The UK’s support to the African Development Bank

Purpose, rationale and scope

Purpose: The overall purpose of this review is to assess the effectiveness of DFID’s support to the African Development Bank Group in the context of the UK’s broader aid priorities. The AfDB Group is a regional development bank that aims to promote sustainable economic development and reduce poverty in Africa by:

- mobilising and allocating resources for investment in regional member countries

- providing policy advice and technical assistance to support development efforts.

The Group comprises three entities, the African Development Bank (AfDB), the African Development Fund (ADF) and the Nigeria Trust Fund. The first two will form the focus of this review given their share of overall Group activity. The review will consider the benefits that DFID has identified of working through the AfDB Group, as well as concerns that it has noted relating to AfDB Group’s performance, and how these have informed decision-making. It will also assess DFID’s management of its contribution to the AfDB Group.

Rationale: A review of DFID’s management of its contribution to the AfDB Group is relevant both because it involves use of UK taxpayers’ money and because of the AfDB Group’s importance for development in Africa. Over the review period, the UK’s average annual contributions to the AfDB Group were approximately £205 million, which amounts to approximately 1.6% of its overall official development assistance (ODA). DFID’s engagement in the AfDB Group comprises:

- a shareholding in the AfDB representing approximately 1.75% of the AfDB’s capital

- contributions to the ADF through replenishments that take place every three years

- several projects that are managed by the AfDB Group and co-financed by DFID through trust funds

such as the Transition Support Facility and the Africa Water Facility Fund.

DFID’s rationale for working with the AfDB Group includes the financial and technical support that the Group provides to the poorest countries in Africa as well as middle-income countries. Working with the AfDB Group also enables DFID to expand its reach to support vulnerable communities where DFID does not have large programmes or teams on the ground. The review is also relevant in view of possible wider lessons for DFID’s contributions to other multilateral and regional development banks.

Scope: The review covers the period since 2014, which includes the 13th and 14th replenishments of the ADF. This timeframe will not preclude consideration of the UK’s current contribution to the AfDB – agreed as part of the 2010 General Capital Increase (GCI) – or other information that provides important context for interpreting more recent performance trends. The review will include an overview of the AfDB Group but will not focus equally on all 17 of the Sustainable Development Goals that the AfDB Group lists in its Mission and Strategy Statement. It will focus in particular on specific themes (such as fragility, financial leverage and leave no one behind) and sectors (those that have received the most funding in recent years) as further described below in the discussion of our sampling approach.

Background

The AfDB Group is headquartered in Abidjan, Côte d’Ivoire, and as of 2019 has a physical presence in 39 regional member countries across Africa, and regional research and resource centres that service member countries. The AfDB Group regional member countries are divided into five regional groupings, for each of which a director general is responsible within the Group. It is the smallest of the major regional development banks in terms of lending volume, with a total approved finance of £7.79 billion in 2018. It is also one of only three multilateral or regional development banks to offer a full range of six financial instruments: loans (both sovereign and non-sovereign guaranteed), grants, lines of credit, technical assistance, guarantees and equity.

The AfDB is the non-concessional arm of the Group and, using its AAA credit rating, borrows from financial markets to provide loans to eligible countries with terms that are more favourable than countries could access from markets on their own. The ADF is the concessional financing window of the Group and provides concessional loans, grants, guarantees and technical assistance to eligible countries. During the period 2014 to 2018, the AfDB Group approved £35.23 billion 11 with £25.3 billion in new lending approved by the AfDB and £6.36 billion in concessional ADF funding.

The AfDB last agreed a General Capital Increase (GCI) with member states in 2010 and is currently engaged in discussions for a 7th GCI, which are expected to conclude in October 2019. In 2017, the ADF completed the 14th replenishment of the amount of £4.41 billion of which £3.48 billion was contributed by non-regional members. Although the UK’s contribution fell from £605 million in the 13th replenishment (in 2013) to £460 million in the 14th replenishment, the UK remains the largest contributing non-regional member of the ADF. A 15th round of replenishment discussions is currently underway and is expected to conclude in December 2019.

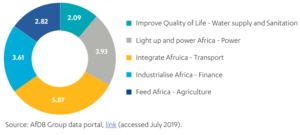

In 2015 the African Development Bank set out its five development priorities for transforming Africa. These ‘High 5’ priorities are displayed below in Figure 1 together with the total amount spent on projects in each of the five sectors.

Figure 1: The AfDB Group’s Development Priorities14

Sectors receiving the greatest amount of lending from AfDB Group since 2014 (£ billions)

Review questions

This review is built around the criteria of relevance, effectiveness and efficiency. The relevance question will explore how well aligned the AfDB Group is with the UK’s aid priorities in Africa in terms of its strategies and portfolio. Under the effectiveness question, we will explore how effective the AfDB Group is at delivering the UK’s aid priorities. By focusing on the sectors where the AfDB Group spends most of its money we will shed light on how well it uses the UK’s money. This will build on our findings with respect to alignment and establish how successfully strategies are being implemented in practice. It will include measuring and reporting results at sector and project levels within selected case study countries. We will also look at how successful the AfDB Group is in leveraging third party finance.

The efficiency question will explore how well DFID ensures the value for money of its contributions to the AfDB Group in terms of outcomes, promoting reform, the coherence of DFID’s engagement (how consistent is DFID’s strategic and operational approach across HQ, country offices and other UK aid channels), and whether contributions are evidence based. Review questions and sub-questions have been developed for each of the above criteria (Table 1).

Table 1: Our review questions

| Review criteria and questions | Sub-questions |

|---|---|

| Relevance: How well aligned is the AfDB with the UK’s aid priorities in Africa? | • How well do the AfDB’s strategies and portfolio support DFID’s development goals for Africa? |

| Effectiveness: How effective is the AfDB at delivering UK aid priorities? | • How well has the AfDB delivered its intended results through its lending operations? • How well has the AfDB helped mobilise other sources of development finance? |

| Efficiency: How well does DFID ensure the value for money of its contributions to the AfDB? | • What is DFID’s contribution to AfDB buying in terms of outcomes? • How effective has DFID been at promoting reform of the AfDB (including unintended consequences and lesson learning)? • How coherent is DFID’s engagement with AfDB at central and country levels, and across UK aid channels (including OGDs and CDC)? • To what extent are DFID’s contributions based on robust evidence of performance, value for money and comparative advantage? |

Methodology

This review will consider DFID’s management of the AfDB Group and its performance at two levels: (i) a strategic, corporate level; and (ii) five case studies including two country visits. We will collect data through: (i) an overall review of relevant literature as well as other specific desk reviews; and (ii) semi-structured interviews with DFID staff (a combination of current and former staff involved in the management of AfDB Group), other relevant HMG staff, the AfDB, and other stakeholders.

The documentary and interview evidence that we collect will focus on the period between 2014 and 2018, but will also include some contextual data that predates this period, as well as enabling the review to draw out implications for the current situation. While the data will be mostly qualitative, we will also collect some quantitative data (eg financial and performance data) which we will analyse using descriptive statistics. The work will be divided into four mutually reinforcing components explained below. These components are sequenced to allow the Literature Review and Corporate Level Review to inform the subsequent five case studies including two country visits.

Component 1 – Literature Review

We will conduct a review of articles and publications from relevant academic experts, donor organisations and International Financial Institutions, including papers from the recent G20 summit on Financial Markets and the World Economy. This will inform our understanding of the wider multilateral development bank landscape, the role of the AfDB Group and help address our core questions which include:

- the wider MDB and RDB landscape including the added value of multilateral spend versus bilateral spend

- the scale and nature of AfDB Group lending and technical assistance

- AfDB institutional reform.

This will inform our ability to assess the AfDB Group’s approach, shape the research tools and help identify key stakeholders to interview as part of the Corporate Level Review. It will also help us compare and contrast the AfDB Group with other IFIs and identify relevant benchmarks.

Component 2 – Corporate-level review

We will review the DFID and AfDB Group’s corporate-level documentation and evidence, and will conduct interviews with key stakeholders within the AfDB and DFID, as well as other bilaterals that support the AfDB Group, including the Netherlands and Italy.16 This will allow us to understand the AfDB Group’s strategy and approach to lending and achieving results. It will include looking at which countries and sectors have been targeted and with what financial instruments, how they align with UK aid objectives, how results are monitored and achieved at a portfolio level and how performance data is gathered, validated and aggregated. We will also examine three key cross-cutting areas that are a priority for DFID and how the AfDB Group addresses them: fragility, leveraging third party capital, and the Sustainable Development Goal, “leave no one behind”.

We will conduct key informant interviews with relevant AfDB Group staff at a strategic level and at HQ. We will also interview staff at DFID who work in relevant sectors or who have been involved in working with AfDB Group or other regional developments, to explore the relevance of the AfDB Group’s approach to DFID’s strategy, how DFID supports the AfDB Group and how they work to promote inclusive growth. Moreover, we will convene a workshop in London for academic and development practitioner experts to draw on their knowledge. While we do not propose to benchmark the AfDB Group against other multilateral development banks in a precise way, given the significant differences in resources, mandates and areas of focus, we will interview staff from other multilateral development banks to learn how they have dealt with similar challenges and we will aim to identify publicly available benchmarks for reference.

Component 3 – Case studies

We will develop five in-depth case studies to gain a detailed understanding of how the AfDB Group works in specific contexts and the effectiveness of its lending operations in those countries. Three of these case studies will be desk-based (with interviews conducted remotely), and two will include a country visit (allowing faceto-face interviews). In these case studies, we will aim to understand the alignment of AfDB Group operations with national country priorities and DFID aid objectives, as well as the results achieved in those countries. We will examine a sample of projects in each country across four of the top sectors receiving AfDB Group funding (agriculture, power, transport and WASH). This will allow us to explore the reasons underlying broader performance themes and trends that we have identified through the corporate review component above. In Section 5 (Sampling Approach) we outline how we have selected our five case studies (Nigeria, Uganda, Tunisia, Kenya and Mali) and our choice of sectors and projects.

For the selected countries and projects, we will review relevant AfDB Group documentation, including memoranda of understanding, annual reviews and project completion reports to explore the decision-making process that underpins the project lifecycle, including results achieved. We will also interview a number of stakeholders within the AfDB Group responsible for the projects, both at HQ and in the relevant country offices. This evidence will be gathered, analysed and triangulated using an assessment framework for each project and an assessment framework for country case studies, designed to enable systematic assessment against the review questions.

Component 4 – Country visits

We will visit two of our selected case study countries – Nigeria and Uganda – as well as Cote d’Ivoire, which is where the AfDB Group headquarters are located, in order to expand upon the evidence collected through the corporate-level review and the case studies. Country visits will allow us to conduct interviews with a broader range of stakeholders than for projects and case studies reviewed remotely, including stakeholders beyond the AfDB Group (such as other donors, other multilateral organisations such as the World Bank Group, sector experts in that country, investors and DFID economic advisers). Where feasible we will also conduct interviews with beneficiaries of the projects that will be facilitated through local NGOs. Visits will also allow us to meet with the staff responsible for each project to help verify the reported results of AfDB Group lending activities, evidence of considerations of, leave no one behind, principles and fragility where relevant, as well as the AfDB’s contribution to leveraging third party finance in that country. Evidence will feed into the case studies and the project-level assessment frameworks.

In addition to investigating the sampled projects further, country visits will allow us to look at issues beyond the individual project-level. In particular, country visits will allow for a deeper assessment of whether DFID’s support to the AfDB Group is helping to develop or accelerate particular sectors and markets in a country and mobilise further capital.

Sampling approach

Country case study selection

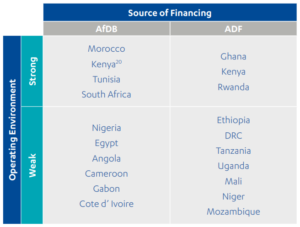

Almost all of DFID’s funding to the AfDB Group is through core contributions. As such it comprises a fungible resource which, along with that of other shareholders and contributing donors, is used by the AfDB Group across the full gamut of its work. In this review we will therefore look in depth at the performance of both the AfDB and ADF in countries that illustrate a full range of the AfDB Group’s activities. Our selection process consists of two stages. In the first stage, we identified the ten largest recipients of lending by each of the AfDB and ADF in order to ensure a minimum spread and depth of activity. We then classified these countries as representing either strong or weak operating environments in order to illustrate the performance of the AfDB and ADF in differing governance environments – a critical limiting factor in the development potential of countries.18 This results in the distribution shown in Figure 4.

Figure 4: Top 10 countries by total spend since 2014 for AfDB and ADF categorised by operating environment

In the second stage we selected specific countries based on their joint potential to enable further, in-depth analysis of the AfDB’s priority sectors (ie those that have received the greatest amount of lending from the AfDB Group since 2014: see Figure 1). Countries are thus selected because of their ability to cast light on the AfDB Group’s activities and UK aid priorities in Africa as a whole – eg because of the breadth of the project activity in those countries – rather than for their individual importance for UK aid objectives. The country case

studies emerging from this two-stage process are as follows:

- Tunisia is a country with a strong operating environment that is eligible for only AfDB funding. Tunisia is not a priority for DFID and is not a rising power (South Africa) or major trading partner (Morocco). Including Tunisia will allow us to understand why DFID funds the AfDB despite countries like Tunisia not being a DFID priority.

- Nigeria is a weak operating environment and a country that soon will not be eligible for any ADF funding, because it is graduating to AfDB only funding.

- Kenya is a country with a strong operating environment that currently receives a blend of both AfDB and ADF funding.

- Uganda is a country with a weak operating environment that is an ADF only country.

- Mali is a country with a weak operating environment, that is an ADF only country and in the Sahel, a priority region for DFID due to its combination of extreme poverty, climate risk, and fragility.

We chose two ADF-only countries because the majority of DFID funding to the AfDB Group is through replenishments to the ADF. For an overview of our selected countries see Table 2 below.

Table 2: Overview of selected countries

| Operating Environment | Country | Region | Fragility | Sovereign | Nonsovereign lending | Programmes | Office | ||

|---|---|---|---|---|---|---|---|---|---|

| DFID | CDC | DFID | CDC | ||||||

| AfDB Strong | Tunisia | North | 14 | 3 | 0 | 2 | |||

| AfDB Weak | Nigeria | West | High | 13 | 11 | 32 | 55 | Tick | Tick |

| ADF Strong | Kenya | East | Low | 10 | 5 | 18 | 59 | Tick | Tick |

| ADF Weak | Uganda | East | 8 | 2 | 16 | 27 | Tick | ||

| Mali | Sahel | Low | 9 | 1 | 2 | 3 | |||

As shown in Table 2, our selection of five country case studies also represents a reasonable spread in terms of region, level of fragility and extent of AfDB Group sovereign and non-sovereign lending.

Table 3: Sampled projects per country and sector

| Country | Agriculture | Multi-Sector | Power | Transport | WASH | Total |

|---|---|---|---|---|---|---|

| Tunisia | 2 | 1 | 1 | 1 | 5 | |

| Nigeria | 1 | 1 | 1 | 1 | 4 | |

| Kenya | 1 | 1 | 1 | 1 | 4 | |

| Uganda | 2 | 1 | 1 | 1 | 5 | |

| Mali | 1 | 1 | 1 | 1 | 1 | 5 |

| Total | 7 | 1 | 5 | 5 | 5 | 23 |

We propose examining between four and five projects per country to cover all of our priority sectors (transport, power, agriculture and WASH) and have tended to select larger projects in each sector. In addition to this, we have also aimed to include some projects financed through DFID-supported trust funds in order to understand how they differ from the other projects. We present the total number of sampled projects per sector in Table 3.

Country visits

Of the five case studies selected, two are further earmarked for a country visit. The purpose of these weeklong country visits is to facilitate discussions with stakeholders on the ground, notably government officials, private sector actors, civil society and development partners. These stakeholders will be identified during the review of project-level documentation and through consultation with AfDB Group staff. We are selecting one AfDB country and one ADF country. The selection of the countries to visit is based primarily on the presence of DFID in-country as well as other relevant donors.

- AfDB: Tunisia or Nigeria

- We select Nigeria ahead of Tunisia because of the presence of a DFID country office as well as CDC presence and an IFC office, which allows us to interview a greater number of relevant stakeholders.

- ADF: Kenya or Uganda

- We select Uganda ahead of Kenya because there are more projects in our sample to visit.

We have selected Uganda and Nigeria for the country visits. In addition, a visit to the African Development Bank headquarters in Abidjan (Cote d’Ivoire) is proposed in order to facilitate discussions with AfDB staff andUK representatives.

Limitations to methodology

Below we present some of the limitations to our methodology:

The potential for an overly subjective choice of case studies and themes. We have tried to be explicit and transparent about the review’s choice of country case studies. While we acknowledge that it is possible to construct arguments in favour of alternative countries, we believe that our selection will shed light on key aspects of the AfDB Group’s work. Our thematic focus results from an initial review of previous assessments of the AfDB Group by DFID and the Multilateral Organisation Performance Assessment Network (MOPAN).

The risk that our selection of country case studies, sectors and themes do not help explain the ‘how and why’ of issues identified in our corporate-level review. Given the diverse activities of the AfDB Group and the wide range of countries it has worked in during the review period (38 countries and 817 projects), we have aimed to strike a balance between the need for an in-depth review of its operations through the case studies and a strategic overview of its operations. The literature review and strategic corporate review, including strategic interviews with key stakeholders, will provide the overall context for the in-depth case studies and help ensure that our case study investigations are shaped by, as well as shape, broader corporatelevel insights.

The potential for a lack of transparency in our analysis and drawing of conclusions. We have included suggested assessment criteria including benchmarking in our design framework to ensure that the basis for our analysis is transparent. Given the scope of the review, understanding the AfDB’s performance and how DFID’s support contributes to achieving its aid objectives is challenging to assess. We will aim to compare the results the AfDB achieves in comparison to what it aimed to achieve and, where possible, in comparison to other regional development banks.

Risk management

Table 4: Risk management

| Risk | Mitigation and management actions |

|---|---|

| Time required to engage with AfDB | The review team will aim to engage with AfDB as soon as possible and articulate the utility of the review both to the AfDB Group and to the UK as a shareholder. The review team will further emphasise that the scope of the review is of DFID’s support to the AfDB Group. |

| Replenishment process causes logistical disruptions | The review overlaps with the replenishment process of the General Capital Increase 7 for the AfDB and the 13th replenishment of the ADF. The stakeholders involved in these replenishments (at AfDB and DFID) are likely to have an unusually busy workload making access to them and coordination with them more challenging. |

| Stakeholders unavailable | There is a risk that without a sufficient number of stakeholders interviewed the country studies will fail to create enough evidence for the review. |

| Potential lack of performance and efficiency data for all projects | The review team will review publicly available documentation to understand what is feasible and design the approach accordingly. It will sample interviewees to cover potential gaps in documentation to get an understanding of the progress made for each priority area. |

| Potential absence of value for money data | The review team will review available documentation on value for money benchmarks – including early consultation with DFID and AfDB – to understand what is feasible and design the approach accordingly. |

Quality assurance

The review will be carried out under the guidance of the ICAI commissioner Tamsyn Barton, with support from the ICAI secretariat. The review will be subject to quality assurance by the service provider consortium. Both the methodology and the final report will be peer reviewed by Annalisa Prizzon, Senior Research Fellow in the Development Strategy and Finance Programme at the Overseas Development Institute.

Timing and deliverables

This review will be conducted over a period of around nine months, beginning in June 2019.

Table 5: Timing and deliverables

| Phase | Timing and deliverables |

|---|---|

| Inception | Approach Paper: September 2019 |

| Data collection | • Literature Review: July to November 2019 • Corporate Level Review: July to November 2019 • Case Studies: August to November 2019 • Country Visits: October 2019 • Evidence pack and emerging findings: November 2019 |

| Reporting Final report: | Spring 2019 |