DFID’s transport and urban infrastructure investments

1. Purpose, scope and rationale

The purpose of this performance review is to assess whether DFID’s transport and urban infrastructure work is delivered effectively and is targeted in a manner that is likely to have a sustainable impact on poverty. It will assess DFID’s management of its transport and urban infrastructure investments, its response to changing patterns of development finance for infrastructure, its promotion of supporting policies and institutions and its efforts to secure the best value for money from the UK’s multilateral infrastructure investments.

The review will explore a number of themes and issues relating to transport and urban infrastructure including value for money, cross-cutting priorities such as inclusion and minimising fraud and corruption, the impact on growth and poverty, the mobilisation of transport and urban infrastructure finance and how DFID improves the quality of multilateral investments in transport and urban infrastructure.

This is a long-standing and substantial area of work for DFID, with current commitments of over £1.6 billion. We have therefore opted to conduct a performance review, to probe whether the design and delivery of programmes are effective, and likely to deliver impact and maximise value for money.

2. Background

DFID’s priority countries in sub-Saharan Africa and South Asia face major infrastructure gaps, which limit economic growth and poverty reduction. Hundreds of millions of people lack access to electricity, transport, and water and sanitation. Inadequate transport infrastructure is consistently identified as a significant constraint to doing business. Poor road, rail and harbour infrastructure is estimated to add 30 to 40% to the costs of goods traded among African countries.1 Inland countries face particularly high transit costs, necessitating a regional approach to transit corridor development. Rapid urbanisation is placing additional strain on urban infrastructure. The 2015 UK aid strategy identified infrastructure development as part of DFID’s work on economic development, and committed DFID to unlocking private and public investment in infrastructure and urbanisation in developing countries.2

While the importance of addressing infrastructure deficits is widely recognised, World Bank analysis suggests that the current rate of investment in infrastructure globally falls well below what is needed. An additional $1 trillion of annual investment in low- and middle-income countries is needed to sustain existing economic growth rates, and more if the impact of climate change is taken into account.3 Studies estimate that developing countries need to invest in the order of 5 to 6% of GDP in infrastructure. Many fall well short of that level.4

There is widespread agreement that public resources will not be sufficient to fill this investment gap and that developing countries also need to leverage private investment. Among developing countries, private financing for infrastructure is currently concentrated in middle-income countries; in 2014, 73% of private infrastructure financing commitments were in just five countries – Brazil, Colombia, India, Peru and Turkey.5

An important role for development assistance is to mobilise additional sources of transport and urban infrastructure finance, such as by supporting project preparation costs or providing guarantees to lower the cost of finance. Development assistance can also help to put in place the policies and institutions required for effective infrastructure development – including assurance that the value of investments is protected through proper maintenance and asset management. Preventing corruption in infrastructure development is particularly challenging, partly due to the high value of capital contracts. Global losses from corruption, mismanagement and inefficiency in infrastructure could reach between $1.2 trillion and $3.6 trillion annually by 2020.6

Effective infrastructure development is essential to achieving the UN Sustainable Development Goals, both directly and indirectly. Goal 9 calls for constructing resilient infrastructure. Transport is also included in other goals, including Goal 3 (road safety) and Goal 11 (urban transport). The International Institute for Sustainable Development notes that infrastructure development is linked to the achievement of 11 goals.7

While DFID has no explicit spending commitments on infrastructure, its 2017 Economic Development Strategy suggests that the department will “step up” its work on both infrastructure and urban development, in view of their centrality to growth and economic transformation.8 DFID’s portfolio includes mainly smaller-scale investments in areas such as trade infrastructure (for example, improvements to the port in Dar es Salaam) and community-facing infrastructure (for example, a rural roads programme in Nepal). DFID also funds and manages some large transport and urban infrastructure investments in ODA-eligible UK overseas territories. In most contexts, DFID does not finance large-scale infrastructure investments directly, supporting them instead through other measures, including technical assistance, mobilising private investment and building the evidence base.9 DFID’s interest in achieving value for money – including through its multilateral aid contributions – is particularly pertinent in the infrastructure sector due to the scale of the investment involved.

We chose to focus this review on two of DFID’s five areas of infrastructure investment: transport and urban. The others are water and sanitation (covered in a previous ICAI review),10 energy, and information and communications. This covers 57 active or recently completed transport and urban bilateral programmes with a combined value of £3.4 billion. Around 35% is spent in Africa, 42% in Asia and 23% in other regions. DFID also spends around £400 million per year on transport infrastructure through multilateral channels. Its multilateral partners in the sector include the World Bank, the European Development Fund, the African Development Bank, the Asian Development Bank, the Asian Infrastructure Investment Bank and the Caribbean Development Bank.

3. Review questions

This performance review is built around the evaluation criteria of relevance and effectiveness. It will address the following questions and sub-questions:

Table 1: Our review questions

| Review criteria and questions | Sub-questions |

|---|---|

| 1. Relevance: Does DFID have a coherent approach to promoting economic development and poverty reduction through transport and urban infrastructure development? |

|

| 2. Effectiveness: How effective are DFID's bilateral transport and urban infrastructure programmes? |

|

| 3. Effectiveness: How well does DFID use bilateral aid to enhance the effectiveness and value for money of multilateral infrastructure finance? |

|

4. Methodology

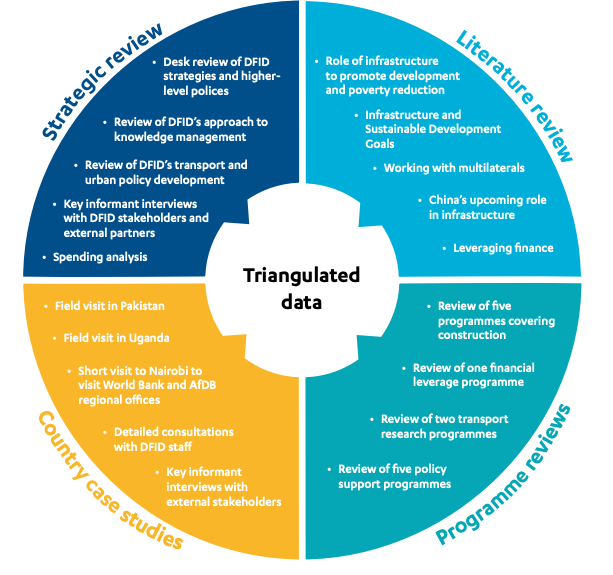

Our methodology consists of four main components, summarised in the figure below. Together, these four components will enable us to assess whether DFID’s bilateral programmes and its influence over the multilateral agencies support the department’s objectives and commitments, and whether they are delivering effectively and achieving value for money.

Component 1 – Strategic review

We will review DFID’s strategies and approaches to its transport and urban infrastructure work, assessing them against its policy commitments and objectives, as these have evolved. We will explore whether DFID’s approach is focused on achieving poverty reduction, and is inclusive of women, children and marginalised groups. We will assess whether appropriate safeguard policies are in place, including environmental, resettlement and employment policies.

We will review how DFID has adapted and applied its value for money principles and practices to the transport and urban infrastructure portfolios, including through sector-specific guidance and tools. This will inform our value for money assessments at project level and portfolio level.

We will explore whether DFID has clearly established a role for itself in transport and urban infrastructure support. This will be achieved through a review of its strategy documents and through key informant interviews with DFID staff and external partners. We will ascertain whether DFID can add value alongside other actors given the changing patterns of global infrastructure finance, and whether DFID has aligned itself with partner country needs. We will assess whether DFID has the systems and capacities required to implement its approach, including through bilateral programmes and its engagement with multilateral partners.

We will also review how well DFID has identified gaps in knowledge and data related to its portfolio and taken steps to fill the gaps.

Component 2 – Literature review

We will summarise available evidence related to: i) changing patterns of global infrastructure finance; ii) how development aid for infrastructure is changing in response; and iii) existing evidence and knowledge on the effectiveness of interventions. The literature review will include a brief discussion of China’s growing investment in developing country infrastructure, and its implications for DFID’s work in this area. It will explore how DFID’s work compares to the available evidence on what works. It will take note of current thinking on institutional reform priorities in the sector. It will also examine the relationship between growth and accessibility, especially for landlocked countries. It will explore how DFID is responding to the challenges and opportunities posed by rapid urbanisation.

Component 3 – Programme desk reviews

In order to assess the relevance, effectiveness and value for money of DFID’s transport and urban infrastructure portfolios, we have selected a cross section of programmes for desk review, including bilateral and multilateral programmes, construction and technical assistance, knowledge and research, and financial leverage. We will cover growth-orientated transport corridor programmes, and rural road programmes with objectives linked to poverty reduction and women’s economic empowerment. To examine financial leverage, we will review transport and urban programmes undertaken by DFID’s Private Infrastructure Development Group and the Regional Infrastructure Programme for Africa. We will explore how well partner countries (including fragile states) have been able to manage and absorb infrastructure finance provided or supported by DFID. We will assess whether safeguard policies have been followed, and the quality of results measurement and reporting processes. Using existing project reporting, we will assess whether the programmes have delivered effectively on their objectives and targets at output and outcome levels. We will look at how DFID’s transport and urban technical assistance programmes influence the sustainability and effectiveness of multilateral investments and partner country programmes.

Component 4 – Country case studies

In order to provide a broad-based understanding of how DFID manages its bilateral and multilateral transport and urban infrastructure programmes, we will conduct in-country case studies of DFID’s infrastructure portfolios in Uganda and Pakistan. As part of the Uganda study, we will also undertake a brief visit to Nairobi to meet officials from the regional World Bank and African Development Bank offices, as well as TradeMark East Africa. The case studies will enable us to explore in depth DFID’s country offices’ approach to infrastructure work, and to triangulate information from the desk reviews through feedback from key informants, including implementing partners and officials from partner government agencies. In both East Africa and Pakistan, DFID is implementing major corridor investments and trade facilitation measures through multilateral channels. The case studies will therefore also explore how DFID works with and influences multilateral programmes. The visits will provide an opportunity to review the effectiveness of DFID’s policy dialogue and technical assistance regarding partner country policies and practices, and assess how they complement DFID’s infrastructure finance. The visits will also allow for the opportunity to speak with other bilateral development agencies to facilitate comparisons with their infrastructure work and DFID’s.

5. Sampling approach

There are two sampling elements to our methodology: the selection of country case studies and of programmes for desk review. The two samples are overlapping in that we will conduct desk reviews of two programmes from each case study country in preparation for the country visits.

Case study countries

DFID is implementing transport and urban infrastructure programmes in 17 countries. From this list, we selected Uganda and Pakistan for country case studies because they offered:

- significant expenditure on relevant programmes

- a combination of centrally managed and country-managed programmes, and partnerships with multilateral agencies

- a range of intervention types

- sufficient coverage of both transport (including transport corridor and trade-related investments) and infrastructure programming

- two contrasting country contexts.

Programme desk reviews

DFID has informed us that it has 57 programmes in its transport and urban infrastructure portfolios. The programmes are diverse in their objectives, activities and delivery channels. We have selected a sample of programmes for desk review that is as representative as possible against the following criteria:

- sectoral focus (transport, urban infrastructure, cross-sectoral)

- centrally managed and country programmes

- country context (including low- and middle-income countries)

- type of intervention (build, technical assistance, research-based, financial leverage)

- objective (country policy and strategy development, trade-related, rural development, urban development)

- programme budget.

A purposive selection was made that maximised coverage across these criteria within the budget and time period available. The sample selected includes five centrally managed programmes, including two with a strong focus on financial leverage and influencing multilateral partners, one multi-country programme focused on technical assistance for urban development, one knowledge-based programme, and one focused on international influence on road safety issues. For country-based programmes, we selected two from each of the case study countries and three projects from other countries to provide sufficient coverage of the selection criteria. The resulting sample of 13 programmes is listed in Table 2.

Table 2: Desk review programme sample

| Programme | Location | Timeframe |

|---|---|---|

| Private Infrastructure Development Group | Centrally managed | 2012 - 2019 |

| Regional Infrastructure Programme for Africa | Centrally managed | 2012 - 2016 |

| Research for Community Access Partnership11 | Centrally managed | 2014 - 2023 |

| Infrastructure and Cities for Economic Development | Centrally managed | 2015 - 2020 |

| Global Road Safety Facility | Centrally managed | 2013 - 2017 |

| Economic Corridors Programme | Pakistan | 2015 - 2020 |

| Immediate Bilateral Support for Vital Transport and Education Infrastructure in Border Areas | Pakistan | 2010 - 2016 |

| TradeMark East Africa | Uganda | 2009 - 2017 |

| Creating Sustainable Opportunities for Spending on Roads | Uganda | 2009 - 2018 |

| Rural Accessibility Programme | Nepal | 2013 - 2019 |

| Infrastructure Trust Fund Phase II | Afghanistan | 2014 - 2018 |

| Building Urban Resilience to Climate Change | Tanzania | 2014 - 2020 |

| Strengthening Regional Economic Integration | Kenya | 2013 - 2017 |

The resulting sample covers over 40% of the transport and urban infrastructure portfolios by value. This is not fully representative, given the diversity of the portfolio, but in combination with the country case studies it will enable us to explore the issues raised by our review questions and to identify the most important factors affecting the performance of the portfolio.

6. Limitations of the methodology

Our assessment of the effectiveness and value for money of DFID programmes will be primarily dependent on data generated by the programmes themselves, supplemented by an assessment of the quality of the monitoring arrangements and triangulated where possible with feedback from counterpart institutions and independent observers in the partner countries. Where the monitoring is incomplete or unreliable, we may not be able to reach robust conclusions on programme effectiveness.

It would be challenging to conduct a full assessment of DFID’s influencing efforts with multilateral partners in the infrastructure field, as there are many different channels for influence (such as through the boards of directors of the multilateral development banks and periodic replenishment processes). Influencing activities are also not always well documented. We will therefore focus on the use of centrally managed programmes to support DFID’s multilateral infrastructure finance, where the results of influencing efforts should have been monitored and documented.

7. Risk management

| Risk | Mitigation and management actions |

|---|---|

| Disruption to fieldwork plans due to unforeseen events | There is a possibility that the proposed field visits could be cancelled or delayed due to security problems, visa issues or unforeseen events. If this occurs, an alternative field visit will be arranged and timelines altered accordingly. |

8. Quality assurance

The review will be carried out under the guidance of ICAI lead commissioner Tina Fahm, with support from the ICAI secretariat. The review will be subject to quality assurance by the service provider consortium.

Both the methodology and the final report will be peer reviewed by Francesc Trillas Jané from the Barcelona Institute of Economics, part of the University of Barcelona. He is an expert in infrastructure development.

9. Timing and deliverables

The review will be completed in approximately nine months from January 2018.

| Phase | Timing and deliverables |

|---|---|

| Inception | Approach paper: March 2018 |

| Data collection | Country visits: March 2018 Evidence pack: May 2018 Emerging findings presentation: June 2018 |

| Reporting | Final report: autumn 2018 |

Footnotes

- Addressing Africa’s Infrastructure Challenges, Deloitte, 2013, link.

- UK aid: tackling global challenges in the national interest, HM Treasury and DFID, November 2015, p. 17, link.

- Global Infrastructure Facility, World Bank, October 2014, link.

- Financing African Infrastructure: Can the World Deliver?, Brookings Institution, March 2015, link.

- 2014 Global Private Participation in Infrastructure Update, World Bank, 2014, link.

- Openness and accountability in public infrastructure could save $2.5 trillion by 2020, Construction Sector Transparency Initiative, press release, 22 October 2012, link.

- Why infrastructure is key to the success of the SDGs, IISD, 2015, link.

- Economic Development Strategy: prosperity, poverty and meeting global challenges, DFID, January 2017, p. 15, link.

- Sustainable infrastructure for shared prosperity and poverty reduction: a policy framework, DFID, 2015, link.

- Assessing DFID’s results in water, sanitation and hygiene: an impact review, ICAI, May 2016, link.

- The desk review of the Research for Community Access Partnership (RECAP) will take into account work undertaken under relevant predecessor programmes, notably the African Community Action Programme (AFCAP) and the South East Asia Community Access Programme (SEACAP).