Tackling fraud in UK Aid

Introduction

Fraud is a deliberate and illegal act which results in funds being diverted from their intended purpose. It is usually designed to be hidden so can be hard to detect. This rapid review will assess the effectiveness of counter-fraud measures across UK government departments that spend UK Official Development Assistance (ODA).

Background

Definition and context

Fraud, according to the UK’s 2006 Fraud Act, is “The making of a false representation or failing to disclose relevant information, or the abuse of position, in order to make a financial gain or misappropriate assets.” The amount of public spending lost to fraud is difficult to quantify. The UK government’s Counter Fraud Centre of Expertise estimates fraud and error losses in UK public spending outside the tax and welfare system to be between 0.5% and 5%. HMRC estimated an error and fraud rate of between 5% and 10% for payments under the £3.5 billion Coronavirus Job Retention Scheme. Overall, fraud in the UK public sector in 2017 was estimated to be around 5% of public spending.4Globally, it is estimated between 3% and 10% of Gross Domestic Product is lost to fraud.

Although there is no reliable estimate of fraud in UK aid, the amount of reported detected fraud by theformer D epartment for International Development (DFID) – now merged into the Foreign, Commonwealth and Development Office (FCDO) – has been much lower than the above ranges. This is also the case for all other government departments (see Table 1) and other major donors such as the US Agency for International Development and United Nations bodies.

Table 1: Reported detected fraud compared to spend by UK government department in 2017-18

| Government department (Highlighted departments are within the scope of this review) | Reported detected fraud (£m) | Departmental expenditure limits (£m) | Reported detected fraud % |

|---|---|---|---|

| Ministry of Defence | 116.6 | 36,605 | 0.32 |

| Department for Transport | 5.1 | 8,284 | 0.06 |

| Department for International Development (DFID) | 5.9 | 10,262 | 0.06 |

| Department for Digital, Culture, Media and Sport | 0.7 | 1,786 | 0.04 |

| Department for Business, Energy and Industrial Strategy (BEIS) | 3.2 | 11,839 | 0.03 |

| Foreign and Commonwealth Office (FCO) | 0.3 | 1,809 | 0.02 |

| Cabinet Office | 0.1 | 857 | 0.01 |

| Department for Work and Pensions | 0.7 | 6,433 | 0.01 |

| Department for Health and Social Care (DHSC) | 13.4 | 125,156 | 0.01 |

| Ministry of Justice | 0.7 | 7,549 | 0.01 |

| Department for Education | 3.8 | 65,277 | 0.01 |

| HM Revenue and Customs | 0.2 | 3,930 | 0.01 |

| Department for Environment, Food and Rural Affairs | 0.1 | 2,285 | 0.00 |

| Home Office | 0.1 | 11,237 | 0.00 |

| HM Treasury | 0.0 | 139 | 0.00 |

| Ministry of Housing, Communities and Local Government | 0.0 | 15,739 | 0.00 |

Previous reviews

ICAI’s 2011 review of DFID’s approach to anti-corruption found that “DFID’s current organisation of responsibilities for fraud and corruption is fragmented and that this inhibits a coherent and strategic response to this critical issue.” ICAI’s 2016 review of DFID’s approach to managing fiduciary risk in conflict-affected environments found that DFID had made progress in managing fraud and corruption risks in high-risk environments, but that the responsibility for managing this risk is often pushed down the delivery chain, distancing DFID staff from the practical risks of delivery. Previous work by ICAI and the National Audit Office (NAO) has highlighted the relatively low level of fraud detected in UK aid compared to estimated levels. Changes in how UK aid is delivered may also affect fraud risks. ICAI’s 2017 and 2018 reviews of DFID’s procurement highlighted a trend towards larger programmes delivered through complex consortia, often led by a commercial fund manager. They also highlighted efforts to apply pressure on fee levels of suppliers to help to achieve better value for money. A 2016 parliamentary report found evidence of some contractors using the weaknesses inherent in the design of milestones to conceal poor performance. UK aid has also increasingly been delivered through more government departments and in higher risk, fragile and conflict-affected environments. Since March 2020, the COVID-19 pandemic has forced changes in how aid is spent and monitored due to social distancing and travel restrictions.

Purpose and scope of the rapid review

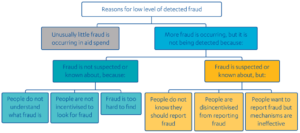

This review will assess the extent to which the UK government takes a robust approach to tackling fraud in its aid spending. It will explore how departments prevent, detect, investigate, sanction and report on fraud in their aid delivery chains, and how they decide how to balance and manage fraud risk within portfolios, programmes and projects. The review will also explore the evolution of departments’ approaches to tackling fraud since 2016-17 to enable us to understand changes in fraud risk management as UK aid is increasingly spent across government departments, and the extent to which lessons have been learned and applied to their guidance, systems and practices. In particular, we will focus on understanding why so little fraud is detected compared to estimates. Figure 1 shows the hypotheses we aim to explore.

Figure 1: Possible reasons for low level of detected fraud

The review aims to provide timely and useful insights following the merger of the Foreign and Commonwealth Office (FCO) and DFID to form the new Foreign, Commonwealth and Development Office (FCDO), and as departments adjust to changes in fraud risk following the COVID-19 pandemic. We will focus on the five government departments allocated more than £100 million of ODA in 2019-20 as shown in Table 2.

Table 2: ODA allocation by government department

| Department | 2019-20 ODA allocation (£m) | Increase in ODA allocation since 2016-17 |

|---|---|---|

| Department for International Development (DFID) (including CDC Group) | 10,371 | 3% |

| Foreign and Commonwealth Office (FCO) (including the Joint Funds Unit) | 1,540 | 53% |

| Department for Business, Energy and Industrial Strategy (BEIS) | 1,038 | 44% |

| Home Office | 409 | 6% |

| Department for Health and Social Care (DHSC) | 289 | 192% |

The review is primarily concerned with how government departments seek to understand and address fraud risks related to the delivery of ODA. We will therefore focus on how government departments manage risk in their aid delivery chains as opposed to internal fraud by government employees.

Review questions

- Relevance: To what extent do departments have systems, processes, governance structures, resources and incentives in place to manage risks to their ODA expenditure from fraud?

- Effectiveness: How effectively do departments prevent, detect and investigate fraud at portfolio, individual programme delivery and partner levels?

- Learning: How effectively do departments capture and apply learning in the development of their systems and processes for fraud risk management in their aid programmes?

Review limitations

The review is subject to the following limitations:

- This review does not seek to investigate specific instances of fraud but to assess the effectiveness of fraud risk management across ODA-spending government departments. We will report any fraud identified through our review via appropriate channels.

- ICAI is mandated to evaluate the effectiveness of ODA so the review will only cover ODA expenditure.

- We will also exclude central funding to multilateral organisations, as this is subject to specific accountability mechanisms that are not covered by this review.

- While this review is informed by prior ICAI reviews, it is not intended as a direct follow-up on previous recommendations.

- Similarly, while we are informed by prior work by the NAO, the review is not intended as a formal follow-up of its findings.

Methodology

Our methodology is composed of the following components:

- Annotated bibliography: A review of selected literature on fraud in the UK public sector and international development and on general good practice in fraud risk management, including in the private sector. We will use this to establish a framework to assess and compare departments’ counterfraud measures and identify specific instances of good practice for dissemination across other departments.

- Systems review: We will conduct document reviews and interviews with counter-fraud leads in the five government departments and CDC Group. We will also interview stakeholders in the Cabinet Officehosted Counter Fraud Centre of Expertise and the Serious Fraud Office.

- Programme review: We will review 20 programmes across the five government departments and CDC to assess how fraud risk has been managed. Our sample will include at least ten programmes where suspected fraud has been reported.

- Stakeholder consultation: We will seek perspectives on fraud risk management in UK aid from stakeholders throughout the delivery chain and provide an opportunity for stakeholders to independently raise their concerns about fraud risk management in UK aid.

Timeline

Research for this review began in August 2020, with publication expected in March 2021.