The use of UK aid to enhance mutual prosperity

Executive summary

In recent policy statements, the UK government has signalled its intention to use UK aid to generate economic and commercial benefits both for recipient countries and for the UK – in short, “enhancing mutual prosperity by building the foundations for UK trade and commercial opportunities in horizon markets”.

The purpose of this information note is to provide a descriptive first look at the mutual prosperity agenda and how the UK aid programme is shifting in response to it. It does not reach evaluative conclusions on whether particular interventions are relevant or effective, but it does highlight issues that merit future exploration. We do not focus on other areas of mutual benefit, for instance national security, public health threats or global public goods such as climate change.

We explore the development of the mutual prosperity agenda since the publication of the November 2015 UK aid strategy in two broad areas: policies and programmes. We focus on the activities of the Department for International Development (DFID), the Foreign and Commonwealth Office (FCO) and the Department for International Trade (DIT), which are currently responsible for delivering on cross-government mutual prosperity strategies. This includes work under the cross-government Prosperity Fund, which was established in 2016 “grounded on the premise that economic growth, when sustainable and inclusive, can raise welfare and prosperity in emerging economies. It can also benefit trade and investment with partners such as the UK.”

What is mutual prosperity?

Mutual prosperity is a broad and somewhat ambiguous concept, covering a spectrum of possibilities. There is no common definition in UK policy documents. One end of the spectrum represents an uncontroversial application of the mutual prosperity idea: the use of UK aid to support global economic development, which ultimately benefits both the partner country and the UK through the expansion of global trade. Towards the centre of the spectrum, UK aid programmes could be used to promote economic growth in countries or sectors that are of particular interest to the UK. At the other end of the spectrum, mutual prosperity could mean the pursuit of short-term commercial advantages for the UK, as well as benefits to the partner country.

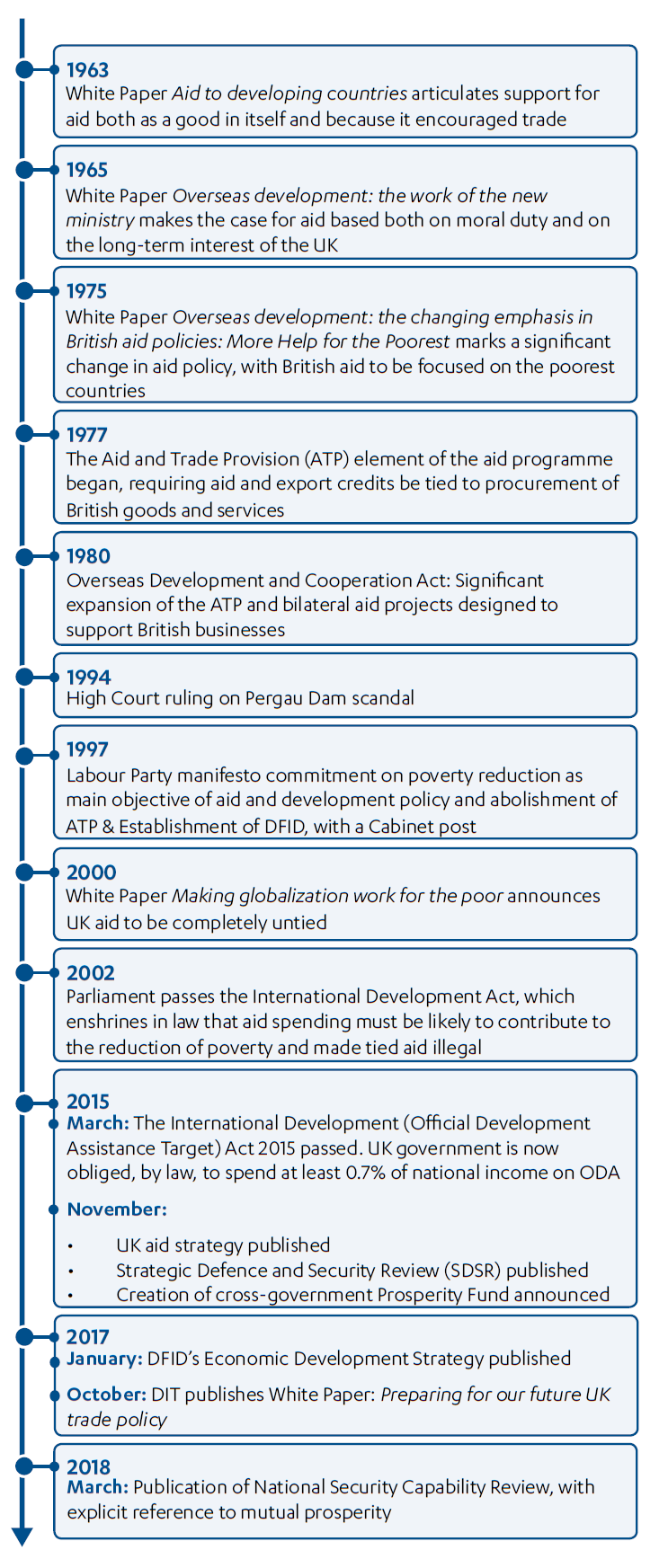

The use of UK aid to pursue mutual prosperity is not a new phenomenon. There is a long history of the UK using aid to enhance its own prosperity through economic and commercial benefits resulting from various government policies dating back to the 1960s. For instance, the 1977 Aid and Trade Provision linked aid to export credits which had to be used for the purchase of British goods and services. The Pergau dam incident in Malaysia in the early 1990s, which saw hundreds of millions of pounds in UK aid linked to a secretive arms deal, marked a low point in the reputation of British aid. Pergau contributed to the decision in 2000 to untie all UK aid (removing the condition that it be used to procure goods or services from the UK) and to enact the 2002 International Development Act (IDA), which stipulated that UK aid must be likely to contribute to a reduction in poverty.

While the mutual prosperity agenda long predates the 2016 referendum, the focus on mutual prosperity in UK policy appears to have intensified after the vote to leave the European Union. Some UK government documents tie it explicitly to the ‘Global Britain’ agenda – that is, the need to reposition the UK internationally after Brexit.

Policies

The UK aid programme has no single strategy or objective in relation to mutual prosperity. Rather, it is a crosscutting agenda that is increasingly prominent in policies and strategies across government but implemented differently by departments. Although the UK aid strategy of 2015 does not use the term “mutual prosperity”, the third of its four strategic objectives is “promoting global prosperity” – using official development assistance (ODA) “to promote economic development and prosperity in the developing world. This will contribute to the reduction of poverty and also strengthen UK trade and investment opportunities around the world.” Mutual prosperity has also been referenced in a few key policy speeches over the past two years, for instance in former Prime Minister Theresa May’s August 2018 Cape Town speech, where she stressed the UK national interest in fostering stronger relationships with African countries.

Broadly speaking, mutual prosperity can be understood as one manifestation of the ‘Fusion Doctrine’, which is the UK government’s proposition that it should use its tools of external engagement in the economic, security and diplomatic spheres in a joined-up way, in pursuit of common objectives. Mutual prosperity is one such objective. There are cross-government implementation groups under the National Security Council Secretariat to take forward joint working in specific countries, regions and thematic areas. In 2018, DFID, the FCO and DIT were tasked with developing cross-government prosperity strategies for individual countries. These strategies are designed to promote joined-up UK work in country towards the goal of promoting mutual prosperity.

Programmes

Because mutual prosperity is a cross-cutting agenda with no clearly defined boundaries, there is no classification of the total number of aid programmes under this heading, nor is it possible to determine how much of the UK aid budget has been allocated in its pursuit. The Prosperity Fund, with a total budget of over £1.2 billion between 2016 and 2023, is the clearest example. There is also a new class of DFID programmes that contain mutual prosperity language in their business cases, for example the Jobs and Economic Transformation programme currently being implemented in Ghana.

The Prosperity Fund was the first UK aid instrument to be explicit about the pursuit of secondary benefits at the same time as delivering on the Fund’s primary purpose. Because it spends under the authority of the IDA, the primary objective of its programmes “shall have regard to the desirability of providing development assistance that is likely to contribute to reducing poverty”. However, for the first time, secondary benefits to the UK – defined as “new economic opportunities for international, including UK, business and mutually beneficial economic relationships” – were among the criteria for programme selection and had to be explicitly stated and quantified in programme designs. These could be indirect or direct secondary benefits to the UK. Concept notes for the Prosperity Fund were scored for their potential contribution to both, with the primary benefit given greater weight (35% of the total score, as compared to 25%). The Prosperity Fund is also able to blend ODA and a small percentage of non-ODA funds, enabling it to pursue benefits to UK firms more directly.

While all of DFID’s economic development programming supports mutual prosperity in its broadest sense, it does not separately identify – or seek to quantify – the potential economic benefits to the UK of its programmes. However, DFID is increasingly expected to contribute to this agenda, as evidenced by its participation in the creation of joint strategies and its work in cross-government teams to achieve mutual prosperity aims.

Potential opportunities and risks

ICAI undertook three participatory focus group discussions (with UK civil society organisations, universities and think tanks, and consultancies and businesses) to elicit broad insights into the government’s emerging approach to mutual prosperity, rather than feedback on specific initiatives or programmes. When asked to identify opportunities and risks connected to this agenda, participants mentioned several relevant areas, including:

- the poverty focus of the UK aid programme

- the public support for UK aid

- the UK’s international profile

- the accountability of UK aid

- the coherence of UK aid

- the quality of development partnerships

- the quality of UK aid.

In several cases, participants from across and within focus groups identified the same area or theme as both a risk and an opportunity.

Issues for further investigation

Based on the information that we have collected on the mutual prosperity agenda and its implications for UK aid, we offer the following observations:

- The UK’s shift towards mutual prosperity has moved it to the position of several other donors and is in line with the expectations of some partner countries.

- There are potential benefits to UK aid from enhanced partnerships with the UK private sector, including through innovative technology and financial instruments.

- UK departments are currently proceeding with caution in their use of aid to promote mutual prosperity, being careful to operate under the rules of the 2002 International Development Act (IDA).

- However, with departments under growing pressure to use aid in in a manner more closely aligned to UK interests, there is a need for a set of principles governing the appropriate uses of aid.

- There are risks that the poverty focus of UK aid may be diluted.

- At present, it is too soon to tell what the outcomes of the mutual prosperity agenda will be, as programming under this banner is nascent. As departments continue to use the aid programme to promote mutual prosperity and the UK national interest, questions will continue to arise about how to ensure the best use of aid and how to maintain coherence across aid-spending departments.

These issues will merit close scrutiny over the coming period by the International Development Committee and other interested stakeholders.

Introduction

In recent policy statements, the UK government has signalled its intention to use UK aid to generate economic and commercial benefits both for recipient countries and for the UK – in short, to enhance mutual prosperity. The 2015 UK aid strategy includes the objective of promoting trade and investment opportunities for the UK. The 2018 National Security Capability Review affirms the UK’s commitment to eradicating poverty and meeting the Sustainable Development Goals “whilst also enhancing mutual prosperity by building the foundations for UK trade and commercial opportunities in horizon markets”.

The objective of securing economic benefits for the UK through the aid programme is by no means a new one. It was government policy before the International Development Act of 2002 and continued in its broadest sense to be part of the rationale for UK aid after the Act, in that the promotion of global poverty reduction and economic development is understood as being in the UK’s economic interest. What is new in recent years, however, is that UK aid programmes are increasingly called upon or required to be explicit about the secondary benefits that will accrue directly to the UK, and in some cases to report on and quantify these benefits.

So far, there is limited information in the public domain about how the UK’s approach to spending aid is changing as a consequence of the mutual prosperity agenda. This lack of information has contributed to concerns that the mutual prosperity agenda may involve a loss of focus on poverty reduction or even a return to past practices of tying aid (providing aid on the condition that it be used to procure goods or services from the UK).

This information note has been prepared in order to provide a descriptive first look at the mutual prosperity agenda and how the UK aid programme is shifting in response. We do not focus on other areas of mutual benefit, for instance national security, public health threats or global public goods such as climate change. The note is not intended to be evaluative, and therefore does not reach any conclusions as to whether particular interventions are relevant or effective. However, it concludes by highlighting issues (both risks and opportunities) that merit future exploration, whether by ICAI itself, the International Development Committee or other interested stakeholders.

We explore the emergence of the mutual prosperity agenda in two broad areas: policies and programmes. Covering the period since the November 2015 UK aid strategy, we discuss the activities of the Department for International Development (DFID), the Foreign and Commonwealth Office (FCO) and the Department for International Trade (DIT), which are currently responsible for delivering on the cross-government mutual prosperity agenda. This includes work under the cross-government Prosperity Fund, which was established in 2016 to promote economic growth in emerging economies and create opportunities for international business. CDC, the UK’s development finance institution, also has relevant activities but is not covered by this note as it has been reviewed by ICAI within the past year. Aid spending channelled through UK universities and other research institutions through funds administered by the Department for Business, Energy and Industrial Strategy is also not within the scope of this note. This has been assessed in two recent ICAI reviews on the Global Challenges Research Fund and the Newton Fund.

Box 1: Methodology

This information note is based on five data sources:

- An annotated bibliography based on a rapid survey of the contemporary literature, link.

- A review of UK government policy documents and guidance, as well as findings from previous ICAI reviews.

- A review of a sample of five Prosperity Fund business cases – selected to provide a balance of lead department, programme size, geography and sector focus.

- 31 Interviews, including with UK government staff across DFID, DIT, the FCO and HM Treasury.

- Focus group discussions with civil society, UK businesses and academic experts, using a participatory methodology based on the Institute for Cultural Affairs’ Group Facilitation Methods, with a total of 22 participants.

The note was independently peer-reviewed by a UK academic expert.

Limitations to the methodology:

- Data for this note was collected during the 2019 Spending Review and in a period of considerable uncertainty in the UK political context in the lead-up to the planned departure from the European Union, so it may date quickly.

- Mutual prosperity is not currently a defined portfolio of work under the UK aid programme (at the time of writing), and the question of which programming and expenditure contributes to the mutual prosperity objective is currently a matter of interpretation. How it has been interpreted in recent years by different actors is discussed in Section 2 of this report.

What does mutual prosperity mean?

A spectrum of possibilities

Mutual prosperity is a broad and somewhat ambiguous concept, covering a spectrum of possibilities, and there is no common definition across UK policy documents.

At the broadest level, there is a view that support for economic development around the world could ultimately benefit the UK economy, through the expansion of global trade. This is seen by some as an uncontroversial application of the mutual prosperity idea, as the benefit to the UK emerges as a result of economic growth in developing countries. It has arguably always been an objective of UK economic development assistance, whether articulated explicitly or not.

At the other end of the spectrum, mutual prosperity could mean the pursuit of short-term commercial advantages for the UK. This might happen if aid programmes included interventions that directly benefit UK investors or firms. At its extreme, this could also occur through a return to tying aid – that is, making UK aid subject to the condition that it is used to buy goods or services from UK companies. In those instances, the benefit to UK companies would come at the expense of other trading partners, and would accrue irrespective of whether the aid most effectively benefitted the partner country.

Towards the centre of the spectrum, UK aid programmes could promote economic growth in countries or sectors that are of special interest to the UK for the commercial benefit that they may offer. For example, the Prosperity Fund channels a significant share of its assistance towards upper-middle-income countries and into sectors (such as infrastructure, financial services and digital access) where UK companies are thought to be competitive.

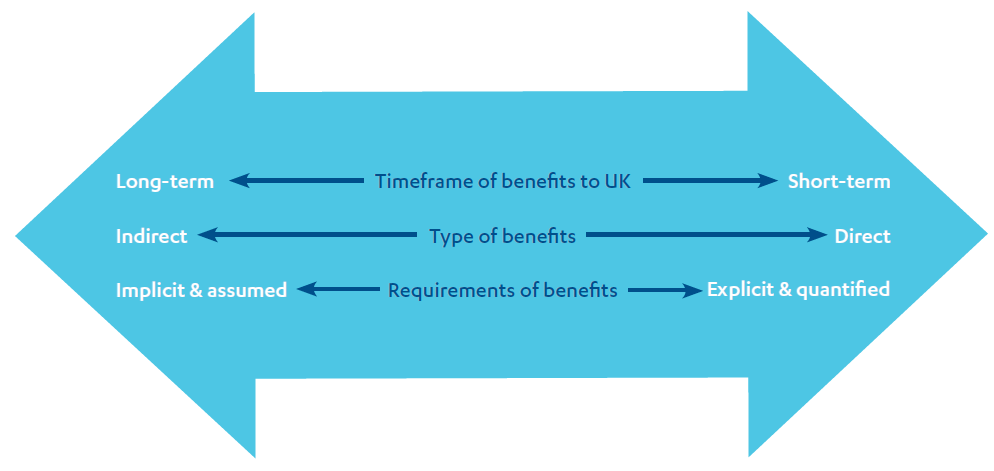

Figure 1 below highlights this conceptual spectrum. What has changed since the publishing of the 2015 UK aid strategy is the introduction of a requirement that all programmes under the Prosperity Fund outline and quantify indirect or direct secondary benefits at the approval stage – we return to this in more detail in Section 4. There is currently no requirement for other mutual prosperity programmes to do so.

Figure 1: Spectrum of secondary benefits

Most of the stakeholders we spoke to agreed that there are circumstances in which aid programmes can legitimately deliver mutual economic benefits. Indeed, UK diplomatic staff report that governments in some recipient countries have expressed a preference for aid that builds bilateral economic ties, seeing it as the basis for a more equal, long-term partnership. These types of partnership are particularly applicable in middle-income countries or countries the UK has designated as ‘rising powers’ (China, India, Brazil, South Africa, Turkey and Indonesia). It is often observed that the role of aid is changing by moving away from funding development interventions and directly towards mobilising other sources of development finance.

On the other hand, using aid to more directly advantage the donor country is more controversial. There is a risk that if those responsible for spending aid are under pressure to identify ‘win-win’ opportunities, they may not choose the most effective development interventions. Faced with a trade-off, they may choose to maximise secondary benefits to the UK at the expense of poverty reduction.

While the mutual prosperity agenda predates the 2016 referendum, the focus on mutual prosperity in UK policy appears to have intensified after the vote to leave the European Union. Some UK government documents tie it explicitly to the ‘Global Britain’ agenda – that is, the need to reposition the UK internationally following its departure from the EU. In 2018, former International Development Secretary Penny Mordaunt outlined five pledges for UK aid, beginning with developing, alongside DIT, a “bold new Brexit-ready proposition to boost trade and investment with developing countries and promote sustainable economic development and job creation”. In an October 2018 speech, Mordaunt described it as a “win-win agenda”, noting that “Global Britain wants mutual prosperity; based on British values.” In 2019, the new Secretary of State Alok Sharma led his first overseas trip with the message: “UK aid is helping to generate trade and investment opportunities – both for African and British businesses”.

A short history of mutual prosperity in UK aid

As noted above, there is a long history of the UK using aid to enhance its own prosperity through economic and commercial benefits. Before 2001, tying of aid was common practice. In the 1970s, UK aid projects were often selected based on their capacity to make use of British inputs. For example, the UK funded water projects in Indonesia because they made use of British consultants, drilling equipment and pumps. In 1977, the government introduced the Aid and Trade Provision, which linked aid to export credits which had to be used for the purchase of British goods and services. This was motivated by competition with other donor countries, such as France, which were also using aid to promote their exports. It led to a concentration of aid in capital-intensive projects in higher-income countries. In February 1980, the government announced that it would “give greater weight in the allocation of our aid to political, industrial and commercial objectives alongside our basic developmental objectives”.

The Pergau dam incident in the early 1990s marked a low point in the reputation of British aid (see Box 2). It informed the decision, following the 1997 election, to untie all UK aid. Since 2000, the government has formally committed to untying all UK aid, although in practice this commitment has not been achieved by the UK or by other Organisation for Economic Co-operation and Development’s Development Assistance Committee (OECD-DAC) donors. In 2002, the UK also enacted the International Development Act (IDA), which stipulated that UK aid must be likely to contribute to a reduction in poverty.

Box 2: Pergau dam

The Pergau dam incident was a significant inflection point in the history of UK aid. In the early 1990s, DFID’s predecessor, the Overseas Development Administration, agreed to provide $234 million to fund a hydroelectric scheme on the Pergau river in Malaysia, despite serious concerns about its economic viability. It later transpired that a secret arms export deal had been agreed, whereby Malaysia was offered 20% of the value of its arms purchase in aid. This was contrary to international trade rules at the time. Following a legal challenge by the World Development Movement, an advocacy non-governmental organisation, the High Court ruled in March 1994 that the aid granted for Pergau was unlawful. The court noted that experts from the Overseas Development Administration had assessed that the project would in fact increase the price of electricity for Malaysian consumers, as cheaper generation methods were available. The payment was therefore contrary to UK legislation at the time, which only permitted the Foreign Secretary to approve aid for the purpose of promoting the development and welfare of the recipient country.

For more details on the Pergau dam, see the Mutual Prosperity annotated bibliography, link.

Figure 2: Timeline of key policy developments

During the first decade of the 21st century, UK aid had a strong focus on poverty reduction and promoting basic services such as health, education and clean water. This was in keeping with the development agenda set out in the UN Millennium Development Goals. Since the 2010 election, there has been a rebalancing of UK aid back towards economic development. By 2015, DFID had doubled its expenditure on economic development to £1.8 billion per year. From 2015, it dramatically scaled up its development capital investments (that is, using aid to invest in business opportunities in developing countries), with capital injections into CDC of £1.8 billion between 2015 and 2018. In November 2015, the cross-government Prosperity Fund was established to promote economic growth and to create opportunities for international business including UK companies, as a result of this economic growth, as a secondary benefit.

It is also currently government policy to build trading ties with a wider range of countries, including emerging economic powers such as Brazil and China and ‘frontier economies’, like Ghana and Senegal, that may be trading partners in the future. DFID is being asked to step up its efforts on ‘market creation’ to help promote a business environment that is conducive to international investment, including by UK firms. There is a new focus on making the City of London a more active investor in developing countries, to expand bilateral economic and financial ties. As the UK leaves the EU, a key priority is to ensure continuity in its trading arrangements with developing countries. This is necessary in order to maintain current levels of access to the UK market for developing countries, and to avoid disruption to the supply chains of UK businesses that rely on imports from these countries.

A key question articulated by external stakeholders is whether the direction of travel is back to a past era of aid tying and promotion of UK exports, or towards a new ‘win-win’ approach for the UK and developing country partners. The IDA and the UK’s official commitment to untying all its aid remain in place. However, discussions at high levels about broadening the ODA definition (see Box 3 for details) or folding DFID back into the FCO suggest that some fundamental issues about the direction of UK aid have not gone away.

Box 3: Changing the international ODA rules on support to the private sector

Over the past five years, the UK (alongside other donors) has successfully lobbied the OECD-DAC for changes to some of the rules governing what counts as ODA. The OECD-DAC provides donors with a forum to discuss issues surrounding aid, development and poverty reduction in developing countries. At the February 2016 high-level meeting of the DAC, agreement was reached on new principles for private sector instruments, which include equity investments, guarantees and other ‘market-like’ instruments. According to the DAC, one of the objectives of the changes is to “remove the disincentives for using these instruments and defi ne a balanced and coherent system that would promote longer-term support to the private sector where needed”. After the change was agreed, the UK noted that “donors are incentivised to work more with the private sector to boost economic development and create jobs in some of the world’s poorest countries”.

Mutual prosperity in other donor countries

To place the UK position in context, we looked at the aid strategies of a sample of four OECD-DAC donors and one non-DAC donor (see Box 4). The comparison suggests that among those donors predominantly focused on the primary purpose of poverty reduction, there have recently been moves towards using aid to support mutual prosperity. The UK has moved further than Sweden, whose aid remains focused on poverty reduction and human rights, but not as far as the Netherlands, which uses small amounts of ODA to subsidise Dutch businesses trading in developing countries. American and Japanese aid is explicitly designed to secure competitive advantages for national firms, with a substantial degree of tying. China has been included as an example of a non-DAC donor that supports developing countries in an entirely different way, with a clear focus on its own geo-strategic and economic interests. Many Southern partners share this approach, which is expressed in terms of a principled commitment to equality and solidarity between poorer countries. It is a ‘win-win’ narrative that has proved compelling, and it may well have played an influencing role with many DAC donors, as they have been increasingly explicit about the benefits of aid to donors.

Box 4: Policies to deliver on mutual prosperity: other donor approaches

There is a trend among some OECD-DAC donors of moving away from a strong focus on poverty reduction towards the pursuit of mutual benefits, whereas others have more consistently adopted this approach. However, while the language of mutual prosperity is increasingly prominent in development policy, donors vary in the extent to which their practices have moved in this direction. Here we present a short summary of the approach taken by four DAC donors and one non-DAC donor, to illustrate this range.

Sweden: The Swedish government does not have an explicit approach to using aid for mutual prosperity. The policy framework for development cooperation is characterised by two overarching concerns: poverty reduction and human rights. It acknowledges that business has a central role to play in economic development and that development cooperation “must draw on the countries’ own visions, priorities and plans”. Sweden has committed to spend 1% of its gross national income (GNI) on ODA since 2008 (1.04% in 2018, the highest of any donor) and is a strong supporter of multilateral aid. Key development priorities are democratic governance (rule of law, human rights, freedom of speech), climate change, gender equality and women’s empowerment, and Sweden’s funding is primarily targeted towards low-income countries.

Netherlands: There has been a clear shift in Dutch development policy in recent years towards the pursuit of mutual prosperity. The Rutte-II government adopted the Agenda for Aid and Trade, merging the roles of the ministries of trade and development cooperation into one. Development cooperation is regarded as an integral part of Dutch foreign policy. Released in May 2018, the policy document ‘Investing in Global Prospects: For the World, For the Netherlands’ laid out the objectives and priorities of Dutch development policy, with “promoting the economic growth of the Netherlands” as one of four objectives. There are a number of aid instruments that support private sector development, some of which provide “finances and subsidies for Dutch businesses” investing in developing countries. The Netherlands spent 0.61% of its GNI on ODA in 2018, and the majority of Dutch aid is delivered bilaterally (72% of ODA in 2017).

Japan: Japan has long had an explicit approach to using aid to enhance its strategic and economic interest. In its development policy framework document, the Development Cooperation Charter, the government prioritises promoting economic growth and using ODA to engage Japanese companies in emerging markets (mainly in Asia and Africa). The term ‘mutual prosperity’ is used in the Charter when describing the benefits derived from development cooperation with the Middle East. The Ministry of Foreign Affairs’ Annual Report on Japan’s ODA Evaluation 2017 further notes that “it is essential to implement cooperation that will promote two-way economic growth”. Japan spent 0.28% of its GNI on ODA in 2018. Most of its ODA (more than 80%) is delivered bilaterally, in the form of loans and with an emphasis on infrastructure, the largest share of which goes to middle-income countries. In 2016, untied aid represented 77% of Japan’s total bilateral ODA.

United States: The United States has one of the most explicit approaches to using aid for the purposes of enhancing mutual prosperity. Development assistance has been and continues to be strongly linked to US national security and economic growth. The Joint Strategic Plan for FY 2018-2022 by the Department of State and USAID notes that “the Department of State and USAID must position the United States more advantageously to ensure the conditions for economic dynamism at home”. The trend towards a greater focus on US commercial interest is intensifying. In April 2017, President Donald Trump issued an executive order that requires all government agencies, including those delivering development programmes, to “buy American and hire American”. The 2020 budget request from USAID states: “Renew America’s Competitive Advantage for Economic Growth and Job Creation.” The United States is the largest donor country in dollar terms, but ODA accounts for only 0.17% of its GNI. In 2016, untied aid represented 65% of the US’s total bilateral ODA across all sectors and countries.

China: China is both an aid recipient and a substantial development assistance partner/donor, but its concept and delivery of aid is fundamentally different from the traditional OECD-DAC community. The 2014 Foreign Aid White Paper states that ‘mutual benefi ts’ and ‘win-win’ are basic principles of Chinese foreign assistance. This aid philosophy is based on the Eight Principles for Economic Aid and Technical Assistance, developed in 1964: the Chinese government “never regards aid as a kind of unilateral aim but as something mutual”. On a DAC equivalency basis, China is the eighth-largest donor in the world ($6.1 billion in 2015); loans and tied aid are given priority over other aid modalities. ODA occupies only a small portion of China’s Official Finance while the majority of it belongs to Other Official Flows (non-concessional in terms, with less than a 25% grant element). China’s International Development Cooperation Agency was established in 2018 but the majority of Chinese foreign aid remains in the hands of Ministry of Commerce. Economic cooperation is a key characteristic of China’s development aid and the Belt and Road Initiative, launched in 2013, is a key example of how China pursues mutual benefit under its foreign assistance policy.

Policies

The UK aid programme has no single strategy or objective on mutual prosperity. Rather, it is a cross-cutting agenda that is increasingly prominent in policies and strategies across government departments. It has been referenced in a number of key policy speeches over the past two years, which were referred to in multiple interviews during this review as key indicators of the UK’s future policy direction. For example, former Prime Minister Theresa May signalled a shift in UK policy towards Africa in a speech in Cape Town in August 2018. She stressed the UK national interest in stronger relationships with African countries and stated that she was “unashamed about the need to ensure that [the] aid programme works for the UK”. The speech proposed a “new partnership” with Africa, built around “shared prosperity and shared security”.

The most concrete reference in public documents is in the National Security Capability Review, which seeks to enhance “mutual prosperity by building the foundations for UK trade and commercial opportunities” and prioritises working in “horizon markets… to help create the UK’s trading partners of the future”. UK strategic planning documents originally prepared for the 2019 Spending Review – mostly not in the public domain – emphasise the importance of using the aid programme to help partner countries accelerate growth, raise productivity, create jobs and reduce poverty, while at the same time enabling UK business to access new trade and investment opportunities as secondary benefits.

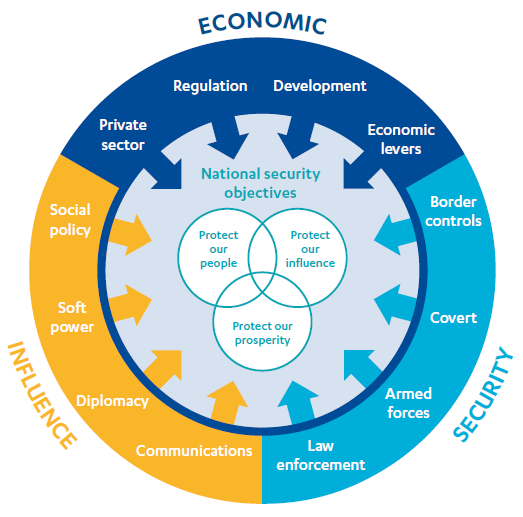

Mutual prosperity can be understood as one manifestation of the ‘Fusion Doctrine’, outlined in the National Security Capability Review. The Fusion Doctrine is the proposition that the UK government should use its tools of external engagement in the economic, security and diplomatic spheres in a joined-up way, in pursuit of common objectives in the national interest. Mutual prosperity is one such objective. There is an emerging structure of cross-government implementation groups under the National Security Council (NSC) Secretariat to take forward joint working in some countries, regions and thematic areas. These are known as National Security Strategy Implementation Groups (NSSIGs), each of which is led by a Senior Responsible Owner (SRO) accountable to the NSC. NSSIGs are internal government mechanisms to facilitate the development of strategies, none of which have an explicit ODA remit, but which can influence the implementation of ODA-funded activities. There is little information in the public domain on these NSSIGs, including on their objectives and membership.

Figure 3: The Fusion Doctrine

The Prosperity Fund is clear about its place in this new approach. Its second annual report was introduced by the Chair of the new National Security Council subcommittee for cross-government funds, who stated that he was “pleased that the UK is changing the way it delivers aid”, alongside a page devoted to the outcome of the National Security Capability Review. The Annual Report explains the delivery of the Fund against the three national security objectives, noting that it can drive broader geographic and thematic reach than could be achieved by departmental allocations alone. It also announced that the Fund’s new SRO is the Director General for Exports in the Department for International Trade.

Policies governing mutual prosperity activities

The government policies and documents relevant to mutual prosperity reviewed by ICAI as part of this information note have cited the International Development Act (IDA) as the legal framework and spending authority. Under the IDA, the aid must be “likely to contribute to reducing poverty”. Under the later 2015 Act, consideration must also be given to the possibility of providing aid in ways that reduce gender inequality.

The cross-government Prosperity Fund is the most explicit example of UK aid being used in pursuit of mutual prosperity, and it is governed by an overarching theory of change that aims to improve conditions for sustainable and inclusive growth in partner countries while developing mutually beneficial economic relationships. DFID also contributes to the overall goal of mutual prosperity. It adopted a strategy in 2014 for working with the private sector to promote inclusive growth, which used the term “shared prosperity” and committed DFID to working jointly with other departments. DFID’s 2017 Economic Development Strategy discusses the importance of trade as an engine for poverty reduction, and states that DFID will “build the potential for developing countries to trade more with the UK and the rest of the world”, while “making it easier for companies – including from the UK – to enter and invest in markets of the future”. It states that DFID will work with DIT and the Department for Business, Energy and Industrial Strategy to help UK and other businesses have better access to information about new commercial opportunities in developing countries – including procurement opportunities in UK aid programmes.

DFID’s Single Departmental Plan from June 2019 lists “global prosperity” as an objective, and states that DFID will help developing countries build sustainable trading links, including with the UK (a shared objective with DIT). It commits DFID to building partnerships with the City of London to increase access to finance for developing countries. DFID has also developed an internal Smart Guide for DFID staff on engaging with businesses, which specifies how DFID staff and programmes can be used to support business, including UK business.

DIT’s primary mandate as a department, established in July 2016 following the EU referendum, is to support UK trade. Its objectives include building a free and fair trade framework with new and existing partners and using trade and investment to promote Global Britain. It also has a remit to spend ODA, including through the Prosperity Fund. In 2017, it published the Trade White Paper: our future UK trade policy, which commits to supporting developing countries to reduce poverty. DIT is new to the management of aid but has committed to building aid-management capacity in its current Single Departmental Plan. According to DIT staff, potential areas for future programming include promoting entrepreneurship and data technologies.

In addition to the cross-governmental and department-specific policies listed above, in May 2018, not long after a joint UK government conference on ‘Trade and Prosperity’, DFID, the FCO and DIT were tasked with developing cross-government prosperity strategies for particular countries. The strategies are designed to promote joined-up UK engagement towards the goal of promoting mutual prosperity. They cover topics such as promoting economic growth, improving the regulatory environment for business and investment, and addressing challenges faced by UK business. So far, 21 countries have developed prosperity strategies, including Kenya, Nigeria and South Africa. Cross-department committees are being established to support their implementation. In Brazil, for instance, the Prosperity Committee is chaired by the Trade Commissioner and attended by the Deputy Head of Mission, the Consul General in Rio de Janeiro and a DFID representative. It meets every six to eight weeks and oversees both aid programming and non-aid engagement. In India, there is a Prosperity Fund board that meets quarterly, as does a broader Economics & Prosperity Board. Other countries and global programmes have similar structures in place, but they are each operated in accordance with the national context.

What appears to be emerging is a division of labour between DFID, the FCO and DIT in the promotion of mutual prosperity (see Figure 4), together with an emerging cross-government architecture in the UK and in priority countries to encourage them to work collaboratively.

Figure 4: A simplified division of labour in mutual prosperity

Programmes

Because mutual prosperity is a cross-cutting agenda with no clearly defined boundaries, there is no classification of the full universe of aid programmes under this heading, nor is it possible to determine how much of the UK aid budget has been allocated in its pursuit. The Prosperity Fund is the clearest example, with a total budget of around £1.2 billion. There is also a new class of DFID programmes that contain mutual prosperity language in their business cases. DIT leads the Investment Promotion Programme (IPP) under the Prosperity Fund and received £2 million to increase the number of fulltime staff under the Africa strategy. The joint DFID-DIT Trade for Development team has an overall portfolio of £93 million with programmes extending to 2023.

The recent settlement for 2020-21, published by HM Treasury, allocated £305 million to the Prosperity Fund in line with the Fund’s spend profile. An extra £50 million has been allocated to the FCO to support the UK’s existing foreign policy objectives and commitments – part of this may be used to advance mutual prosperity.

The Prosperity Fund: pursuing primary purpose and secondary benefits

The Prosperity Fund was the first UK aid instrument to be explicit about the pursuit of secondary economic benefits at the same time as delivering on the Fund’s primary purpose. Because it spends under the authority of the International Development Act (IDA), the primary objective of its programmes must be the promotion of poverty reduction in the partner country. However, for the first time, secondary benefits to the UK – defined as new economic opportunities for international, including UK, business and mutually beneficial economic relationships – were among the criteria for programme selection and had to be explicitly stated and quantified in programme designs. Funding bids to the Prosperity Fund were scored for their potential contribution to both objectives, with the primary benefit given greater weight (35% of the total score, compared with 25%). The Prosperity Fund uses both ODA and a small percentage of non-ODA funds, enabling it to pursue benefits to UK firms more directly.

In interviews, Prosperity Fund staff characterised the primary and secondary benefits as ‘two sides of the same coin’, and therefore did not consider that any trade-off was involved in pursuing both. However, some literature suggests that the relationship between primary and secondary benefits is often in tension. We looked at 17 Prosperity Fund programmes for which there are public business cases or programme summaries and analysed five business cases in more depth (see Table 1). Our selection criteria focused on attaining a set of business cases with variation across the following dimensions: thematic area, programme size, geographical spread (single country versus global programmes), and lead departments.

We found that programmes do not appear to include any explicit measures to advantage UK firms at the expense of competitors. The majority are designed to improve the business environment or boost trade and investment, to the benefit of UK and other international businesses. For example:

- The Anti-Corruption Programme (2017-22 with a £45.1 million ODA budget) works in eight countries to combat corruption and improve the business environment. This is expected to promote economic growth in the recipient countries, while at the same time opening up opportunities for UK and other international business by creating a more level playing field.

- The Global Skills for Prosperity Programme (2019-23, with a £75 million ODA budget) will help to fill skills gaps in ten countries in sectors key to economic growth, such as the energy and automotive sectors, creating new markets for international business, including from the UK.

In these cases, the intended benefit to the UK arises as a by-product of achieving the primary goal of boosting trade and investment, sometimes via a long and indirect causal chain.

The initial choice of sectors for the Prosperity Fund was informed by an assessment of where the UK private sector has a global leadership role. Around a quarter of the Prosperity Fund programmes that we examined target sectors where UK firms are thought to have a comparative advantage. For example, the Better Health Programme provides technical assistance to help partner countries strengthen their health systems. The business case notes that UK businesses and organisations, including NHS trusts and academic institutions, possess world-leading capability in the health field and would be well placed to benefit from the expansion of health services into new areas such as non-communicable diseases. Prosperity Fund programmes also promote opportunities for business, including UK business, in infrastructure, green trade and investment, renewable energy, agricultural technologies, higher education and financial services – all described as areas where UK firms have a competitive offer.

One programme, the UK Trade Partnerships Programme (£20 million; 2019-22) supports the conclusion of trade agreements with developing countries following the UK’s withdrawal from the EU. The intention is that partner countries will continue to have access to the UK market for their exports (primary benefit) while UK firms that trade with those countries can continue to do so (secondary benefit). Other programmes seek to enhance the UK’s global leadership or bilateral influence.

Of the five business cases we examined in detail, all gave explicit consideration to compliance with the international ODA definition, the IDA and UK government policy on untied aid.

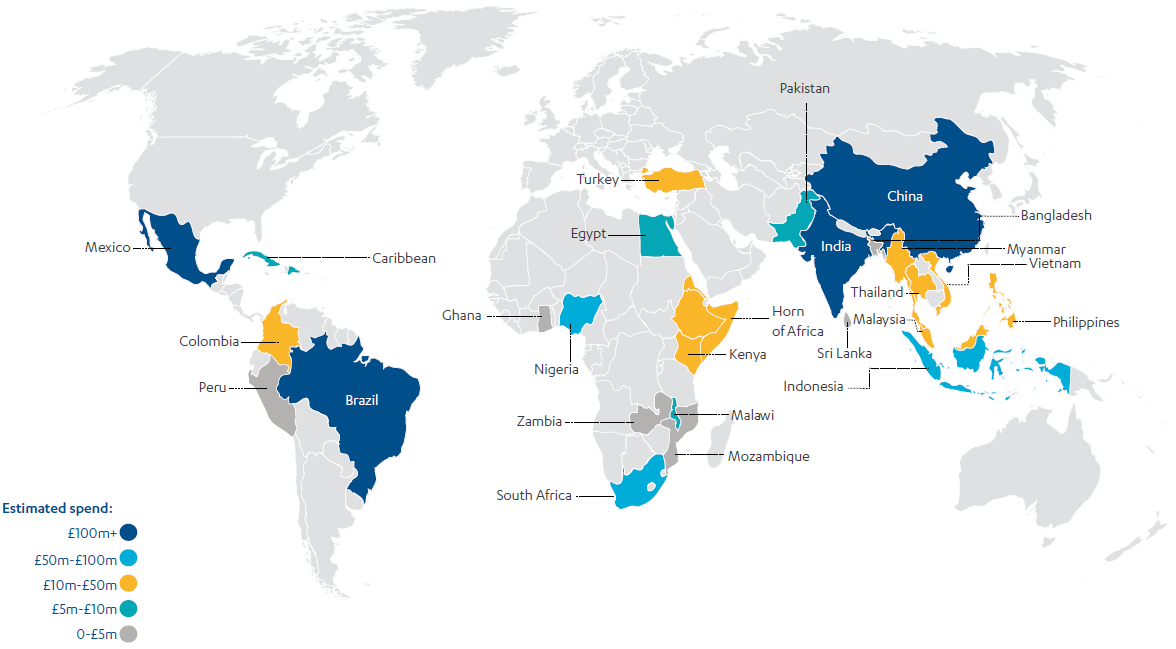

Another area of interest is the decision to prioritise countries with the greatest potential for growth, which are therefore of greater economic interest to the UK. As we noted in The current state of UK aid: A synthesis of ICAI findings from 2015 to 2019, over 80% of non-DFID aid is spent in middle-income countries, compared with just 40% of DFID’s budget. Figure 5 shows that the Prosperity Fund’s largest budgetary allocations include India, China, Brazil, Turkey, Mexico and Indonesia.

Table 1: ICAI analysis of five Prosperity Fund business cases

| Programme and lead department | ODA budget | Duration | Objectives, primary purpose, secondary benefits |

|---|---|---|---|

| Investment Promotion Programme (IPP) – DIT | £50 million | 4 years 2018/19 to 2021/22 | Objective: support partner countries’ investment promotion agencies Primary purpose: increase foreign direct investment, leading to greater productivity, technology transfer, economic growth and job creation Secondary benefit: improve the quality, clarity and transparency of investment opportunities in order to increase access to the target markets by foreign investors and UK businesses in particular |

| UK Trade Partnerships Programme – part of the Global Trade Programme – DFID | £20 million | 3 years 2019 to 2022 | Objective: ensure Economic Partnership Agreements (EPAs) between the UK and African, Caribbean and Pacific countries are rolled over after leaving the EU Primary purpose: ensure trading partners benefit from EPA trade agreements Secondary benefit: ensure UK businesses’ continuity in trade relationships despite leaving the EU |

| Global Finance Programme (GFP) – DFID | £28 million | 4 years 2018 to 2022 | Objective: establish strategic partnerships with key global financial institutions, mostly based in the City of London Primary purpose: improve access to finance in developing countries, boost economic growth and resilience Secondary benefit: raising regulatory standards and deepening UK leadership in financial services, for example in Islamic and green finance |

| China Programme – Phase 1 – FCO | £85 million | 6 years 2017 to 2023 | Objectives: improve rule of law and the business environment for all firms in China; a more efficient and inclusive financial system; a faster transition to a low-carbon economy; more sustainable investment in higher-quality infrastructure projects Primary purpose: inclusive economic growth and China’s transition to an inclusive, sustainable and productive economy Secondary benefits: increasing market access and removing obstacles to structural reform that make it easier for foreign businesses to operate, provide employment and generate wealth, with a focus on the constraints that matter most for UK business |

| Asian Infrastructure Investment Fund Special Fund (AIIB) – HM Treasury | $50 million | 3 years 2017 to 2020 | Objective: provide international expertise to emerging economies in Asia to help them to prepare high-quality infrastructure projects for AIIB and other financing Primary purpose: accelerate infrastructure development and thus raise sustainable economic growth and reduce poverty in Asian developing countries Secondary benefit: higher demand for UK exports, additional UK exports and a positive impact on the UK’s strategic relationships in Asia and beyond |

Figure 5: Breakdown of Prosperity Fund estimated spend by country 2017-2023

An evolving role for DFID in the cross-government prosperity agenda

DFID spends around £1.8 billion per year on economic development. This includes in-country economic development programmes and centrally managed programmes operating across several countries. In addition, it has a growing portfolio of development capital investment, including loans, equity investments and guarantees to companies in developing countries, most of it managed by CDC, the UK’s development finance institution, which focuses on boosting economic growth in partner countries. DFID supports the Private Infrastructure Development Group (PIDG), a multi-donor infrastructure development and finance organisation with a total funding base of $3 billion.

While all these activities support mutual prosperity in its broadest sense, DFID does not separately identify – or seek to quantify – the potential economic benefits to the UK of its programmes. However, DFID is increasingly expected to contribute to the cross-government mutual prosperity agenda. It is also expected to contribute at the country level, including through the cross-departmental Economic Development, Investment and Trade (EDIT) team in Ghana (see Box 5). DFID Ghana’s Jobs and Economic Transformation (JET) programme is intended to promote a new strategic partnership between the UK and Ghana, based on “economic development, investment, trade and strategic political cooperation”, in keeping with the UK Africa Strategy. In alignment with the Ghanaian government’s ‘beyond aid’ vision, it aims to stimulate investment in sectors that will be important to Ghana’s economic transformation, with the goal of generating £50 million in new private sector investment and 15,000 new jobs.

Box 5: DFID’s approach to mutual prosperity in Ghana

The DFID JET programme business case makes some general references to economic benefits for the UK. It notes that, in addition to its primary development outcomes, “the programme is also expected to deliver indirect benefits by creating commercial and trade opportunities for the UK particularly where UK commercial capability matches Government of Ghana’s priorities”. However, there is no suggestion in the business case that the priority sectors for UK investment under JET will be chosen by reference to UK comparative advantage.

The business case notes an important change in the way that DFID works with the rest of the UK government in Ghana. It states that the programme “will lie at the heart of a radically strengthened, integrated, cross-HMG off er on economic development, investment and trade”. It notes DFID’s participation in the EDIT team, chaired by the High Commissioner, which is seeking to maximise the combined impact of the UK’s trade, investment and development expertise, working with CDC, UK Export Finance and UK business. It notes that DFID will be part of a “coherent, cross-mission approach to promoting investment and trade in Ghana” – with DFID leading on promoting long-term growth and poverty reduction, while DIT leads on strengthening Ghana as a trading partner for the UK and on engaging with UK business. The latter will include promoting UK commercial engagement in a number of Ghana’s priority sectors, including pharmaceuticals, mining infrastructure and textiles.

From the business case, the JET programme does not appear to represent a radical shift in the way DFID spends its aid budget. Its objectives are well aligned with the government of Ghana’s priorities and within the boundaries of conventional economic development programming. The major diff erence lies in DFID staff using the insight and intelligence they gain from working on Ghana’s economic transformation to help the rest of the UK government to promote UK commercial interests.

DFID recently produced an internal guide on choosing programmes that have additional benefits for UK business. The guide states that, when two potential programmes both meet the requirements of the IDA, “it is legitimate to choose between them on the grounds of secondary benefit”. This formulation leaves open the possibility that staff might prioritise interventions with a relatively lower poverty reduction benefit in order to secure benefits to the UK. Determining that a programme is compliant with the IDA is a relatively low bar and is not the same as determining that it represents the best available use of UK aid. This is a challenge common to all ODA programming but the pursuit of two objectives, one of which is not development-related and may be in tension with the primary development objective, makes this even more challenging.

We have not identified any examples of DFID compromising development impact for secondary benefit in the programme business cases shared with us. For instance, its Invest Africa programme (which is not part of the Prosperity Fund) aims to contribute to economic transformation in East Africa by encouraging foreign investment in manufacturing. Its selection of countries and sectors was based on poverty reduction potential and alignment with partner country priorities and comparative advantages, rather than UK economic interests. While the business case states that the programme fits within a broader UK government prosperity approach, it does not claim any specific benefits for UK business.

DFID is responding to the mutual prosperity agenda. As ICAI noted in the synthesis review, “as departments look for more opportunities to use the aid programme to promote mutual prosperity and the UK national interest, questions will continue to arise about how to ensure the best use of aid and how to maintain coherence across aid-spending departments. There are concerns that the search for opportunities may distort the allocation of aid by country or sector.”

A shift in how staff deliver programmes

Mutual prosperity is not just about delivering aid funds. It is also about how UK government staff deploy their time and knowledge. As outlined in the section above, DFID staff, both at headquarters and at the country level, are being asked to spend more of their time on developing strategies or activities that support mutual prosperity. This includes sharing knowledge on economic conditions and opportunities in specific countries with other departments, and supporting cross-government strategies, policies and initiatives. DFID is also increasingly drawing on the expertise of staff from other departments to inform its economic development programming.

The cost of UK government staff working on the aid programme is part of the UK aid budget. Where staff also spend time pursuing benefits to the UK, departments have to decide how this remains within the ODA eligibility requirements. There appear to be three broad approaches in use across all three departments:

- Using 100% ODA resources to pay for staff time, but designating the time spent pursuing benefits to the UK as secondary to the primary purpose of promoting poverty reduction (current model used by the Prosperity Fund).

- Blending people’s time, by identifying what proportion of their time is spent on ODA-related activities (for example, the FCO estimates the proportion of time that staff in diplomatic missions spend supporting the aid programme).

- Using non-ODA resources for the pursuit of UK economic interests (DIT has funded Secondary Benefits Advisers for its Prosperity Fund programme, to operate alongside, but separately from, the programme managers). This does not fall under ICAI’s remit.

For any secondary benefits that require non-ODA funding, staff delivering Prosperity Fund programmes can draw on the Opportunities Fund, which is managed through a cross-Whitehall working group and has a total budget of £33 million, of which £7 million was spent in 2017-18. One of the non-ODA activities funded under the Opportunities Fund is consultancy support to aid in the development of robust secondary benefits action plans across the Prosperity Fund portfolio.

Potential opportunities and risks

As part of this information note, ICAI undertook three participatory focus group consultations to elicit views from external stakeholders on the implications of using UK aid to enhance mutual prosperity. The three groups were: i) UK civil society organisations, ii) universities and think tanks, iii) consultancies and businesses. The discussions were designed to elicit broad insights into the emerging approach to mutual prosperity, rather than feedback on specific initiatives or programmes.

We asked participants to explore both opportunities and risks for UK aid from the mutual prosperity agenda. The first two groups were primarily concerned with risks to UK aid, principally around a loss of focus on poverty reduction. Participants in the business focus group were better able to identify opportunities as well as risks. Table 2 summarises the opportunities and risks that were most often identified across the three sessions.

Table 2: The opportunities and risks for UK aid within the mutual prosperity agenda

| Area | Opportunities | Risks |

|---|---|---|

| Poverty focus | • loss of focus on the primary objective of reducing poverty • diversion of aid away from the poorest and marginalised, contrary to the ‘leave no one behind’ commitment • reducing development to economic prosperity |

|

| Support for UK aid | • more broad-based political and public support for aid | • undermines public support and trust in aid if the perception is that aid is used for purposes other than poverty reduction |

| UK international profile | • enhancement of UK soft power | • reputational risk to the UK government • losing leadership as a ‘development superpower’ |

| Coherence | • greater coherence across the UK government | • conceptual confusion around the mutual prosperity agenda |

| Accountability | • weak accountability structures, especially those governing secondary benefits |

|

| Quality of development partnerships | • moving from a donorrecipient relationship towards a more equal development partnership | • reinforcing negative power relations (mutuality does not automatically mean equality) |

| Quality of UK aid | • increased innovation – for example, new financing instruments • promotion of higher standards for businesses in development | • undermining of the value for money of UK aid as additional objectives are pursued • a focus on short-term results over long-term sustainability • challenges with measuring mutual prosperity |

Opportunities

The first two focus groups struggled to identify opportunities for UK aid from the mutual prosperity agenda, and the examples they offered were carefully qualified. In the third focus group, there was genuine optimism about the value of mobilising the full breadth of the UK private sector’s expertise and capitalising on British innovation. The following opportunities emerged from the discussion.

- Coherence: Focus group participants recognised opportunities from increased coherence across UK government departments – including the opportunity to influence the way the government uses its non-aid instruments (diplomacy, trade engagements) to make them more aware of and supportive of development issues.

- UK support: Participants believed that the mutual prosperity agenda answers certain demands being made of UK aid from elements in the UK political class, media and the public. It therefore has the potential to enhance support for the aid programme.

- UK soft power: Participants saw opportunities for enhanced UK leadership in the economic development sphere, if done in the right way, contributing to the UK’s international influence.

- More equal development partnerships: Some participants recognised that the traditional donor-recipient relationship implied in the giving of aid is outdated and increasingly contested, and that partner countries are looking for a new kind of development partnership, based on long-term mutual interests. The mutual prosperity agenda could lead to a more equal dynamic and a more mature development partnership. Such partnerships might also be better placed to tackle issues of mutual benefit, such as climate change.

- Productive partnerships with UK business: There are potential benefits to the quality of UK aid from tapping into the expertise of UK business, and specifically its capacity to bring new technologies and innovative financial strategies to bear on development challenges. Participants saw it as an opportunity to raise the business standards of UK business and improve their ability to partner with businesses in developing countries. Engaging commercial actors and financiers from the City of London in UK aid programmes might also help with scaling up results.

Risks

All three focus groups brought up a range of risks for the UK from the mutual prosperity agenda. The most important risks were as follows:

- Loss of poverty focus: The primary concern for most participants was that the mutual prosperity agenda would lead to a loss of focus on the primary mission of UK aid to reduce poverty. Participants believed that it might skew the allocation of aid towards countries or sectors in which the UK has commercial interests, rather than those with the greatest potential impact on poverty. There were also concerns that it would undermine the ‘leave no one behind’ commitment by diverting aid away from the poorest and most marginalised (so far, only DFID has explicitly adopted this commitment).

- Trade-offs and loss of programme quality: Participants from all three groups noted that there are likely to be trade-offs between the pursuit of primary development goals and secondary benefits for the UK, and that these trade-offs could impact on programme quality. UK government officials might be incentivised to choose interventions with lower development impact, if they offered secondary benefits. There were concerns that private sector interventions might come to be seen as a ‘magic bullet’ to development problems that actually require a range of interventions to address. Participants noted that combining primary and secondary benefits is likely to be challenging in practice and could lead to poor-quality programmes that fail to deliver on either objective. A lack of conceptual clarity and clear accountability lines for the mutual prosperity agenda compound this risk. There were also concerns that a continuing shift of aid resources away from DFID towards departments with less experience in development cooperation might undermine quality.

- Undermining public support: While participants acknowledge that some parts of the British public might welcome the focus on the UK national interest, the more prevalent view was that the mutual prosperity agenda might undermine public support for and trust in UK aid, given that survey data from the Aid Attitudes Tracker has shown that only 10% of the British public believe aid should be tipped in favour of UK national interests. There were concerns that it would reinforce perceptions that aid primarily helps elites in developing countries, rather than those most in need.

- Undermining the reputation of UK aid: Participants noted that any increase in UK soft power from the mutual prosperity agenda might be undermined by a loss of the UK’s reputation as a champion of effective development cooperation and its status as a ‘development superpower.’ The reputational cost would be particularly high if UK aid were seen to be outside the international ODA definition. There would also be potential reputational risks if the UK were to work with businesses that engage in unethical business practices.

Issues for further investigation

Based on the information that we have collected on the mutual prosperity agenda and its implications for UK aid, we can offer the following observations, together with some issues that merit further scrutiny by the International Development Committee and other interested stakeholders.

The UK’s shift towards mutual prosperity has moved it to the position of several other donors and is in line with the expectations of some partner countries. There is a trend for more OECD donors to be more explicit about their own national interests in their use of aid, and in the desire to use development cooperation to build bilateral trade and investment ties. It is possible that increasing competition with non-OECD donors for geopolitical influence and economic opportunities underlies this trend. It is also linked to changes in development finance needs. Many recipient countries now have access to a wider choice of development finance, beyond ODA, and some (such as Ghana) are asking development partners for new forms of cooperation based on the strengthening of commercial ties (in addition to the continued provision of ODA in the form of grants, for instance to support social sector spending on education and health).

There are potential benefits to the UK aid programme from enhanced partnerships with the private sector. The stakeholders we spoke to recognise that UK business has a lot to offer the aid programme, including innovative technologies and (through the City of London) financial instruments. UK business can be supported to establish new partnerships with firms in developing countries, which could in turn deliver development results at scale in a more sustainable way than grant-based aid. This outcome would support the implicit theory of change for mutual prosperity – that poverty falls as a result of a stronger focus on creating jobs and increasing trade. Stakeholders also recognise potential benefits from more joint working between the UK aid programme and its diplomatic and trade engagements, which could contribute to a deeper understanding of development needs and processes. In addition, there is potential for the UK to lead this overall agenda, setting a high standard for other donors to follow.

DFID, the FCO and DIT have been proceeding with caution in their use of aid to promote mutual prosperity. The departments are being careful to stay within ODA eligibility rules and UK government policy commitments on untied aid. The programmes that we have identified as including mutual prosperity goals – including through the Prosperity Fund – continue to fall within the boundaries of traditional economic development assistance. We did not find any examples of UK aid being used exclusively to pursue short-term commercial opportunities or to help individual UK businesses at the expense of their competitors. Rather, Prosperity Fund programmes are promoting growth in markets that are of interest to the UK, alongside other international investors.

With departments under growing pressure to use aid in support of mutual prosperity, there is a need for greater clarity about the appropriate uses of aid. This is a new and rapidly evolving area for UK aid. While the Prosperity Fund is into its fourth year of operation, DFID is only just developing a new generation of economic development programmes that support the government’s mutual prosperity agenda, while DIT is now bidding for an ODA budget of its own. There will be increased competition for aid resources in future Spending Reviews and pressures on aid-spending departments under the Fusion Doctrine to show their support for cross-government objectives. In light of this and the risks highlighted by our focus groups, the UK government would benefit from having an explicit set of principles governing the appropriate use of aid for mutual prosperity.

There are potential risks involved in blurring departmental mandates and incentives. We saw evidence in UK government documents of a further division of labour within the mutual prosperity agenda, with DFID focused on promoting economic development and building markets while the FCO and DIT provide more direct support to UK business. In many cases, staff have split responsibility for delivering both on primary purpose and secondary benefits (though non-ODA options for the latter are being considered).

Yet DFID is also increasingly being asked to offer its staff time, expertise and knowledge of national contexts to support cross-government prosperity goals. It is an open question whether this will detract from DFID’s primary mission, and whether it is entirely compatible with being a trusted development partner. Furthermore, if the FCO and DIT are granted aid budgets to support their mutual prosperity work, there are risks that they may be incentivised to choose interventions that, while ODA-eligible, settle for lower or diluted primary development impact in pursuit of secondary benefits.

The evidence on whether untied aid can or cannot be used to promote donor commercial interests remains limited. Our annotated bibliography and focus group discussions confirmed that aid is currently better suited to the pursuit of development goals than commercial ones. Within the Prosperity Fund portfolio, some of the secondary benefits to the UK identified in programme business cases would only come about through some very attenuated and uncertain results chains. The potential economic pay-off to the UK from this use of aid may not therefore be particularly high. In fact, many of the informed stakeholders we spoke to thought that the main risk of dual-purpose aid of this type is that it fails to achieve either purpose particularly well.

There are risks that the poverty focus of UK aid may be diluted. As we noted in a recent report, most non-DFID ODA goes to middle-income rather than low-income countries, reversing the trend in UK aid of the past two decades. This is not solely down to the mutual prosperity agenda – it also reflects the UK’s objectives of responding to conflict and crises and mitigating climate change. However, the mutual prosperity agenda does create pressures to spend aid in the developing countries that are most likely to be important trading partners. There are risks that this could lead to the global allocation of UK aid becoming less pro-poor, and less focused on the most marginalised. While there are many good reasons for spending aid in middle-income countries, including low-carbon development and promoting climate resilience, promoting global security and tackling deep-seated pockets of residual poverty, there is a risk that the pursuit of mutual prosperity will shift the balance of UK aid away from the people and countries that need aid the most.

Box 6: Potential risks to an effective approach to poverty reduction

As noted in Section 4 above, there is concern from a range of stakeholders that using UK aid to enhance mutual prosperity could undermine its contribution to the reduction of poverty. Conceptually, risks to poverty reduction could include the following:

- A lower share of ODA is allocated to the poorest countries.

- A lower share of ODA is allocated to poor people in middle-income countries.

- Mutual prosperity programmes achieve economic growth outcomes for UK and partner country businesses, but this does not translate into poverty reduction or development outcomes in partner countries.

- Mutual prosperity programmes achieve both primary and secondary objectives, but there is an opportunity cost if the ODA would have achieved greater poverty reduction outcomes if deployed in more ‘traditional’ ways.

- ‘Poverty reduction’ is undermined as a global development norm.

There is also a tendency, explicit within the Prosperity Fund, to focus on sectors where the UK has particular expertise. On the one hand, aid could be delivered more effectively in these sectors, given the UK’s knowledge of the area. On the other, these may not be the interventions with the highest impact on poverty. While there are still many poor people living in middle-income countries, reaching them requires grappling with challenging issues around equality and exclusion. It cannot be assumed that interventions aimed solely at improving the business or investment climate will be pro-poor. A key issue for exploration as implementation progresses is whether their chosen activities will deliver the poverty reduction objectives sought in their programme designs. We do note, however, that it is too soon to tell what the effects of the mutual prosperity agenda will be, given that most Prosperity Fund programming, for instance, is still nascent.

Conclusion

As departments continue to use the aid programme to promote mutual prosperity and the UK national interest, questions will continue to arise about how to ensure the best use of aid and how to maintain coherence across aid-spending departments. The mutual prosperity agenda also raises challenging questions around ODA eligibility and good development practice. These issues will no doubt merit scrutiny over the coming period by the International Development Committee and other interested stakeholders. While the pursuit of mutual prosperity is not necessarily in conflict with good development practice, the focus needs to remain on building long-term opportunities, rather than securing short-term advantage for the UK national interest. So far, the limited programming we examined as part of this note does not appear to pursue economic benefits to the UK at the expense of the primary purpose of poverty reduction. However, future inquiries may wish to examine the impact on the quality and value for money of UK aid as the mutual prosperity agenda evolves.

It will be important to establish a clear set of principles across government determining the appropriate use of aid in support of mutual prosperity, to ensure that risks to the integrity and quality of UK aid are minimised. This includes recognising that meeting the international ODA definition and the requirements of the International Development Act is only the legal minimum. The UK should aspire to the best use of its aid against the Act, which states it must be “likely to contribute to poverty reduction”, along with the four strategic objectives outlined in the 2015 UK aid strategy, while also meeting the international ODA definition.