimed at sharing anti-corruption messages and shaping a mindset among the young.

“If you demand accountability as a poor man, you are likely to find yourself in trouble; people in the assembly fuel vehicles for community visitation but do not visit communities as required.”

Citizen Participant, Town Hall, Mion, ICAI interview in Ghana, 21st May 2019

As well as supporting the government, supporting civil society has also been central to DFID Ghana’s approach to tackling corruption in Ghana. The two bilateral programmes, STAAC and GOGIG, have both supply-side and demand-side elements, while STAR Ghana works exclusively on social accountability and norm change. All three programmes work with civil society organisations through building capacity, convening and providing financial, monitoring and evaluation expertise to change norms and hold government accountable.

This has been an important element of anti-corruption programming and has been used in other contexts through UK aid support with success, including in Uganda and Tanzania. As with these examples, social accountability is central to combatting corruption in Ghana. Without this embedded in programming, a lack of social accountability can lead to a crisis of legitimacy among citizens and their government.

Tackling the problem of corruption in Ghana goes well beyond the technical assistance provided through aid programmes and requires a cross-government approach. In our interviews and focus groups with anti-corruption practitioners and academics, we heard that traditional technical assistance programmes focused on discrete institution building are not effective alone and are especially ineffective in development contexts that do not have a rules-based approach to governance. Anti-corruption needs to be solved through developing local incentives to follow rules as well as with technical assistance to support rules-based institutions.

Corruption in Ghana is also not a problem that the UK can address on its own. It requires coordinated interventions across national and international stakeholders to support norm change. There is, for instance, an opportunity for the UK government to make use of the FCO’s capacity in country to advocate norm change. UK strategies for tackling corruption in developing countries such as Ghana must be aligned with the country’s national efforts to deal with illicit financial flows and havens and be part of broader international systems strengthening.

“People are not corrupt because they are Ghanaians, they are corrupt because Ghanaian institutions don’t work well.”

Professor Ernest Aryeetey, Former VC of the University of Ghana, ICAI interview in Ghana, January 2019

Summary lines of enquiry

The mapping exercise conducted in this information note has captured a range of UK government actors operating at domestic, international and bilateral levels, using ODA and non-ODA funds.

We approached this mapping with an iterative methodology. We had an original set of questions around which we built our interviews. These were based on initial design discussions with key stakeholders in government and civil society, as well as on our initial documentary review. However, during the course of the mapping exercise, our questions evolved and opened up lines for further enquiry.

For ease of review we have categorised these into six summary lines of enquiry. These focus on: (i) the scope and prioritisation of the work, (ii) how the government’s activities fit together and are governed, (iii) the resources required to tackle corruption and illicit financial flows, (iv) the UK’s approach to influencing global partners to tackle these issues, (v) how the UK is using and building evidence to guide this field of work, and (vi) the policy tensions between the UK acting as a good global citizen and as a global partner of choice.

The summary lines of enquiry have been prepared to provide a descriptive analysis of the anti-corruption and illicit financial flows agenda, and how the UK aid programme is shifting in response. We have focused only on areas of government programming that are within scope. The note is not intended to be evaluative, and does not reach any conclusions as to whether particular interventions are relevant or effective. The summary lines of enquiry highlight issues (both risks and opportunities) that merit future exploration, whether by ICAI itself, the IDC or other interested stakeholders.

The scope and prioritisation of anti-corruption work

Broad and ambitious goals in a fast-evolving field require prioritisation

The anti-corruption and illicit financial flows agenda recognises that corruption is not solely a developing country problem, but one in which the global financial system and international financial centres, including the City of London, need to change too. Maintaining commitment and focus is challenging when the civil service, government and Parliament are preoccupied with the currently challenging political landscape. Some of the elements of the Anti-Corruption Strategy, such as registers of beneficial ownership, have been impacted by this.

As this note shows, the anti-corruption agenda is far from solely a DFID or ODA issue. The success of any ODA expenditure is tightly interwoven with UK domestic and cross-border initiatives. Effective UK engagement will involve a clear set of priorities, sufficient allocation of resources and coordination with international partners.

The UK government has a whole-of-government ‘fusion’ approach, meaning that the government departments ‘fuse capabilities’ across the full extent of the UK government’s departments and agencies, from economics and security to social policy and basic service provision. There are several challenges to this. Sometimes these are intra-departmental, for example the FCO faces the challenge of short-term diplomatic efforts versus long-term change. Sometimes these are inter-departmental, for example DFID’s mandate is to reduce global poverty and champion the needs of developing countries, where most other departments or agencies have the UK citizen as the primary beneficiary.

A key challenge with addressing corruption is that the success of innovations in any given channel or asset class is likely to result in significant displacement into alternatives. The challenge is therefore not just gaining evidence on what works, but also intelligence on how the threat is evolving. For example, information technology is causing the nature of the threat to evolve rapidly, such as to cryptocurrencies. This requires strategic and regularly realigned priorities and resources to prevent the strategies from becoming outdated and the associated realignment of resources.

Measuring impact and outcomes, particularly with regard to norm change and global influencing, is complicated by the speed of the displacement of criminal corruption and illicit finance activity.

Key questions: Scope and prioritisation of anti-corruption work

- Does the government’s strategy give sufficient emphasis to reducing corruption in developing countries?

- Is the government doing enough to identify future threats, and how to counter them?

- Are the indicators for success domestically, for national-level bilateral development, and internationally for the benefit of developing countries and for global good, clear and disaggregated?

Governance

Accountability for the benefit of developing countries

The UK government has demonstrably prioritised anti-corruption – and further deepened and broadened its anti-corruption and adjacent work with the development of the Serious and Organised Crime Strategy, the International Illicit Finance Strategy and the Economic Crime Plan. However, some stakeholders expressed concern that the adoption of additional strategies may have the unintended consequence of reducing both the coherence of the government’s anti-corruption policy and its implementation, as well as the relative priority given to reducing corruption in developing countries. The evolution of how the government categorises and tackles corruption alongside other complex issues, including organised crime, terrorism and trade, opens up a risk of UK security and prosperity priorities trumping benefits to developing countries.

In our discussions with government stakeholders, the multiplicity of strategies was cited as a clear challenge to their work. For example, it was noted that it is not clear how the new Economic Crime Strategy Board (where DFID is invited if an agenda point appears to reference development) will interact with JACU and the anti-corruption inter-ministerial group. However, it was also noted that the perspectives of the different lead departments offer important counter-balances to enable delivery across the board. For example, SOCNet, a new cross-departmental (FCO, DFID and Home Office) initiative that seeks to map and propose methods to combat serious and organised crime threats to the UK from around the world, receives partial ODA funding, and with that funding seeks to support work tackling illicit financial flows for the benefit of developing countries.

There have been two concrete changes to the anti-corruption portfolio oversight and delivery: (i) JACU has moved from the Cabinet Office, which encouraged a cross-government approach, to the Home Office, and (ii) the anti-corruption champion is no longer a cabinet minister. As the co-chair of the inter-ministerial group on anti-corruption, the champion has to lead by persuasion, rather than executive authority. The annual reporting on the strategy was cited as positive both by civil society and by the champion.

Key questions: Governance

- Would the strategy be more strongly led, and more accountable to Parliament, if the anti-corruption champion was a minister?

- Has JACU’s move to the Home Office from the Cabinet Office made the strategy’s support by officials too focused on the priorities of one government department, to the detriment of development priorities?

- Who is championing the developing country interest in this architecture? Should DFID attend all meetings of the Economic Crime Strategy Board?

- Does the government require a multi-departmental ODA strategy for tackling anti-corruption and illicit financial flows?

Global norms and international influence

It is not all about expenditure

The fight against illicit financial flows is a joint responsibility of the international community, as made clear by the adoption of SDG target 16.4, which states: “By 2030, illicit financial and arms flows shall be reduced significantly, the recovery and return of stolen assets will be strengthened.” The UK cannot solve this alone, but as a global financial centre and the world’s fifth-biggest economy it is in a strong position to lead action to achieve this target.

There are successful areas of influencing activity, for example (i) the prioritisation of illicit finance as part of the UK presidency of the G7 being coordinated by the Cabinet Office with DFID contributing, (ii) JACU’s influence in the OECD working group on foreign bribery – where 40 countries have signed up to it, and (iii) the international beneficial ownership campaign.

The UK can be impactful through global influence, as well as through programming, to achieve its in country developmental goals. Effective influencing is very resource-intensive and requires sustained and strategic activity at multiple levels. The 2016 summit was a good example of this. However, our civil society focus group suggested that there is a danger that the UK is approaching leadership passively by becoming an exemplar, rather than actively by showing global leadership through identifying global issues and convening global action accordingly. A strong influencing strategy requires strong political leadership and effective international networking.

Our focus group discussions suggested that “the global influencing approach needs to be clarified”. The UK works with a number of international organisations, but activities on anti-corruption are one of many competing issues. The anti-corruption champion in interview with ICAI noted that there could be an opportunity to improve on leveraging the capacities across government to enable this.

Progress in these areas can be achieved without significant expenditure. It is anticipated that this influencing work will also benefit the UK as it tries to set or meet the bar for transparency and level the playing field for UK trade.

Key questions: Global norms & international influence

- Is there a clear, joined-up UK influencing approach that makes full use of all our various international memberships and partnerships?

- How should we work with international partnerships, organisations and groups to make the global sum greater than the parts?

- Are we demonstrating sufficient global thought leadership as distinct from leadership by example?

The anti-corruption and illicit financial flows capacity gap

The right kinds of activity in the right places

Across the global effort to tackle corruption and illicit financial flows, there is a systematic lack of capacity and what our focus groups described as “a global under-investment”. The UK cannot service it all. UK financing represents a small part of the solution. Success will be predicated, among other things, on how well the UK learns from multilateral institutions like the OECD and other DAC donors and reciprocally contributes to their learning.

Countries at different stages of development need different support. In interviews, staff from the anti-corruption evidence (ACE) programme noted by way of example that institutional support works best when it is targeted at countries at the correct stage of their development. For instance support to set up anti-corruption commissions has not proven effective in countries that do not already have evolved associated institutions, governance and rule-following behaviour. However, if undertaken in more emerging markets (such as those which the Prosperity Fund focuses on) where rules and rule-following are intrinsically linked to economic growth and business success, and rule of law is enforced, then this kind of support has the potential to make a meaningful impact.

Limited human resources is also an issue. There are technical assistance demands from other countries asking for expertise from UK practitioners. However, UK experts are needed in the UK, and their departments may be reluctant to release them without additional resources to back-fill their posts. This raises the risk of international work for the benefit of developing countries being under-resourced. One senior civil servant noted “[my] ideal end game encompasses all the resources we would need, investigators, prosecutors, supervisors – terrorist financing experts. Funded by non-ODA, who can then be deployed to different countries” – in other words a central resource that doesn’t also have the burden of domestic work.

There are also specific global skills gaps. The National Crime Agency, for instance, struggles to recruit financial investigators. The FATF annual review of the UK, while very positive, points out that one key weakness is the low number of people available to work in investigation. Skilled technical experts are in short supply and so the private sector can attract government employees with higher salaries.

Key questions: The anti-corruption and illicit financial flows capacity gap

- What is the strategy to mobilise and retain the human resources required to implement the government’s strategy at home and abroad?

- Are there sufficient resourcing partnerships for this work with other donors and international organisations?

- The Economic Crime Plan notes that law-enforcement efforts are inadequate – civil society agrees. How much more money is needed, and what proportion might reasonably come from ODA?

- Is the support being provided to partner countries sufficiently tailored to their stage of political and institutional development?

The evidence gap

In-country programming in a new era

There are ongoing academic debates about whether it is more useful to treat corruption as a problem in its own right, rather than as a symptom of deeper political and institutional issues. In practice, the government needs to address both corruption and its causes.

The UK and other donors’ understanding of how to tackle corruption is ever-evolving. Recent emphasis on combatting illicit financial flows and their links to corruption have prompted some new thinking, but have to date seen limited programmatic manifestation, with conventional two-track in-country anti-corruption programming continuing. DFID has recognised this with the recent appointment of an illicit financial flows lead and associated programme design.

The UK has identified a need for national anti-corruption strategies, but not all countries have opted to prioritise this. The current international evidence base for selecting approaches and prioritising interventions has limitations for all donors, including DFID. There is evidence of traction in particular strands of programming. There are also a set of programmes to collect evidence and build viable theories, notably the ACE programme and DFID’s funding of the U4 Anti-Corruption Resource Centre. While they are ambitious in scope, the investment is relatively small in scale and the work is inevitably long-term.

A significant amount of the UK’s anti-corruption ODA programming is experimental or adaptive. Stakeholders questioned whether there is enough investment in design, monitoring and learning to support the experimental and adaptive programming that is being undertaken. There is currently no road map for in-country anti-corruption planning. However, UK government representatives in-country do have access to specific guidance on how to develop effective anti-corruption and illicit financial flows strategies and interventions, albeit limited by the constraints of the international evidence base.

Key questions: The evidence gap

- Is there a comprehensive plan to address the evidence gaps?

- What international efforts are being undertaken to encourage other countries, and institutions, to share their learning?

- Is the UK clear where it is experimenting? How will the impact of these experimental programmes be measured? How are priorities and non-priorities identified?

- Does the government need a more explicit approach and accompanying guidance to support in country anti-corruption strategies and interventions?

The UK as a good global citizen and partner of choice

Global leadership through transparency and trade

The UK has clearly stated goals to champion a rules-based global order, while demonstrating that it is open for business. This creates an opportunity to join up its international and domestic work demonstrating that being a good global citizen is compatible with being a trading partner of choice. It has made significant efforts to merge the potentially conflicting interests of trade and transparency. The efforts being undertaken need to be protected to ensure that Britain’s shorter-term national interests, on promoting international trade for example, do not compromise its longer-term responsibilities.

There are new programmes – DIT’s Investment Promotion Programme and the DFID/DIT/FCO Business Integrity Initiative – which represent a theory of change of improved prosperity and transparency through increased investment and trade in a target country.

The UK has, however, been criticised for its international and domestic role in enabling illicit financial flows, for example through enabling “tax havens”. According to the Corporate Tax Haven Index published by the Tax Justice Network, the UK and its “corporate tax haven network” is the world’s greatest enabler of corporate tax avoidance. As of 2019, British territories and dependencies made up four of the ten places that have done the most to “proliferate corporate tax avoidance” on the corporate tax haven index.

In addition, there is a perception within civil society of the UK being good on tackling the more obvious forms of corruption but having a blindness to subtle and institutionalised conflicts of interest – such as the dominance of the “big four” accountancy firms. There is a recognition in government by most of the civil servants we interviewed that the UK is a jurisdiction of risk in the eyes of many countries.

The international perception, represented by Transparency International, was also summarised at our civil society focus group: “The UK, to some extent, is a global leader in this field and it is championing new international law; however, the UK also plays harmful global citizen, enabling all sorts of corruption in the world.” This perceived hypocrisy in the UK’s domestic financial stance may undermine its ability to support developing countries effectively, as a champion of global rules.

There are major issues of transparency and corruption in global and offshore finance centres as well as in the UK. In these jurisdictions it is often challenging to disaggregate the primary beneficiary when the work is for the global public good but clearly benefits a non-ODA jurisdiction.

Key questions: The UK as a good global citizen and partner of choice

- Is the UK acting as a good global citizen and thus affirming its role as a good trading partner?

- How will the government ensure that the pressures to forge new trading ties remain consistent with an agenda of domestic and international transparency?

- To what extent does being a “good global citizen” promote trade? What is the evidence for this?

Recommended lines of enquiry

Table 3: The table below shows the conclusive questions for further consideration

Annexes

Annex 1 Mapping – HM Government roles and responsibilities

Annex 2 Mapping – strategy, goals and commitments

Three of the six priorities in the strategy are particularly important for developing countries. All priorities are listed below. In this annex we elucidate those parts which deliver greater benefits to development and thus are within this information note’s scope. The UK Anti-Corruption Strategy sets out what the government commits to do in the UK, internationally and to support other countries on anti-corruption, building on the commitments made at the UK Anti-Corruption Summit in 2016, hosted by the then prime minister, David Cameron.

- Reduce the insider threat in high-risk domestic sectors such as borders and ports

- Strengthen the integrity of the UK as an international financial centre

- Greater transparency over who owns and controls companies and other legal entities.

- The UK commits to publish a public register of beneficial ownership and to encourage others to do so (including Overseas Territories and Crown Dependencies). This will include information on who owns and purchases property in the UK.

- Work with the OECD Global Forum and the Financial Action Task Force, on implementation of beneficial ownership international standards.

- Consider extending corporate criminal liability beyond bribery and tax evasion to wider economic crimes.

- Implement all key elements of the Criminal Finances Act, including unexplained wealth orders.

- Greater transparency over who owns and controls companies and other legal entities.

- Promote integrity across the public and private sectors

- Reduce corruption in public procurement and grants

- Improve the business environment globally

- Reduced impact of corruption on trade and investment internationally by securing strengthened business environments internationally and in selected markets.

- The UK will support countries to implement the international anti-corruption standards, especially the OECD Anti-Bribery Convention.

- Support G20 and G7 policies and principles to tackle corruption.

- Work in 35 countries to support ‘ease of doing business’ and trade facilitation reforms, including building capacity to increase transparency and legislation (including through the Prosperity Fund).

- Enhanced international development finance and export finance practices. The CDC Group and UK Export Finance (UKEF) will lead international best practice, encouraging similar international institutions to adopt higher integrity standards.

- Review CDC tax policy annually to make sure it keeps pace with evolving global standards.

- Establish a dedicated anti-bribery and corruption and due diligence team within UKEF to review policies and identify areas for improvement.

- Increased investment and UK businesses supported in operating with integrity in challenging overseas markets.

- Strengthen the support that is available to companies.

- Improve the awareness and understanding of corruption among UK embassy staff.

- Reduced impact of corruption on trade and investment internationally by securing strengthened business environments internationally and in selected markets.

- Work with other countries to combat corruption

- Enhanced international transparency, especially in beneficial ownership, extractives, public finance and contracting.

- Continue to champion the Extractive Industries Transparency Initiative (EITI) domestically and support developing countries to comply with the EITI Standard.

- Support 15 developing countries to make a measurable improvement in their level of fiscal transparency.