The changing nature of UK aid in Ghana

Introduction

This literature review supports the ICAI country portfolio review of The changing nature of UK aid to Ghana by providing background information on the Ghana context and exploring the main debates and findings in the academic and grey literature on key topics relevant to the review. We conduct a systematic review of existing literature on selected topics related to Ghana’s development challenges and opportunities, and the choices and priorities made in the UK aid portfolio. While we give an overview of Ghana’s development gains before 2011, the literature review focuses mainly on 2011 to 2019 – the period covered by the ICAI portfolio review. We have paid particular attention to the key challenges and opportunities which the UK aid portfolio seemed to be responding to in its social sector, private sector development and governance portfolios.

Literature review methodology

The review is divided into three themes:

- Ghana’s (socio-) economic development and its political economy.

- Lessons from sub-Saharan Africa on oil and gas governance and the implications for Ghana.

- Approaches to aid when development partnerships are in transition, especially UK aid approaches.

The first is Ghana-specific, the second draws on Africa-wide literature and the third also includes literature from outside the African continent. In this third theme we found no literature that is Ghana-specific. The three themes are addressed separately, but links between them are drawn where relevant.

We have not attempted to undertake a comprehensive and systematic review of all relevant literature. Instead, we took a strategic approach to selecting papers and other texts. The aim was to understand what the main issues are, rather than record the full scope of the debate around them. For each theme, we selected an initial set of literature from rated journals and publishers. Our selection was also informed by the sub-components of each subject that the literature review needed to cover to support ICAI’s portfolio review of UK aid to Ghana. For example, on the transitioning theme, we identified three broad sources, namely literature used to inform ICAI’s recent review on DFID’s approach to managing exit and transition in its development partnerships (ICAI, 2016), primary data sources, for example published transition strategies of other OECD-Development Assistance Committee (DAC) donors, and recent research and evaluations published by prominent think tanks and intergovernmental bodies.

In each case, further sources were identified from the initial selection through snowballing. Finally, we selected some papers to review more thoroughly, based on the currency of the paper in terms of the timeliness of its findings and the depth, scope and relevance of what it covers relative to the Ghana context and our topics of interest. We privileged papers that already contained good literature reviews themselves.

Overview of the literature review

The literature review is divided into four main sections including this short introduction, with sections 2, 3 and 4 reporting on the main findings from the three review themes set out above.

Section 2 is devoted to the Ghana context. It provides a picture of Ghana’s development progress, opportunities and constraints on private sector development, and factors that may impact institutional strengthening initiatives. This section starts with an overview of Ghana’s important development gains between 1990 and 2015. We found that Ghana’s development trajectory has not been smooth. While growth has been continuous, the pace has fluctuated, slowing significantly after 2012 as a macroeconomic crisis took hold. The pace of poverty reduction seen between 2000 and 2010 also slowed, and gains made in northern Ghana, where poverty is most prevalent, reversed. Ghana did well on some global development targets (such as access to primary education), but not well on others (such as maternal mortality rates and access to sanitation). Inequality has been growing, not only between regions but also within regions.

This section also looks at development challenges of particular relevance to the UK aid portfolio. A first set of issues is about economic diversification and inclusive growth. Authors emphasise the need to diversify the economy and develop a manufacturing sector, as well as small and medium enterprises generally. However, there are many constraints on this happening, including access to finance and human capital. A second set of issues was about state institutions and the political economy. We found rich literature on the influence of Ghana’s political economy on choices made about public resources and the quality of institutions. The literature highlights a need to pursue carefully selected technocratic interventions to strengthen weak public institutions, with support for citizen voice and accountability.

Section 3 provides an overview of the literature on oil and gas revenue management and lessons from subSaharan Africa, as a background to Ghana’s discovery and exploitation of reserves since 2007. The section highlights that while Ghana’s estimated oil and gas reserves may not be large by global standards, they are large enough to affect Ghana’s growth path, in positive but also potentially negative ways. Importantly, on current estimates of reserves, the expectation is that the additional revenue generated for the state will be for a relatively short period, which increases the importance of managing it well. This is an area of interest for this literature review given UK aid’s increase in technical support to the Ghanaian government on how best to manage and spend its oil revenues. Section 3looks at lessons from other African countries, including on whether to spend oil revenue now or save it for future generations, the impact of volatile revenues on the economy, choices about what oil revenues should be used for, how decisions will be made about spending, and political accountability for and transparency of oil revenues.

Section 4 discusses transition in development partnerships, a key aspect of UK aid’s approach to Ghana in the review period. The purpose of this part is to identify key analyses and lessons learned on transition and changing aid relationships from the perspective of the UK’s aid programme, other OECD-DAC donors and recipient/partner countries. We look at the life cycle of transition, beginning with the drivers behind it and the triggers for initiating the process. This is followed by an analysis of the literature on how to best manage the transition process and its associated risks and challenges.

The Ghana paradox: fast development gains but stubborn challenges

Overview of development gains in Ghana

A distinct feature of the development context in Ghana is that it is a stable, peaceful and vibrant democracy where elections are vigorously contested. They are generally free and fair, and voter participation rates are high (Atta Mills, 2018). Since the inauguration of the Fourth Republic in 1993, Ghana has held successive and highly competitive multi-party elections, with the 2000, 2008 and 2016 elections resulting in an electoral turnover of government that makes “Ghana somewhat unique among African democracies” (Gyimah-Boadi et al., 2012, p. 1). It is also generally recognised to have a highly vibrant media and civil society (Atta Mills, 2018). Gyimah-Boadi et al. (2012) posit that governments elected in the Fourth Republic have generally managed the economy prudently. Ghana has indeed seen positive growth since the early 1990s, including periods of relatively rapid growth. One such period was between 2005 and 2012, when the economy grew at 4.5% on average per year, more than twice as fast as the 22 years since the 1993 transition from military rule (World Bank, 2018). This allowed the country to achieve lower-middle-income status in 2011. However, after a peak of 11.3% in 2011, growth declined steadily to 1.6% in 2015. Since 2015, when Ghana accessed another IMF programme, growth has picked up, and the annual GDP growth rate recovered to 8.5% in 2017 (Atta Mills, 2018). A World Bank (2018) report on Ghana attributes the growth phase as in part due to higher prices for Ghana’s main commodity exports, notably gold and cocoa, and the start of commercial oil production in 2011, while the slowdown reflected a combination of declining commodity prices, energy rationing, and a major fiscal crisis in 2013.

Geiger et al. (2019) note other determinants of growth since 2000, including structural improvements, particularly in infrastructure and financial development, stabilising inflation policies, the real exchange rate and financial stability. Gyimah-Boadi et al. (2012) concur, noting that Ghana has made substantial investments in infrastructure, including in roads and energy, and also highlighting significant strides in social services, including the introduction of national health insurance, a capitation grant for pupils in education, and a school feeding scheme, all of which were already in place by 2012.

The consensus is that Ghana’s growth momentum helped it to reduce poverty. Ghana’s Human Development Index rose 27% between 1990 and 2016 (UNDP, 2018) and the country achieved the first Millennium Development Goal (MDG) of reducing the national poverty rate by more than half, from 52.7% in 1991 to 24.2% in 2012 (World Bank, 2018). The World Bank diagnostic identifies two main factors for the rapid and steady decline in poverty – increased agricultural production and human capital development, especially through investment in education. According to the Human Development Index, Ghana has achieved good progress across a range of local indicators. For example, average life expectancy rose by five years to 62, the share of births attended by skilled personnel rose from 40% to 74%, under-five mortality declined by more than half, gender parity was achieved in primary education, and gross primary completion rose to over 100% for both boys and girls by 2016/17 UNDP, 2018).

Table 1 below provides the summary findings on the indicators tracked for Ghana from the final MDG report against each of the eight goals (UNDP, 2015). It shows that besides the first goal, Ghana was considered to have “largely achieved” an additional three goals (universal primary education, reducing child mortality, and developing a partnership for development), and made considerable progress on two more (promoting gender equality and empowerment, and combating HIV/AIDS, malaria and other diseases). Two goals were not achieved, namely reducing maternal mortality and ensuring environmental sustainability, where poor performance on sanitation improvements held Ghana back.

Table 1: Summary of progress on the Millennium Development Goals

| Goal | Summary assessment | Reasoning |

|---|---|---|

| Goal 1: Eradicate extreme poverty and hunger | Largely achieved | The proportion of people living in extreme poverty was halved by 2006. On average this was achieved in both urban and rural areas and in seven regions. |

| Goal 2: Achieve universal primary education | Largely achieved | The gross enrolment and completion rate targets have been exceeded, but net enrolment remains a challenge, improving by less than a percentage point from 2008/9 to reach 89.3% in 2013/14. |

| Goal 3: Promote gender equality and empower women | Not achieved, but significant progress | Gender parity has been achieved in pre-school education and was on track at primary and high school levels and in private tertiary institutions. The proportion of women representatives in Parliament rose marginally to 10.9% in 2012. Women’s access to non-agricultural wage employment rose from 25.4% in 2006 to 30.5% in 2013. |

| Goal 4: Reduce child mortality | Largely achieved | The under-five mortality rate improved from 122 per 1,000 live births in 1990 to 83 in 2012, but was well short of the MDG target of 40. Infant mortality fell marginally from 57 to 53 per 1,000 live births between 1994 and 2012, but was short of the target of 22. |

| Goal 5: Improve maternal health | Not achieved | The institutional maternal mortality ratio fell from 216 per 100,000 live births in 1990 to 144 per 100,000 live births in 2014, short of the global target of 54 per 100,000 live births in 2015. Overall maternal mortality is thought to be higher when non-institutional maternal deaths are considered. An official survey in 2008 reported an average maternal mortality ratio of 451 deaths per 100,000 live births for the seven preceding years. The same ratio for least developed countries was 442 in 2015. . |

| Goal 6: Combat HIV/AIDS, malaria and other diseases | Not achieved, but significant progress | National HIV and AIDS prevalence fell from 3.6% in 2007 to 1.3% in 2013, but regional disparities persist. Malaria remains the leading cause of mortality and morbidity in Ghana. It accounted for 32.5% of outpatient attendance and 48.8% of under-five admissions in the health system |

| Goal 7: Ensure environmental sustainability | Not achieved | The target of halving the proportion of people without access to safe water was achieved (standing at 22% in 2012). The sanitation target was missed by a wide margin. In 2012, 84% of people did not have access to improved sanitation, while the target was 48%. Improved sanitation refers to a flush toilet linked to a piped sewer system, a pit latrine or improved pit latrine, or a composting toilet |

| Goal 8: Develop a global partnership for development | Largely achieved | Aid flows fell from 6.9% of GDP in 2009 to 2.8% in 2014, following achievement of middle-income status. However, by 2014, public debt had risen to 67.2%, from 36.6% in 2009. By 2014, mobile and internet usage had increased, with 1.15 mobile subscriptions per inhabitant (from 0.126 in 2001) and 18.9% of the population having an internet subscription (from 0.15 in 2000). |

However, as noted by Gyimah-Boadi et al. (2012), significant challenges and deficits are still present. Atta Mills (2018, p. 1) referred to the “Ghanaian paradox” to describe the contrasts between a vibrant, growing economy with solid investment rates and reasonable macro stability, and one that is at the same time afflicted with crushing (especially public) indebtedness, skewed income distribution, underfunding of social programmes and social tensions. Both Gyimah-Boadi et al. (2012) and Atta Mills (2018) point to the lack of proper implementation of economic reforms and policy decisions as key obstacles to Ghana’s economic growth and as reasons for its continuing development challenges.

The rest of this section will focus on these challenges, as the main background to the context in which UK aid’s Ghana portfolio was designed and implemented. We privileged the topics particularly related to the programming choices made by UK aid, namely the development goal of leaving no one behind, achieving inclusive growth and developing Ghana’s private sector, the impact of the discovery of oil on governance and development, and the political economy.

Stubborn Social Challenges

The United Nations Economic Commission for Africa (UNECA) African Social Development Index report (UNECA, 2016) bemoans the fact that positive economic growth in Africa over the past two decades has not yet translated into meaningful social development. The report notes that structural transformation under way on the continent, driven largely by capital-intensive sectors, has not created sufficient productive employment to raise people’s standard of living and create the conditions for inclusive and equitable development. Unequal access to social and economic opportunities and inadequate social protection have also limited the capacity of many individuals to contribute to and benefit from economic growth in their country.

Over the period of the review (2011 to 2019) over 60% of UK aid expenditure1 was on interventions to address challenges in especially the health, education and social protection sectors in Ghana. One programme, the Millennium Villages Project (which ran from 2012/13 to 2016/17), was the implementation in Ghana of a multidonor ‘big push’ approach to achieving the Millennium Development Goals through simultaneous investments across sectors in several African countries. The theory – closely associated with economist Jeffrey Sachs – was

that such a push would generate synergies, making it more effective (Cabral et al., 2006). The approach, and how to assess it, has garnered significant attention in economic development and sector literature, as well as in development blogs and the media, and as such was included in our literature review. In Ghana, the Millennium Villages project was implemented in a cluster of communities housing 26,500 people in northern Ghana, to the cost of over £11 million. The Ghana project replicated similar projects in nine other African countries supported by a range of donors, after pilot programmes in Kenya and Ethiopia in the early 2000s. In Ghana, however, DFID also commissioned a longitudinal evaluation that included qualitative and quantitative data collection across the development goals and from sizable project and matched control groups before and after project implementation. The evaluation (Barnett et al., 2018) found that whereas there had been noticeable change in the villages over the project period with an attributable reduction in multidimensional poverty, road and electricity improvements, greater access to public provision of services and growing cash needs, the project was not cost-effective, fell short of producing a synergistic effect and overall, had not yielded sufficiently positive results and did not allow the poorest to escape the poverty trap (Barnett et al., 2018). A subsequent study, using the data collected during the evaluation and published towards the end of our review, has found that the project had small or null results including for core welfare indicators such as monetary poverty, undernutrition and child mortality (Masset et al., 2020).

Some key social indicators are lagging

While Ghana has achieved many development gains since 1990, not all key social indicators have shown good improvement, as shown in Table 1 above. Even when the MDG reporting team considered a goal to have been largely achieved, there were problematic aspects. Ghana achieved key goals on eradicating extreme poverty and hunger, but not consistently in all regions. It improved gross primary enrolment in schools, but net enrolment barely moved between 2008 and 2014.4 And while it had improved gender parity at school level, improvement in the workplace was less pronounced. Moreover, as noted above, key goals on sanitation and on maternal and child mortality were not achieved (despite good progress on the latter).

The World Bank (2018) found that Ghana has lagged behind its peer countries on key social indicators, such as sanitation (which also affects health indicators) and tertiary education. On average only 14.9% of the population had access to improved sanitation in 2014-2016, while the average for sub-Saharan Africa was 30% (UNDP, 2015a). In education, Ghana still lags behind its peers in quality and in the share of over-15-year-olds who have completed tertiary education, at only 1.4% compared to the 5% average for lower-middle-income countries.

Slowing poverty reduction

Ghana’s rate of poverty reduction has slowed since 2006. Cook et al. (2016) reported that the annual poverty reduction rate between 2006 and 2012 was 1.1 percentage point per year, slowing to 0.8 of a percentage point between 2012 and 2016. However, the rate of extreme poverty reduced from 16.5% to 8.4% in the same period. Households in rural areas continue to have a much higher average rate of poverty than those in urban areas (37.9% versus 10.6%).

Inequality has increased

While reducing poverty, Ghana has not succeeded in lowering inequality, which has risen steadily since 1992. Many authors emphasise that this is a critical challenge for Ghana as it will affect the sustainability of its growth, social progress and democracy. In Ghana, the Gini coefficient rose from 37 in 1992 to 41 in 2013 (Ghana ranks 49th out of 185 countries, where number one is South Africa with the highest inequality). In Ghana, inequality within certain regions is growing and is now higher than between regions. The Upper West region has the highest level of inequality in the country and the largest increase in inequality since the 1990s. The lowest level of inequality it found in the Greater Accra region. Inequality also increased within rural areas, and the north of the country as a whole also now has high levels of inequality (Cook et al., 2016).

Molini et al. (2015) caution that persistent inequalities threaten future development progress, given the strong link between economic growth and poverty reduction, and the tendency of higher inequality and polarisation to translate into a lower growth elasticity of poverty reduction, or the degree to which poverty decreases as per capita income rises. They posit that it will now be difficult to achieve sustained progress in poverty reduction and shared prosperity without broadening the reach of the development process to those people who have so far been left behind.

Spatial inequality is especially stark

In its Northern Ghana Human Development Report, UNDP (2018) brings into sharp focus the reality of spatial inequality. Poverty reduction stalled in the northern regions, many of which have large numbers of people living beneath the national poverty line of GHS3.6 (or about US$0.8) per day. The Upper West region has the highest incidence of poverty in the country: in many of its districts more than 80% of the population lives below the national poverty line. The Human Development Index for the region was computed to be 0.116 for 2014, far below that for Ghana overall (0.575) and for the Western region (0.455) in 2013. Molini et al. (2015) reported that one out of three poor people lived in the northern rural areas, while in 1991 it had been only one out of five.

Although there have been significant policy reforms in health and education, and some increases in access, many authors have noted budget constraints, difficulties in improving quality and, in some instances, lack of equitable access. The World Bank (2018) reported that education spending was fragmented, with a budget driven primarily by the wage bill rather than by strategic objectives. Despite efforts to establish a performance-based budget, policymakers have not been able to improve equity, retention rates and the efficiency of the system.

Blampied et al. (2018) used the ‘leave no one behind’ concept to understand which groups (geographic, social, economic) are lagging furthest behind in access to services and why, and to focus on solutions that explicitly benefit these groups. They found that almost one-fifth of 13-to-15-year-olds in the Northern region have never had formal education, more than four times the national rate. In health, adequate basic service coverage for maternal and child health in the Northern region was under 50%, and there were just 2.1 health centres per 1,000 km2.

Public spending and social policies

Blampied et al. (2018) argue that despite ambitious policies promoting equity and inclusion in both the health and education sectors, resources have not been allocated to match this intent. They posit that Ghana’s highly competitive electoral dynamics have resulted in the pursuit of universal policies that are extremely ambitious. They cite the example of the national health insurance system’s precarious financial situation and inefficiencies in its administration that have led to extreme delays in reimbursing health facilities and widespread and regressive ‘informal charging’. Similarly, while they praise the rollout of free senior high school nationwide, they caution that this could harm equity unless more is done first to address the hundreds of thousands who will never enter school at all, or the millions of poor and vulnerable children receiving a sub-standard primary education before they even arrive at high school. While free schooling has been crucial to ensuring greater equity in access, public education systems have struggled to keep up with the magnitude of demand created by expansion. A report by Oxfam (Oxfam et al., 2018) similarly expresses concern that Ghana has been moving away from universal health coverage in recent years, as resources do not match ambition, disproportionately impacting marginalised groups. They note that the share of out-of-pocket payments in total health expenditure has grown, while coverage of the population under national health insurance, which is supposed to be universal, has stagnated at around 40%. This is combined with slow progress on improving and extending the reach of quality services, including qualified health workers and health facilities closer to people, especially in the poorest regions. The World Bank (2018) reports that in Ghana, at 1.4% of GDP, public health spending is below the average of 2.3% for sub-Saharan Africa and 1.6% for lower-middle-income countries. In social protection, however, the government’s Livelihood Empowerment Against Poverty (LEAP) programme represents a key effort in the last decade to address inequality. Other efforts include capitation grants for public basic schools, feeding programmes and supplies for deprived schools, and the exemption policy for vulnerable groups under the national health insurance scheme (Oxfam et al., 2018). Cooke et al. (2016) agree that targeted programmes for the poorest, such as LEAP, have benefited the poorest disproportionately in recent years and may have contributed to the reduction in extreme poverty, in addition to multiple other factors related to the economy’s transformation and urbanisation. Aryeetey et al. (2015) however argue that the poverty-reducing strategy of cash transfers to extremely poor households under LEAP is yet to have the necessary effect of averting increasing inequality and depth of poverty. They recommend a re-examination of Ghana’s growth performance to make it more inclusive by ensuring that the benefits of growth are evenly spread through the generation of productive employment across all segments of the country. The reach of LEAP is still limited, estimated by Oxfam at 50% of the extreme poor (Oxfam et al., 2018).

Key challenges in achieving inclusive growth in Ghana

Government commitment to private sector development

The Ghanaian government’s agenda for private sector development was articulated over the review period by the Private Sector Development Strategy 2010-2016. It aimed to transform Ghana into a more productive, diversified and internationally competitive economy. The reforms were, however, characterised by weak coordination, a lack of political commitment, a breakdown in communication among stakeholders, and inadequate budget allocation (World Bank, 2013). As a result, key aspects of the private sector development agenda remained unfulfilled. Whitfield (2011) argues that the strategy failed to achieve much for domestic capitalists, and that while there was progress regarding government support for the private sector, little of it could be attributed to the strategy. The government has since made a renewed commitment to the reform agenda and is developing a programme of cross-cutting policy and regulatory reforms aimed at diversifying the economy, creating a conducive business environment, and facilitating job creation. It has prioritised macroeconomic stabilisation, investment in both physical infrastructure and human capital, and the creation of a sound business environment. While Ghana has made some progress against some of these policy objectives, the literature suggests that on others there may be significant challenges ahead.

A structural change in output and labour shares

Besides its rapid growth between 2005 and 2012, the Ghanaian economy also underwent a structural change in terms of output and labour shares, hinting at economic diversification. Services replaced agriculture as the largest sector of the economy. The share of employment in agriculture fell from 62% in 1991 to 42% in 2015 as it rose from 28% to 43% in services. Meanwhile, industry saw its share decline to the level where it had been in 1960, just 5.5% of GDP, as labour moved straight into the services sector. This shows in a strong sectoral contribution of services to growth, while the contribution of manufacturing is barely visible for most years. The shift of labour into

services is also associated with rapid urbanisation (Molini et al., 2015).

The growth in services did not stem from productivity increases within the sector, as productivity in services has been declining since 2005. Geiger et al. (2019) note that the growth contribution of services stems instead from the fact that the overall size of the sector was large (a level effect) and growing (an effect of structural change). They confirm that most of the labour freed up by productivity increases in agriculture did not find higherproductivity employment opportunities elsewhere. Instead, the sector component that absorbed most labour is wholesale and retail trade, with the economy’s lowest productivity and with disputable potential to boost sustained growth. This, the authors emphasise, may be because the freed-up labour supply does not have the skills to enter high-productivity services.

Structural change did not result in more quality jobs

Much of the literature concurs with Aryeetey et al. (2015) that the shift in dominance from agriculture to services should not be misconstrued as a structural transformation towards Ghana’s ambition of an economy that provides high and secure incomes and improves the livelihoods of the people. Only structural change towards higher value-added sectors, and upgrading of technologies in existing sectors, is expected to allow for better work conditions, better jobs and higher wages.

A study by the African Centre for Economic Transformation (ACET) in 2014 confirms that, besides not being associated with productivity increases, sustained output growth in Ghana has also not been matched by employment growth, and the growth that has occurred was not in high-quality jobs.5 With only about 24% of the labour force in the formal sector, informal employment dominates. Youth unemployment doubled between 2006 and 2012, from 6.6% to 12.9%. Baah-Boateng et al. (2013) note that besides the slow rate of job creation, precarious employment dominated and the working poverty rate in the labour market was high.

Honorati et al. (2016) make a strong case that more productive and inclusive jobs are central to sustainable economic growth and modernisation, and to political and social stability. They note that while Ghana has been successful in moving people from agriculture to off-farm self-employment activities, the challenge is to increase the productivity of the self-employed, reduce their income vulnerability, foster more wage work, and create a middle-income class of workers. Aryeetey et al. (2015) suggest that weak job growth and rising inequality are indications of the urgent need for a rethink of Ghana’s growth strategy. Policymakers need to acknowledge that growth is a necessary condition, but it can only pass the sufficient condition test if it translates into the generation of productive and higher-earning jobs.

The main potential drivers of inclusive growth and their constraints

There is no clear consensus in the literature about what will drive structural transformation towards inclusive job rich growth in Ghana. Honorati et al. (2016) suggest that Ghana needs to diversify its economy through gains in productivity in sectors like agribusiness, transport, construction, energy, and ICT services. They note that rapid urbanisation has generated increased demand for processed food products in terms of both quantity and quality. The agro-processing sector is underdeveloped to meet local (and global) demand and offers opportunities to create productive jobs and increase exports.

Manufacturing and limitations to its growth: Many point to the manufacturing sector as the obvious solution. The African Development Bank (2019) believes that growth driven by a dynamic manufacturing sector can create more jobs than growth driven by any other sector. It notes, however, that Africa’s potential for industrialisation is limited by the premature deindustrialisation in recent decades. It asks a critical question: how can African countries tip the scale in favour of manufacturing and reap the benefits of structural change and rapid economic growth?

The view of Breisinger et al. (2011) is that the initial conditions of manufacturing in Ghana limit the sector’s role in transformation, unless agricultural growth is also accelerated to provide cheap raw materials. Importantly, they believe agricultural growth must be broad-based, and must involve closing the existing yield gaps for major staple crops and productivity growth in the livestock sector.

Research by Davies et al. (2015) notes different challenges with manufacturing in Ghana. It shows that Ghanaian manufacturing firms that existed in 2003 performed poorly over the ten years between 2003 and 2013, a continuation of poor performance from the 1990s. The World Bank, in a 2013 survey, found that access to finance and key aspects of infrastructure were experienced as major business constraints by firms (World Bank, 2013). Overall, it argues, there are not many opportunities for transformative private sector investments in some sectors (mining, tourism, retail, construction, water and sanitation, and manufacturing). This is because it would require

Total employment increased by 3.5% a year on average between 2000 and 2010 (with most of the new jobs in the informal sector). In 2010, seven out of ten jobs were estimated to be vulnerable, while only one out of five jobs could be considered as productive jobs that meet the standard of decent work. Employment in the informal sector increased from 83.9% of total employment to 86.2% between 2000 and 2010, with a corresponding decline in the share of public sector employment from 7.2% to 6.4% and formal private sector employment from 8.9% to 7.4%. several years before the necessary conditions could be put in place. For example, manufacturing would require significantly improved access to competitive energy, finance, trade facilitation and skills.

Small and medium enterprises and limitations on their growth: Small and medium enterprises will be critical to Ghana’s private sector transformation (World Bank, 2013). However, a ‘missing middle’ phenomenon appears to characterise the private sector in Ghana. Tybout (2014, p. 1) defines this as: “When policies are imperfectly enforced, producers tend to stay small in order to fly under the government radar, avoiding taxes and costly regulations. Some high-productivity firms do grow large, anticipating that the costs of doing so will be more than offset by the extra operating profits associated with a large customer base, access to the legal system, and modern factory technologies.”

The World Bank (2013) argues that public financing and capacity building, technical support adapted to the sector in which they operate, and risk-sharing and specialised finance facilities are needed to grow the small and medium enterprise sector. It also makes the argument for transformational foreign direct investment in agribusiness, which would bring tangible benefits in terms of employment, technical know-how and managerial skills, as well as access to new markets. However, many factors hamper Ghana’s ability to attract sizeable (domestic or foreign) investment: macroeconomic instability, infrastructure deficiencies, difficult access to land, weak managerial and entrepreneurial skills base, market size, cost of labour, exchange rate and openness to trade (Yakubu et al, 2019; World Bank, 2013).

Khan (2010) notes that sustaining growth requires institutional solutions to address market failures. If the relevant market failures are primarily the result of weak property rights, the solution would be to focus on governance reforms that strengthen property rights.

The creation of high-quality jobs in vibrant small and medium-sized firms, and in new large industries, also requires the development of human capital to supply the demanded labour. In this regard, there is consensus that Ghana needs to accelerate improvements in the quality of education and skills as well as access to secondary and tertiary education (Baah-Boateng, 2013; Odonkor et al., 2018; World Bank, 2013). This will require refocusing on the quality of core education and the development of cognitive/non-cognitive skills. Beyond basic education, technical and vocational education and training (TVET) and entrepreneurship programmes need to be refocused.

Public institutions in Ghana

In the early post-independence period, Ghana’s public institutions were hailed as among the best and most efficient in Africa. Following the military overthrow of the government in 1966, the effectiveness of public institutions began to decline steadily. Despite waves of largely donor-funded public sector reform programmes during the past three decades to improve core areas of state functionality, most public sector institutions remain largely ineffective. The World Bank (2018) notes that institutional reforms designed to promote economic development, strengthen the investment climate and improve the quality of public management have generally been undermined by weak policy coordination and implementation. The Bank identifies three major weaknesses in the delivery of public services: 1) poor institutional capacity of ministries, departments and agencies to formulate and implement policies for service delivery, 2) inadequate support from central agencies, and 3) limited coordination between sector institutions – structural inefficiencies that have contributed to low levels of service quality in frontline entities.

The literature provides many reasons for weak public institutions in Ghana. A key view from Abdulai (2018) is that it is not the lack of competent Ghanaians or poor remuneration, but rather the partisan political environment that produces a large turnover of senior staff and technocrats whenever governments change, undermining professionalism, continuity, long-term planning orientation, learning and innovation in the public sector. The politicisation of the bureaucracy has meant that while bureaucrats have a high degree of power by virtue of the role they play in policy formulation and implementation, the incentive structure places them in a dilemma with regard to toeing the line of the political elites in the party in power and remaining professionals. In most cases, socially and economically feasible decisions proposed by bureaucrats have been replaced by more politically feasible alternatives through fear of losing political power (Oduru et al., 2014).

Political economy and public institutions

Appiah et al. (2017) argue that the nature of the political settlement in Ghana, described as one of ‘competitive clientelism’, is central to understanding the country’s limited success in improving the effectiveness of public institutions. In view of the credible threat of losing power to excluded factions in competitive elections, policy and reform initiatives tend to be driven largely by ‘visible’ outcomes that will ensure short-term political survival, rather than by their potential to enhance the effectiveness of state institutions. Atta Mills (2018) points to the ‘winner takes all’ political system in Ghana as a key factor, where the successful presidential candidate gets the right to appoint ministers, presidential staffers, managers and board members of all parastatals and, more importantly, to award contracts. Elections are contested on promises of infrastructure projects, utility price reductions, the elimination of (school) fees etc.

In this political environment, policy discontinuities across ruling coalitions are often the norm, undermining the impact of reform initiatives that require a longer time horizon to bear fruit. Ampratwum et al. (2018) illustrate how the political settlement shapes governance in the education sector at sub-national levels in Ghana. The authors note that while discourse has included a focus on quality, this appears to have been outweighed by the political imperatives of providing more tangible goods via access and quantity of provision.

Such promises, however, are short-term. Williams (2017) examined project completion in 2017 using a dataset of over 14,000 small local government projects in Ghana from 2011 to 2013. He estimated that approximately onethird of projects started were never finished, consuming nearly 20% of all local government capital expenditure. He theorises that project non-completion is the outcome of a collective choice process in contexts of limited resources, in which multiple political actors bargain over the distribution of a limited number of discrete, targeted projects. Coalitions around which projects to implement are unstable, as actors do not make credible commitments. Since project construction happens over a period of time, this time-inconsistency leads some projects to be interrupted mid-construction when collective expenditure priorities shift to new projects. The malaise of unfinished projects is not confined to local contracts, but pervades the system.

Reforming public institutions

In this environment, bringing about change requires more than technocratic advice (Appiah et al., 2015; Osei et al., 2015; Kahn, 2010). Osei et al. (2015) posit that support for reforms is more likely to have the desired impact if donors focus on fostering engagement with multiple stakeholders with the incentive and influence to support reform. Donors should also deal with how power and resources are distributed and pay attention to how the political dynamics matter for when reforms gain traction (Appiah et al., 2015). Donors can support influential civil society groups working on governance and anti-corruption reforms to mount political pressure and influence the restructuring of the constitutional rules in a manner that promotes inclusive politics, resource distribution and accountability.

Khan (2010) argues that while many good governance reforms (property rights enforcement, rule of law, anticorruption and political accountability) are desirable in their own right, they are insufficient to address important market failures and are in any case difficult to implement. Sustaining growth requires specific institutional solutions to important market failures that can be implemented in particular political settlements. The question then is to identify policy and institutional instruments for addressing market failures that can be adequately enforced in a particular settlement, given existing enforcement capabilities or feasible improvements in enforcement capabilities through targeted ‘developmental governance’ reforms.

How reforms are approached within institutions also matters. Roll (2013) and Leonard (2010) describe how depending on the capacity and commitment of frontline managers to devise and enforce problem-solving solutions to local problems helps local systems to function effectively, even in contexts where gross ineffectiveness in service delivery is the norm. Such localities (whether within an organisation or geographical) are described in the literature as “pockets of effectiveness”. Abdulai et al. (2019) propose that in the context of Ghana’s competitive clientelist political settlements, interventions that focus on system-wide reforms at the centre are unlikely to yield the desired results. A more realistic agenda would be to support the emergence and maintenance of such pockets of effectiveness. This could take the form of nurturing multi-stakeholder governance arrangements or developmental coalitions at the regional and district levels. Abdulai and Mohan (2019) illustrate how pockets of effectiveness work in health service delivery in Ghana’s Upper East region. They list factors and mechanisms that contributed to addressing maternal mortality, such as: the presence of a dynamic regional health director able to lead on strong vision statements relating to maternal mortality improvements, an agreement with the Ghana Health Service headquarters that created incentives for health workers to remain in the region, the ability to stand up to political and other interference on postings, a more equitable distribution of staff, more effort to train, deploy and retain nurses, offering certificate awards to recognise hard work, better monitoring and supervision, and enforcement of senior management performance contracts.

In a 2019 paper, Abdulai and Hickey (2019) researched Ghana’s Ministry of Finance, declaring it a pocket of effectiveness that has maintained a relatively high degree of performance over the past three decades in delivering on its mandate, although with variations over time. According to the authors, this is explained in broad terms by the coupling of structures within the wider political settlement with more ‘internal’ organisational factors, such as a positive organisational culture, committed and motivated staff, and training and international networking opportunities. The paper explains that periods of high performance shared three main characteristics. First was the relative longevity in ministerial leadership as well as the nature of ministerial leadership, with the ability of more technocratic ministers to resist political pressures and engage in effective political bargaining.7 This supports the literature that in contexts of personalised forms of governance, public sector agencies can enhance their effectiveness, not by isolating themselves from politics but instead by cultivating “strong political relations” and engaging in various forms of “political bargaining” with powerful political and bureaucratic forces (Roll, 2013).

Second, the ministry’s success has hinged over time on elite cohesion within the ruling coalition and the resulting relationships between the executive and senior bureaucrats in the ministry. However, in a political system characterised by competitive clientelism, the ruling elites are not encouraged to build bureaucratic capacities and an existing pocket of effectiveness can be easily dismantled when the opposing party comes to power.

Third, donors can play an influential role, although it is neither the amount of aid nor the strength of aid conditionalities that matter in shaping the impact of external development assistance, but the extent to which the interests/incentives of domestic political elites and external actors are aligned. The limits of external actors in pushing for reforms that are at variance with the interests of domestic political elites is illustrated in significant off-budget expenditures in election years, under IMF programmes with strict structural benchmarks.

Common challenges of oil and gas revenue governance in sub-Saharan Africa and Ghana

A key event in Ghana’s economic trajectory was the discovery of commercially exploitable oil and gas reserves off the country’s coast. Ghana’s reserves are not large by global standards but can make a significant contribution to the country’s development trajectory if managed well. The purpose of this section of the literature review is to explore this context for Ghana, providing information on the country’s oil and gas sector and how the management of the sector compares with lessons learned from comparable contexts.

Finding oil and gas in Ghana

Ghana has been an oil producer since the early 1900s, with small-scale production in the Tano and Keta Basins. In the 1970s the Saltpond field came on line (Skaten, 2018). It was, however, only after the discovery of offshore deposits in the Jubilee field in 2007 that Ghana emerged as a commercial producer of oil and gas (Van der Ploeg et al., 2011; Skaten, 2018). Production started at the Jubilee field in 2010, followed by the TEN and Sankofa8 fields in 2016 and 2017 respectively. The government has approved drilling in the greater Jubilee field. Ghana has four oil basins, three offshore and one, the Voltaian basin which covers 40% of Ghana’s land mass, onshore. The largest offshore basin is the Western basin, where the current commercial fields are. Estimates put Ghana’s oil reserves at between 1,700 (Haglund, 2015) and 4,000 million barrels of oil (Van der Ploeg, 2011; Gkolemi, 2018). Nigeria’s reserves, by contrast, are estimated at 38 billion barrels and Saudi Arabia’s at 265 billion barrels. In per capita terms, Ghana has an estimated 160 barrels per person, while Nigeria has 240 per person (Van der Ploeg, 2013).

Tullow Oil Ghana is the operator for the Jubilee and TEN fields, with the Ghana National Petroleum Company (GNPC), Kosmos Energy, Anadarko and Petro SA as partners across the two fields. The Sankofa field is operated by ENI, with Viton and the GNPC as partners(Skaten, 2018). Production and further exploration of the TEN fields, which are located on the maritime border with Côte d’Ivoire, were affected from 2011 until 2017 by a maritime border dispute between the two countries. In 2014 Ghana turned to the Tribunal of the Law of The Sea (ITLOS) to resolve the issue. After first determining in 2015 that existing drilling operations could continue, ITLOS ruled in favour of Ghana in 2017, opening up the possibility of exploring further fields in the area (Skaten, 2018).

Production from Ghana’s gas reserves has been slower to come on stream. It is expected that gas will replace oil in power production in Ghana. The Atuabo gas processing plant (operated by Ghana National Gas Company, a subsidiary of the GNPC) went into operation in December 2014 with flows from the Jubilee field. The World Bank provided loans and financial guarantees to the Sankofa field development because of the contribution it is set to make to the electricity sector, which is a major constraint on economic growth(Skaten, 2018).

Over the last two years new blocks have been offered for exploration. In January 2018 ExxonMobil was granted the rights to conduct exploratory work in partnership with the GNPC, and in mid-May 2018 the Ministry of Energy announced it would call for bids for the right to explore up to nine new blocks off the west coast, with the first six to be offered in the fourth quarter (Key Facts Energy, 2018).

In February 2019, the Ghana government announced the discovery of further commercial reserves in the Deepwater Tano Cape three points block in the TEN fields. The expectation was that production from this field could more than double Ghana’s crude oil production by 2023 (from 169 million barrels a day to 420 million barrels) (Ministry of Finance, 2019).

In tandem with the scaling up of exploration and production, the government is looking to bolster downstream refining capacity to supply petroleum products to the West Africa region. Earlier liberalisation of the Ghana petroleum product market (in 2005) has provided a foundation for growth, but it is only after the discovery of oil that the market growth took off fully. Since 2009 the number of companies in the downstream market has grown by 144%. The energy ministry announced plans in January 2018 to build a new 150,000-bpd oil refinery over the next four years (Key Facts Energy, 2018, Skaten, 2018).

Impact of oil and gas on Ghana: realised and potential

Oil is credited with fuelling Ghana’s growth spurt in 2010/11. Overall, GDP growth accelerated from 7.9% in 2010 to 14% in 2011. Non-oil GDP growth rates were only 0.5 percentage points higher in 2011 compared to 2010 (IMF, 2015). However, with the decline in oil prices, by 2014 the difference between overall and non-oil growth was as little as 0.1 percentage points. Oil and gas-related revenue as a share of government receipts increased from 5.9% in 2011 to 11.6% in 2014, with the largest contribution (51% of oil revenues) being from the government’s share in oil production. The second-largest share was from corporate tax (29%) and then from royalties (19.7%) (IMF,

2015).

Another immediate effect of the development of the oil and gas fields was the diversification of exports from two commodities (gold and cocoa) to three, with the addition of crude oil. In 2015, these three accounted for about 70% of total exports (Gkolemi et al., 2018). However, the development of the oil industry has also increased imports, spanning a wide range of products and capital goods.

The government’s capital expenditure in the early years of production did not increase with increased revenue (IMF, 2016). Rather, as set out in a report by the African Development Bank and the Bill and Melinda Gates Foundation on natural resource revenue management in Africa, it was associated with a sharp increase in public sector salaries because of a new personnel remuneration policy that standardised pay across the sector (the ‘onespine policy’) (AfDB and BMG, 2015). This is in contrast to what an International Finance Corporation report projected would be the most productive use of oil revenues (Gkolemi et al., 2018). The report estimated that the effects of the oil and gas sector at full production from the Jubilee, TEN and Sankofa fields would be much larger on GDP than employment. If oil revenues were used to upgrade infrastructure, it would increase labour productivity, economic competitiveness and income. If these benefits are fully achieved, the authors estimate an increase of 0.33 percentage points (or an additional US$75 billion) on GDP growth between 2015 and 2030 compared to a scenario in which the oil and gas sector was never developed.

In absolute terms, Ghana’s reserves are relatively small on a global scale. Early estimates placed Ghana approximately 50th in the world in terms of barrels of oil (Van der Ploeg et al., 2011), but this predated later discoveries, including the Deepwater Tano Cape three points block discovery announced early in February 2019. In any event, given Ghana’s income level, the revenue earned from oil can comprise a sizeable portion of GDP and government revenue, but this is significantly dependent on oil prices. Exactly what the impact could be differs between sources. Estimates (published before the latest discoveries) range between 20% and 40% of government revenue at peak production (and between 8% and 21% in the first ten years). Estimates of contribution to GDP are from below 6% to 9% of GDP (or 1.5% to 3.7% in the first ten years) (Van der Ploeg et al., 2011; African Development Bank and Bill and Melinda Gates Foundation, 2015; Haglund et al., 2015). How beneficial it will be will depend significantly on decisions made in the past and decisions that will be made in the future on the management of Ghana’s natural resource wealth.

Governance framework for oil and gas revenue management in Ghana

In Ghana, all mineral resources belong to the Republic of Ghana, with ownership vested in the country’s president.10 The GNPC has been a player in Ghana’s petroleum industry since its establishment by law in 1983, after the discovery of the small Saltpond field, as a regulator and a commercial entity (in line with Brazil’s Petrobras, from which the Ghanaian government received technical advice at the time) (Skaten, 2018; Hickey et al., 2015).

Hickey et al.(2015) note that when larger-scale oil production started in 2010, there was an acute shortage of technical skills at all levels, and the capacity needs of various institutions responsible for managing the sector were considerable. It was only a year after oil had started to flow that the dual commercial and regulatory role of the GNPC was broken up. Hickey et al. (2015) and Skaten (2018) both make a convincing case on how the role and capacities of the company shifted with changes in government. The National Democratic Party, which came to power in 2008, removed the GNPC’s regulatory mandate for both the upstream and downstream sectors in 2011, leaving it as a commercial operator in the upstream sector. This was after earlier allegations of corruption in the awarding of oil contracts under the previous government, when the New Patriotic Party was in government.

A new regulatory body, known as the Petroleum Commission (PC), was established by law in 2011. The Ghana Petroleum Revenue Management Act (2011) established an independent, civil society-based Public Interest and Accountability Committee as an oversight mechanism as well as two funds to be used for the portion of petroleum revenue that was not entering the national budget, namely the stabilisation fund and the heritage fund. The DFID programme supporting the management of oil revenues, one of the programmes scrutinised in ICAI’s review of UK aid to Ghana, included activities to build capacity in the PC, the finance ministry, the Ghana Revenue Authority, the Bank of Ghana and civil society to implement the Act. According to the Act, 70% of the seven-year average of petroleum revenue enters the budget directly. A maximum of 21% is allocated to the stabilisation fund. A minimum of 9% is allocated to a heritage fund for future generations. The Act determines that these percentages are subject to review every three years.

In 2016, the Petroleum (Exploration and Production) Act, 2016 (Act 919) (the E&P Act), was passed to replace the 1984 legislation that had, up to that point, regulated oil exploration and production. Among other regulations, local content regulation has been in place since 2013. DFID has provided support for developing and implementing the E&P Act.

Common challenges in oil and gas revenue management

An abundance of natural resources does not necessarily translate into accelerated economic or human development (Lundgren et al., 2013). The African Development Bank and Bill and Melinda Gates Foundation (2015) found that while natural resource wealth contributes significant export earnings for almost half of the economies in sub-Saharan Africa and while real GDP per capita growth for these economies has been higher than for other African countries since 2000, the translation of the resource rents into higher living standards for populations has been slow.

Van Der Ploeg et al. (2011) in their paper on harnessing oil revenues in Ghana, Lundgren et al. (2013) in an IMF paper on managing natural resource wealth in sub-Saharan Africa, and the Collaborative Africa Budget Reform Initiative (CABRI) in its 2015 keynote paper supporting a dialogue on the management of natural resource revenues in Africa, offer good summaries of the (interrelated) reasons why resource-rich countries may suffer from the resource curse. The challenge in Ghana for the fiscal and governance regime associated with its oil windfall is to avoid these traps and to use the oil wealth to promote sustainable economic growth and provide for future generations. We reflect six policy issues identified in these sources and other literature that are central to determining how well oil and gas wealth supports a country’s development.

Consuming resource wealth now or in the future

An early question policymakers in resource-rich countries must address is how much of the resource wealth to spend now versus later. Devoting all revenues during extraction to current consumption in the economy is inequitable, but postponing the consumption benefits into the future is equally so (Collier and Venables, 2008b). The optimal profile of when resources will enter the economy to improve the well-being of citizens depends on what the return is of spending it now, versus what the rate of return is if the revenue is invested into different kinds of assets. In addition, countries should be concerned about whether the economy can absorb high spending now(CABRI, 2015).

In many sub-Saharan countries, given capital scarcity, the priority is often to orient public spending towards investment, especially in economic infrastructure and human capital (Van der Ploeg et al., 2011; Lundgren et al., 2013; CABRI, 2015). In Ghana, oil revenue is largely directed to the budget, but a heritage fund has been set up. The decision on how much should be allocated to this fund is taken by the legislature on advice of government, regulated by law.

For a long time, the permanent income model or hypothesis dominated policy thinking. The model involves limiting total spending each year to the value of the interest on the total known resource wealth, whether extracted or not (Collier and Venables, 2008b). A variation of the permanent income model is to place the resource flows from natural assets in a fund and only consume the interest on the fund. This leads to continued spending once the revenue flows have ceased but avoids borrowing against future resource revenues and leads to a slow build-up of consumption(Collier and Venables, 2008b). In both models, rather than a temporary inflow of resource revenue, annual consumption can increase permanently (all other things being equal) and boom and bust cycles become easier to avoid (given the volatility of resource revenues).

However, Collier and Venables (2008) and Lundgren et al. (2013) argue that this approach may make more sense in already relatively wealthy economies like Norway than in a developing country. In the latter it will result in future generations being significantly better off than the current generation. For inter-generational equity reasons, and because oil revenue can be used to improve developing countries’ infrastructure up front, putting them on a higher growth path, it therefore makes sense to allocate more of the revenue to current generations (as the 2011 regime set up by the Ghana Petroleum Revenue Management Act did in Ghana).

While these are arguments for spending oil wealth sooner, a counter-argument is the risk that the sudden inflow of oil wealth will negatively affect the existing economy. A common problem for countries after the discovery and exploitation of their resource is that their manufacturing and agricultural export sectors, such as cocoa in the Ghanaian case, become uncompetitive. Hence gains from the burgeoning oil and gas industry risk being offset by losses of capacity in, and output and revenues from, other sectors (the so-called Dutch disease) (AfDB and BMGF, 2015; CABRI, 2015). The challenge is to assess the rate of additional spending at which the negative consequences for other sectors begin to offset the economic and social benefits gained from spending the oil wealth (CABRI,

2015; Lundgren et al., 2013).

Managing the volatility of resource revenue

Resource revenues are unpredictable. Oil price fluctuations complicate macroeconomic management and lead to procyclical economic policies (in which governments spend more when the economy grows and less when it stalls) and boom and bust cycles. The macroeconomic volatility is considered to be an important contributor to the ‘resource curse’, while wide swings in government spending make spending less productive and effective. Governments in oil-rich economies must decide on how much to save in a stabilisation or resource fund. Such funds operate on the simple principle that when prices are high relative to an established benchmark resource, proceeds flow into the fund and are invested in foreign assets. When prices are low, the funds are withdrawn. Many different types of sovereign wealth or stability funds operate in resource-rich countries. The establishment of these funds has become a standard component of the package of advice on the management of natural resource revenues: since 2005 at least 40 funds have been created. In Africa, Algeria, Angola, Botswana, Chad, Equatorial Guinea, Gabon, Kenya, Libya, Mauritania, Nigeria, Rwanda, São Tomé and Principe, South Sudan and Tanzania have funds of one nature or another (CABRI, 2015). In sub-Saharan Africa the funds are still relatively small, since establishing a fund and consistently paying into it when prices are high can be difficult to achieve in countries where expenditure needs are immediate.

Another question is what risk profiles petroleum revenue savings and stabilisation funds should assume and whether their investments should be mostly offshore or onshore. CABRI (2015) argues that if the purpose is to accumulate long-term savings for use by future generations, the fund can accept a relatively high level of risk with the expectation of a higher long-term return (such as investing in long-term securities). If the purpose is to stabilise government revenue in the event of falls in commodity prices, investments will need to be more liquid and less risky. Furthermore, if stabilisation is the main intent, such funds should invest mostly in foreign financial assets to insulate the economy from the effects of boom cycles. There should be clear rules governing when to pay into the fund and when to withdraw from it (CABRI, 2015). There are many examples of failure to set appropriate rules or to enforce those that are set, including in Ghana, where withdrawals were made from the stabilisation fund even though oil prices were still high (Kojo, 2019). Commonly, the technical managers of funds often struggle to stand up to strong political pressures, especially during election periods or instability. Transparency and accountability measures governing sovereign wealth funds are therefore critical, and have been supported by DFID in Ghana.

Stability funds are not the only option for managing volatility and may not be the most efficient. As for heritage funds, whether the revenue flows are sufficiently large to merit a fund is an issue. Alternatives may be that surplus funds could be held on a long-term basis in the foreign exchange reserve account of the central bank(CABRI, 2015; Lundgren, 2013), provided that clear rules are in place to manage fiscal and macroeconomic stability more generally. Generally, a medium-term fiscal framework that can help anchor medium-term targets is considered essential, even when wealth or stabilisation funds have been established (CABRI, 2015; IMF, 2012; Lundgren 2013).

Choices in the use of funds

Once the choice has been made between spending now or saving for the future or for stabilisation, the next decision is on whether to spend on investment projects or consumption. Policymakers need to make spending choices that promote long-term fiscal sustainability, avoid the deterioration of the non-resource economy and generate a return.

In capital-scarce countries the payoff from certain investments (such as in economic infrastructure) can be quite large, hence a substantial share of resource revenue should be allocated for this purpose. This is, for instance, the argument that Gkolemi et al. (2018) make for Ghana. However, spending on human development, such as on education and health, can also yield high returns, and is necessary to ensure inclusive economic development (AfDB and BMGF, 2015). Spending on improving security and to strengthen property rights and address crime and corruption can also yield returns. Therefore, although most resource revenue should generally be used for capital spending, the precise balance between capital and current spending (and between investing in savings or spending now) must be made on a country-specific basis (AfDB and BMGF, 2015; Lundgren et al., 2013). In Ghana, at least 70% of the oil revenues that are transferred to the budget must be used for capital investment in 11priority areas: human resources, agriculture, welfare, educatio n/health, water/sanitation, institutions/governance, alternative energy, transport, rural development, security or the environment. The Africa Centre for Energy Policy (ACEP), a civil society think tank working on natural resource exploitation and revenues in Africa and supported by UK aid, has identified several problems in the way the budget funds are used (ACEP, 2018a). These include spreading the funding too thinly over many projects, so that projects are not completed or suffer delays and cost overruns, weak project selection, weak procurement systems and poor quality of work on projects, all reducing the impact of the funds spent.

Transparency and accountability in the management of resource revenues

Van der Ploeg et al. (2011), Lundgren et al. (2013) and CABRI (2015) discuss the impact of resource revenues on accountability. Governments can become less accountable to their citizens when they rely on resource revenue, which can be captured by elites. Resource revenue both increases the need for and reduces elite incentives to build the strong institutions necessary for broader wealth creation.

To combat corruption, increase accountability and promote government effectiveness, the international community and advocacy groups have been promoting transparency and accountability as the remedy for misappropriation and mismanagement of revenues. Countries have been urged to join the Extractive Industries Transparency Initiative (EITI) and to make relevant changes in legislation (Epremian et al., 2016).

Discussions on whether transparency is effective in ensuring sound natural resource revenue management have so far been dominated by empirical studies and evaluations of EITI’s performance (Epremian et al., 2016). To date these studies have not shown that EITI has had substantive results. There are a number of possible explanations for these disappointing results, including the limited amount of time since EITI was established and implemented in different countries, and the fact that EITI addresses only one among multiple pathways for corruption and mismanagement of extractive resource revenues. Epremian et al. (2016) note that wider research into the relationship between transparency and quality of governance and levels of corruption indicate a positive correlation between release of information, good governance and reduced levels of corruption.

Political economy and resource revenues

The size and exhaustibility of natural resource wealth raise difficult incentives (Van der Ploeg et al., 2011; Lundgren, 2013; CABRI, 2015), which has led donors and international agencies to recommend that countries in sub-Saharan Africa with new-found oil wealth establish sovereign funds (as discussed above), a strong oversight role for constitutional oversight institutions such as parliament, and high transparency. Some authors, however, sound a cautionary note that the character of formal institutions per se matters much less than the ways in which deeper forms of politics and power relations shape how institutions, both formal and informal, actually function in practice. Raveh and Tsur (2018), for example, note how re-election-seeking politicians are myopic, which leads to budget deficit biases, with a debt build-up. Resource windfalls exacerbate this (AfDB and African Union, 2009; Raveh and Tsur, 2018). Gyimah-Boadi and Prempeh (2012) warned that severe deficiencies in contemporary Ghanaian politics, together with possible aggravation of the country’s patronagefuelled democracy and acrimonious political competition on account of the new resource, should give cause for caution, despite the crafting of policies, legislation and institutions to govern the oil sector and oil revenues. Some aspects of the actual management of resource revenue in Ghana, including not following the rules established on resource flows at the national level and not using funds for projects channelled to local levels to undertake the projects (ACEP, 2018a), make this warning ring true.

(Beyond) aid partnerships in transition countries

Transition is a process that entails changing an existing aid relationship from one that relies on a donor-recipient paradigm to one that recognises the inherent equality of a development partnership. A central driver behind the changing nature of UK aid to Ghana is that both the UK-Ghana partnership and Ghana are in transition. On assuming office in January 2017, President Nana Akufo-Addo announced his vision for a ‘beyond aid’ agenda that would reduce the country’s reliance on official development assistance (ODA) in favour of domestic resource mobilisation and alternative sources of development finance (including private sector investment).

The term ‘transition’ is used and understood in a variety of ways: it describes both a change in the relationship between donor and recipient countries as well as the experience of countries that move up the income ladder. For the purposes of this literature review, transition is broadly defined as the process by which donor countries seek to change their relationship with recipient countries using a range of ODA and non-ODA instruments. There is no single approach to, or outcome of, transition, which is highly dependent on the specific context of both the donor and the recipient. In general, however, transition is more often than not marked by a decrease in ODA in the form of grants and an increase in technical assistance and/or loans, equity investments and guarantees (ICAI, 2015 and 2016). Transition often, but not necessarily, means a decrease in total amounts of ODA and finance, for instance from multilateral development banks, becoming less concessional in nature (Calleja and Prizzon, 2019).

Definitions of and approaches to transition

Transition is, by definition, a process of transforming the aid relationship, as opposed to exit (whereby donors withdraw their in-country presence and phase out all forms of bilateral funding). But donors adopt different approaches to transition based on their own political contexts and development policies. Mawdsley, Savage and Kim(2014) point to the 2011 Fourth High Level Forum on Aid Effectiveness in Busan as a turning point: ‘traditional’ donors sought to build relationships with emerging powers as development partners – and, in the process, shifted the emphasis from aid effectiveness to development effectiveness. This shift “implies a broader focus on ‘development finance’ rather than the previously more restrictive definition of ODA as a distinctive flow” (Mawdsley et al., 2014, p. 4). The aim is a ‘post-aid’ reality. In addition, these partnerships are increasingly based on shared interests, and the “pursuit of mutual economic benefit is emerging as a common objective of bilateral aid to middle income countries” (Australian Department of Foreign Affairs and Trade, 2018, p. 25).

Donors employ a wide variety of terms to describe ‘transition’ countries. A few examples include: rising/emerging power (DFID), frontier economy/economic horizon country (Foreign Office and Department for International Trade), more advanced developing country (European Union), global development partner (Germany), economic partnership country (Australian Department of Foreign Affairs and Trade), non-150 account relationship (United States), and graduate (World Bank).

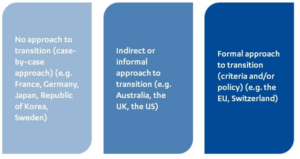

The Overseas Development Institute (ODI) identified three broad approaches to transition across OECD-DAC donors, which lie on a spectrum from no or ad hoc approaches to formal strategies and criteria. This is summarised in the graphic below.

Figure 1: A proposed classification of development partners’ approaches to transition from bilateral development programmes

Dimensions of transition

The literature shows that donors more often than not continue to spend ODA resources throughout a transition process, albeit in different quantities and through different mechanisms. The following table outlines three dimensions of transition, which can be thought of as areas of decision-making for donors to consider when transitioning their development partnerships.

Table 2: Dimensions of transition

| Quantity of ODA spent | Mechanisms for spending ODA | Geographical focus of spend |

|---|---|---|

| Draw down: Continued use of the same bilateral instruments, but with a decrease in the volumes of ODA. Example: Sweden, Norway and Denmark in South Africa circa 2008. | Specialisation: Concentration of ODA in specific sectors. Example: DFID’s transition in Indonesia, 2011 and Sweden, Norway and Denmark in South Africa circa 2008 | Trilateral/ triangular cooperation: Working with a partner country to deliver assistance to third countries. Example: DFID working with India to deliver projects in Africa, for instance Kenya. |

| Phase out: Decrease in bilateral financial aid (grants) until it is entirely phased out. Example: DFID’s transition in India, 2015. | Technical assistance: Increase in technical cooperation/assistance funding rather than grants or loans. Example: DFID’s transitions in South Africa, India and China. | Regionalisation: Working with the country in their region, including trilaterally. Example: Transition from DFID South Africa to DFID Southern Africa. |

| Fewer grants, more loans: Shift away from grant funding to soft (concessional) loans. Example: Germany’s transitions in India, China, Morocco and Indonesia. | Cross-government: ODA spent through various government ministries or instruments. Example: DFID’s transitions in China, India and South Africa and re-entry into Brazil. | Internationalisation: Working with the country on their role as a global donor. Example: DFID’s transition from a bilateral programme to ‘working with China in the world’. |

The UK’s approach to transition

DFID’s approach to transitioning its development partnerships with ‘emerging’ or ‘rising’ powers has shifted over the past nine years, since the publication of the 2010 Bilateral Aid Review in 2011 (DFID, 2011). DFID subsequently identified the need for a transition offering as early as 2012: in oral evidence to the International Development Committee (IDC) in December of that year, DFID’s then permanent secretary Mark Lowcock stated that “as we [DFID] graduate countries, it is important that we do it in a phased way and move to a different sort of relationship, rather than simply say ‘that’s it: we’re no longer interested in you’” (IDC, 2012). In 2014 the then secretary of state, Justine Greening, stated in another IDC hearing (quoted in IDC, 2015): “we are not in a marathon here where a country starts off poor and then we get to the end of the race and it is suddenly developed. It is more like a relay race… We need a transition strategy.”