The UK’s support to the African Development Bank Group

Score summary

The African Development Bank Group is good value for money, allowing the UK taxpayer to influence development across Africa, but more could be done to strengthen strategic engagement between the UK and the Bank and cooperation on the ground.

The African Development Bank Group (the Bank) is a multilateral development bank that aims to promote sustainable economic development and poverty reduction in Africa. The challenge is enormous. Although Africa has made significant advances in some areas, as measured by achievements during the era of the Millennium Development Goals (MDGs) between 1990 and 2015, progress has not been even. For example, 41% of people in sub-Saharan Africa still lived below the international extreme poverty line of $1.90 per day in 2013 (the most recent data available), down from 54% in 1990. This was well short of the MDG target of halving poverty by 2015, and stands in stark contrast to the progress made in East Asia and the Pacific, as well as South Asia, over the same period.

The Bank supports development in Africa by mobilising finance from its members and the capital markets, allocating resources for investment to its regional member countries, and providing policy advice and technical assistance. The UK joined the African Development Fund, a part of the Bank Group that lends to the poorest countries in Africa, in 1973 and is its largest contributor. It became a member of the African Development Bank, also part of the Bank Group, in 1983 and is ranked 14th in terms of shareholding. The Bank’s objectives are well aligned with UK development objectives in Africa, including its focus on renewable energy, risk-sharing instruments to encourage private investment, emphasis on fragile states, contribution to job creation and tracking of gender impact. The Bank’s standing as Africa’s premier development institution increases the UK’s development impact in Africa due to the UK’s position as a board member and contributor. The Bank also complements the UK’s bilateral aid well. Contributing to the Bank enables the UK to deliver important development results that could not be achieved bilaterally, given the Bank’s wider geographical coverage and expertise in areas such as financing large-scale cross-country infrastructure projects.

The Bank is one of the most effective multilateral banks, as evidenced by external reviews of the Bank in comparison to peers, and is making good progress towards achieving its High 5 priorities: Light up and power Africa (energy sector), Industrialise Africa (finance and transport sectors), Integrate Africa (cross-border energy and transport sectors), Feed Africa (agriculture, transport, and water, sanitation and hygiene (WASH) sectors), and Improve the quality of life for the people of Africa ( jobs, social sectors and WASH). However, the Bank is also still some way off achieving its potential, particularly in the areas of project preparation and implementation, engagement with the private sector, and leveraging third-party finance. The Bank is highly cost effective relative to other comparable multilateral banks. Indeed, the challenge for the Bank now is less about reducing unit costs and more about the need to resource an uplift of staff in key areas, such as environmental and social safeguards, and fragile and conflict-affected states. The Bank’s progress in decentralising the allocation of staff and resources to regional and country offices, a strategic priority for the Department for International Development (DFID), has been especially positive. It generates good-quality research and policy advice, although it could do more to share its underlying data with the wider development community as a global public good.

The UK is generally well regarded at the Bank, particularly for its inputs at technical level. However, there has been limited ministerial and senior DFID management engagement with the Bank’s senior staff in recent years, which has impeded dialogue at strategic level. In September 2017, DFID decided to place the Bank under a Performance Improvement Plan (known in the Bank as an Accelerated Delivery Plan), following two consecutive years in which DFID had scored the African Development Fund with a B. There was a widely shared view among senior Bank officials and some DFID officials that unilaterally holding the Bank accountable against this plan, independently of other board members, undermined the multilateral governance framework of the Bank. Engagement between the government and the Bank on the ground could also be stronger, in particular in aligning DFID’s strengths in the area of economic development with the Bank’s focus on infrastructure. Increasingly DFID staff recognise the problems of their approach and this is being reviewed.

This report was written ahead of an independent inquiry into allegations of ethical breaches by the Bank’s president, although the outcome of the inquiry was announced just prior to the publication of our report. ICAI was aware of the claims, but they were not in the scope of this review.

| Individual question scores | |

|---|---|

| Question 1 Relevance: How well aligned is the Bank with the UK’s aid priorities in Africa? |  |

| Question 2 Effectiveness: How effective is the Bank at delivering UK aid priorities? |  |

| Question 3 Efficiency: How well does DFID ensure the value for money of its contributions to the Bank? |  |

Executive summary

This review assesses how the Department for International Development (DFID) manages its contribution to the African Development Bank Group and the value for money this provides for the UK taxpayer. At the time of finalising the review, it has been announced that DFID will be merged with the Foreign Office (FCO), so while DFID, as the lead department during the period under review, is the department referred to throughout most of this review, recommendations are addressed to the new Foreign, Commonwealth and Development Office (FCDO).

Background

The African Development Bank (AfDB) was founded in 1963 by 23 African nations with an initial authorised capital of $250 million. Over time, it has evolved to include shareholders from 80 countries and capital of $208 billion. In 1972, the AfDB and 13 non-regional countries established the African Development Fund (ADF), which lends primarily to low-income countries on terms that are considerably more concessional (favourable) than market rates. In 1976, the government of Nigeria and the AfDB established the Nigeria Trust Fund, which also provides funding on below-market terms. Together, the AfDB, the ADF and the Nigeria Trust Fund are known as the African Development Bank Group (“the Bank Group” or “the Bank”).

The overarching objective of the Bank is to spur sustainable economic development and social progress in its regional member countries, thus contributing to poverty reduction. It aims to achieve this objective by mobilising and allocating resources for investment in regional member countries, and by providing policy advice and technical assistance to support development efforts. It is also committed to the pursuit of the Sustainable Development Goals set out in 2015.

The multilateral development banks, of which the Bank is one, allow DFID and other bilateral donors to benefit from the economies of scale associated with their project preparation and supervision infrastructure, their presence on the ground in countries where the UK has no presence itself, and their knowledge base.

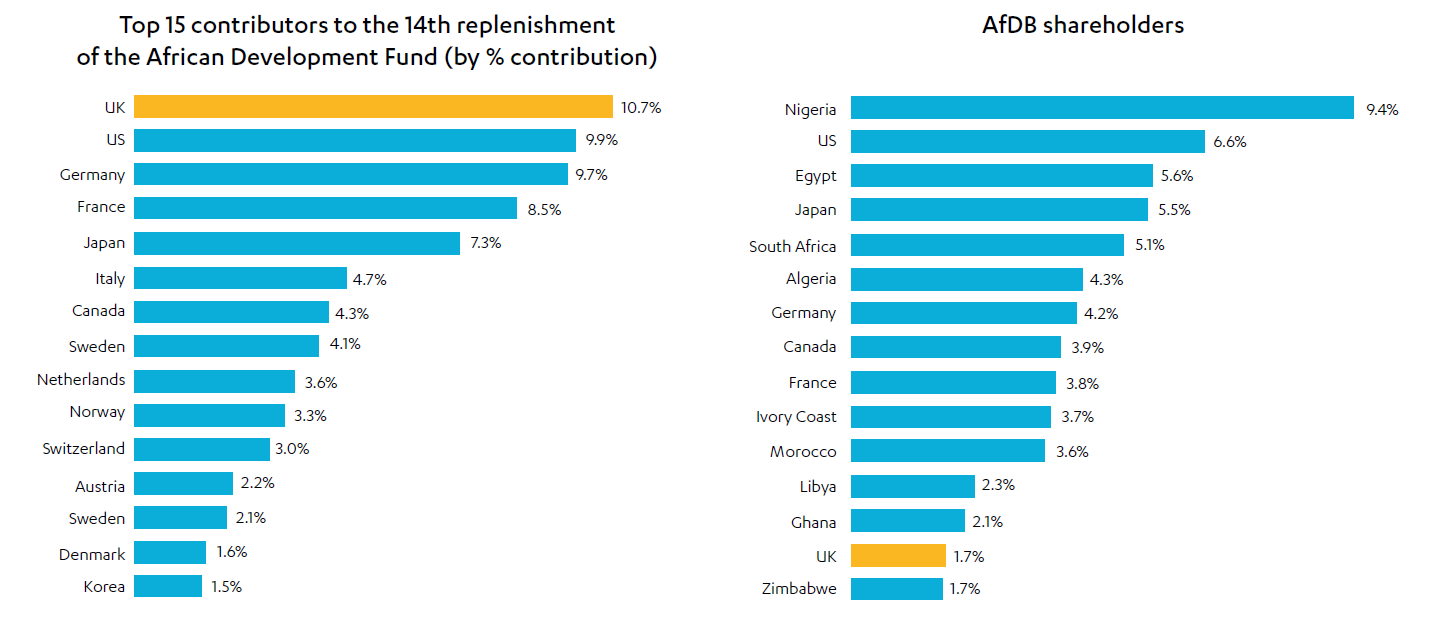

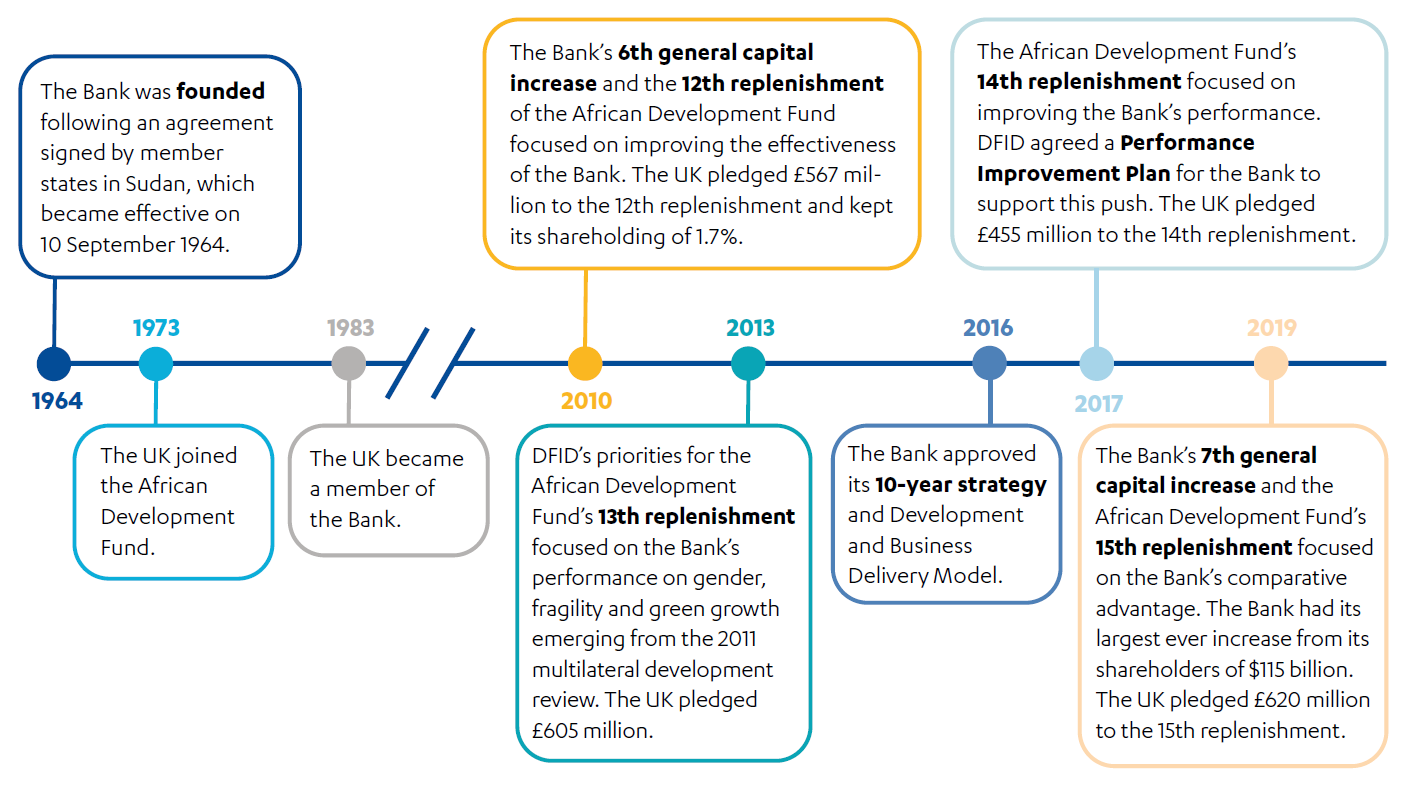

The UK joined the ADF (the concessional lending and grants arm of the Bank) in 1973 and became a member of the African Development Bank in 1983. The UK currently has the smallest shareholding of all G7 countries at 1.72% of total shares and is the 14th largest shareholder overall. This small shareholding means that the UK’s vote on all AfDB issues carries less weight than many other shareholders. It also means that the UK is required to share its representation on the board of executive directors with two other small shareholders (Italy and the Netherlands) on a rotating basis. This contrasts with the UK’s contribution to the ADF where it is the largest donor, representing (on average over recent replenishments) 12.37% of total donor contributions.

Relevance: How well aligned is the Bank with the UK’s aid priorities in Africa?

The Bank’s objectives were set out in its 2013-2022 strategy, At the Centre of Africa’s Transformation. This defined inclusive growth as “growth that is more inclusive, leading not just to equality of treatment and opportunity but to deep reductions in poverty and a correspondingly large increase in jobs”, and green growth as growth that is “sustainable, by helping Africa gradually transition to ‘green growth’ that will protect livelihoods, improve water, energy and food security, promote the sustainable use of natural resources and spur innovation, job creation and economic development”. The Bank has also defined five priorities, known as the High 5 priorities, progress against which is measured in the Bank’s Results Measurement Framework (2016-2025) by targets drawn from a number of sectors: Light up and power Africa (energy sector), Industrialise Africa (finance and transport sectors), Integrate Africa (cross-border energy and transport sectors), Feed Africa (agriculture, transport, and water, sanitation and hygiene (WASH) sectors), and Improve the quality of life for the people of Africa ( jobs, social sectors and WASH).

Africa faces critical infrastructure gaps. While DFID spends about 11% of its bilateral budget on infrastructure, it does not directly deliver large-scale investments in roads and energy, and particularly regional projects. By contrast, nearly 50% of loans approved by the Bank are for transport and energy. Some of these infrastructure investments are complex, regionally significant, cross-border investments.

The Bank also has an extensive on-the-ground presence in fragile states across Africa. In some cases, this presence coincides with that of DFID, but in other cases the Bank provides the UK with indirect reach to strategically important environments.

The Bank’s overarching objectives are well aligned with UK development goals, including key cross-cutting priorities such as fragile states and gender. The Bank’s standing as the premier African development institution increases the UK’s development impact in Africa due to the UK’s position as a board member and contributor. The Bank’s strategy and tools for engaging in ‘transition states’ fit well with the UK’s focus on stability and development in fragile states. However, the Bank is caught between its ambition as Africa’s development bank to provide comprehensive services and pressure from some board members to focus on its core strengths, including transport and energy infrastructure. Overall, we saw a very strong alignment between the Bank’s goals and those of the UK. We therefore award a green score for relevance.

Effectiveness: How effective is the Bank at delivering UK aid priorities?

While the Bank’s development objectives are well aligned with those of the UK, the extent to which it represents value for money for the UK taxpayer depends on its effectiveness, or in other words, how well and to what extent it delivers on its objectives.

The Bank has been rated by several independent assessments as one of the most effective multilateral banks and is making good progress towards achieving its High 5 priorities in the context of its 2016-2025 Results Measurement Framework. However, the Bank is also still some way off achieving its potential. By its own assessment, the quality of its project preparation is satisfactory for only just over half its projects. Despite some improvements, it has also struggled to instill a culture of performance across the organisation and to recruit sufficient staff in key areas, such as safeguards, and fragile and conflict-affected states (FCAS). Its approach to ‘leave no one behind’ is improving, with high-level targets for poverty and inequality introduced in its development effectiveness reporting from 2016, as well as indicators capturing jobs created through Bank projects. The Bank made some advances in gender mainstreaming. It appointed a special envoy on gender between 2014 and 2016 and approved a gender strategy for 2014-18, although the rollout of the strategy was not without problems.

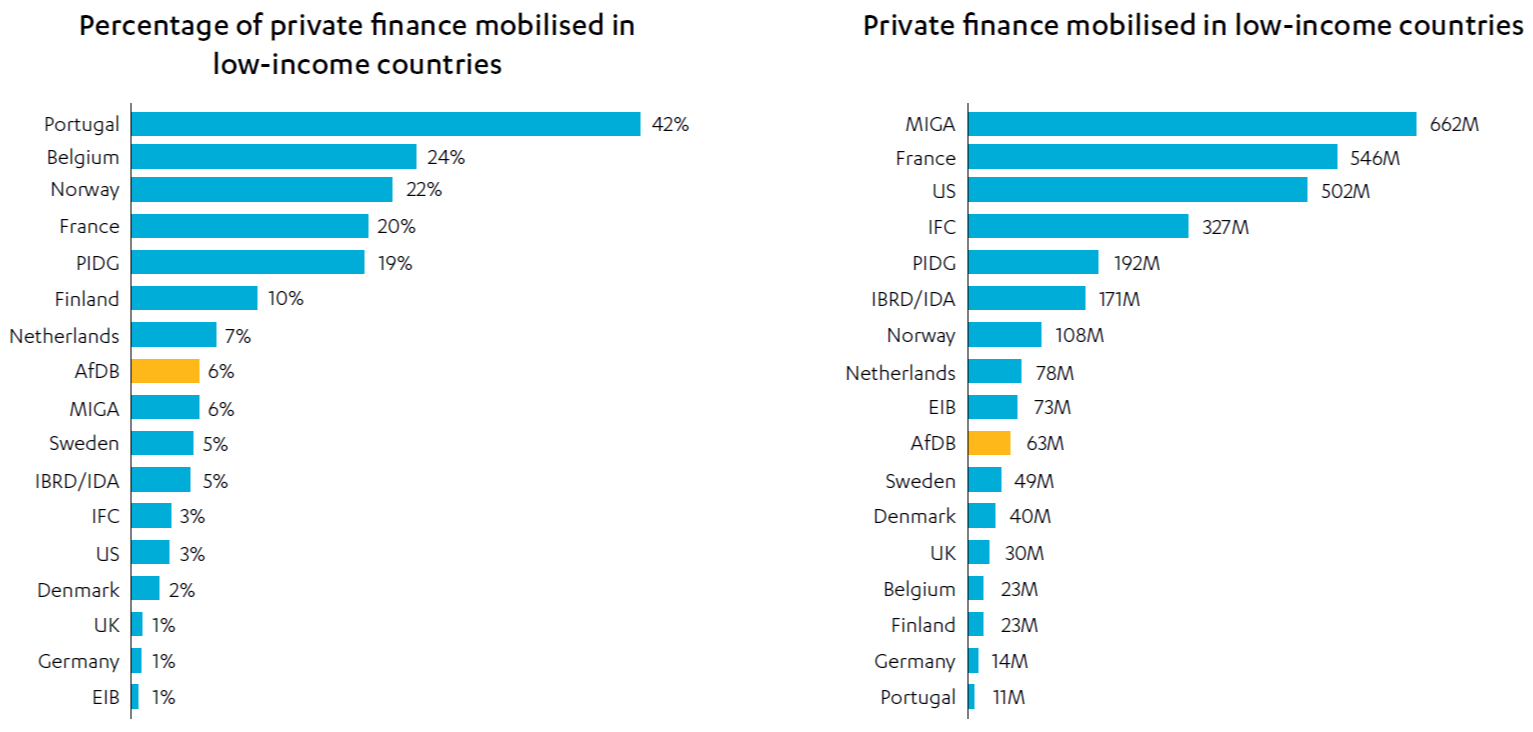

The Bank has increased its engagement with the private sector, although additionality is not always clear and it has a poor track record, like peers, in leveraging private finance into development. It has also so far failed to attract significant third-party donor funds into trust funds under its management. The Bank has played a small but valuable role working with China to build agreement around common standards of corporate governance. It also generates good-quality research and policy advice, although it could do more to share its underlying data with the wider development community.

Overall, while the Bank still has some way to travel before it fully realises its potential, it is fundamentally performing well in relation to peers and is playing a central role delivering complex infrastructure projects that are critical to Africa’s development. We therefore award a green-amber score for effectiveness.

Efficiency: How well does DFID ensure the value for money of its contributions to the Bank?

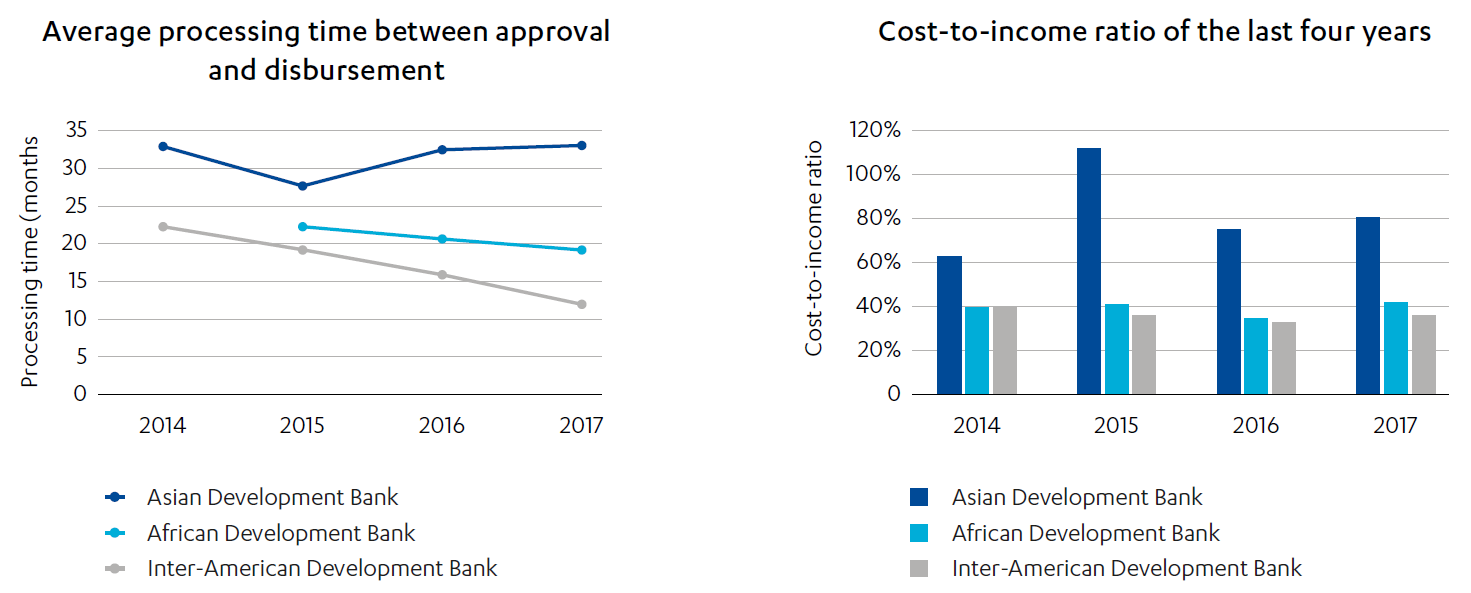

The Bank is highly cost effective relative to other comparable multilateral banks. Indeed, the challenge at the Bank is now less about reducing unit costs and more about the need to resource an uplift of staff in key areas, such as safeguards and FCAS. Business processes have improved and the Bank is continuing to improve efficiency in directions encouraged by the UK, notably through its ongoing decentralisation of staff and resources to regional and country offices.

The UK is well regarded at the Bank, particularly for its inputs at technical level. There is no doubt that the UK is abreast of key issues at the Bank and, through its position on the boards of the Bank and the ADF, as well as through operational exchanges, engages purposefully and energetically. However there has been only limited engagement by ministers and senior management at DFID with the Bank’s senior staff in recent years, which has impeded dialogue at strategic level to some extent. In addition, in 2017, DFID unilaterally placed the Bank under a Performance Improvement Plan (known in the Bank as an Accelerated Delivery Plan), following two consecutive years in which the ADF had failed to meet DFID’s delivery expectations. Increasingly DFID staff and senior managers recognise the problems of their approach and this is being reviewed.

The government’s engagement with the Bank beyond DFID has been limited and is still a work in progress. The establishment of the FCDO may bring wider engagement. In this context, the planned uplift of resources for the government’s work in Africa appears to offer opportunities. For example, in its work with the Bank, there is scope to bring the UK’s approach to the Sahel region, which poses significant security and humanitarian challenges, further in line with the UK’s strategic approach to Africa. DFID’s management of its contribution to the Bank is generally evidence-based. However, the limited interaction between DFID and Bank offices at country level means that the bottom-up flow of information to DFID centrally is somewhat limited. We therefore award a green-amber score for efficiency.

Conclusions and recommendations

At the time of finalising the review, it has been announced that DFID will be merged with the FCO, so while DFID, as the lead department during the period under review, is the department referred to throughout most of this review, recommendations are addressed to the new Foreign, Commonwealth and Development Office. We offer a number of recommendations to help the FCDO increase the value of its contribution to the Bank.

Recommendation 1

FCDO should minimise unilateral reform interventions (such as the 2017 Performance Improvement Plan) that could undermine the multilateral nature of the Bank’s governance structure as well as the UK’s reputation as an honest broker.

Recommendation 2

FCDO should take a broader view of value for money than cost-to-income ratios, and focus on ensuring that key areas of understaffing such as fragile and conflict-affected states and safeguards are addressed.

Recommendation 3

FCDO should pay particular attention to ensuring that the Bank’s environmental and social safeguards are implemented on the ground.

Recommendation 4

If FCDO is to channel more resources to the Bank via Bank-managed trust funds, it should help to build the Bank’s capacity to manage such funds, including technical assistance to strengthen fiduciary and results management.

Recommendation 5

Government country teams could do more to identify synergies with Bank investments, thus encouraging closer working, better information flows and better-informed oversight.

Introduction

This review assesses how the Department for International Development (DFID) manages its contribution to the African Development Bank Group and the value for money of this contribution for the UK taxpayer. The African Development Bank Group (“the Bank Group” or “the Bank”) is a multilateral development bank that aims to promote sustainable economic development and poverty reduction in Africa. The challenge in Africa is enormous. Although there have been significant advances in Africa in some areas, as measured by achievements during the era of the Millennium Development Goals (MDGs) between 1990 and 2015 (the most recent data available), progress has not been even. For example, 41% of people in sub-Saharan Africa lived below the international extreme poverty line of $1.90 per day in 2013 – just 13 percentage points fewer than in 1990. This was well short of the MDG target of halving poverty, and stands in stark contrast to the progress made in East Asia and the Pacific, as well as South Asia, over the same period.

The Bank has regional (African countries) and non-regional (non-African countries) members and is made up of three entities: the African Development Bank (AfDB), the African Development Fund (ADF) and the Nigeria Trust Fund. It promotes development in Africa by mobilising and allocating financial resources for investment in its regional member countries, and providing policy advice and technical assistance in support of development efforts.

The UK’s total annual contributions to the Bank amount to approximately £181 million which is approximately 1.3% of its overall annual official development assistance (ODA). DFID’s engagement in the Bank comprises:

- a shareholding in the AfDB representing approximately 1.72% of the AfDB’s capital

- contributions to the ADF through replenishments that take place every three years

- several projects that are managed by the Bank and co-financed by DFID through trust funds, such as the Transition Support Facility and the Sustainable Energy Fund for Africa.

DFID’s rationale for working with the Bank includes the financial and technical support that the Group provides to the poorest countries in Africa, as well as the government’s emerging priorities through the AfDB’s less concessional finance for middle-income countries and opportunities for co-financing with the CDC Group and the Private Infrastructure Development Group. Working with the Bank also provides the government with an opportunity to expand its reach to places where the UK does not have large programmes or teams on the ground.

Table 1: Our review questions

| Review criteria | Sub-questions |

|---|---|

| How well aligned is the Bank with the UK’s aid priorities in Africa | • How well do the Bank's strategies and portfolio support the UK’s development goals for Africa? |

| How effective is the Bank at delivering UK aid priorities | • How well has the Bank delivered its intended results through its lending operations? • How well has the Bank helped mobilise other sources of development finance? • What is DFID’s contribution to the Bank buying in terms of outcomes? |

| How well does DFID ensure the value for money of its contributions to the Bank | How effective has DFID been at promoting reform of the Bank (to include unintended consequences and lesson learning)? • How coherent is DFID’s engagement with the Bank at central and country levels, and across UK aid channels (including Foreign Office, Department for International Trade and CDC Group)? • To what extent are DFID’s contributions based on robust evidence of performance, value for money and comparative advantage? |

A review of DFID’s management of its contribution to the Bank is relevant both because it involves use of UK taxpayers’ money and because of the Bank’s importance for development in Africa. Our review questions, therefore, seek to assess the relevance, effectiveness and efficiency of the Bank, including alignment with the UK’s priorities and DFID’s oversight of its financial contribution, to ensure it represents value for money for the UK. The review covers the period from 2014 to the present, albeit with a greater emphasis on developments for which sufficient time has elapsed to assess their impact. The review includes an overview of the Bank but does not focus equally on all areas the Bank works in according to its mission and strategy statement. Rather, it focuses on specific themes and sectors that are relevant to the UK and its development objectives or have received the most funding from the Bank in recent years. Box 1 provides an overview of what Sustainable Development Goals are most relevant to this review.

Box 1: How this report relates to the Sustainable Development Goals

The Sustainable Development Goals (SDGs), otherwise known as the Global Goals, are a universal call to action to end poverty, protect the planet and ensure that all people enjoy peace and prosperity.

Related to this review: Since this is a review of an entire organisation, rather than a particular development challenge, a broad range of SDGs are relevant to the UK’s support to the Bank. The list below is not exhaustive, but instead comprises the SDGs that are most relevant to the UK’s support of the Bank:

Goal 1: End poverty in all its forms everywhere – the UK’s support to the Bank through the African Development Fund (ADF) is aimed at alleviating poverty and social and economic development. The fund provides concessional financing to countries that are increasing their economic capacities as well as those that remain fragile.

Goal 5: Achieve gender equality and empower all women and girls – increasing the capabilities of women and girls can boost the productivity and participation of half the African population. Gender is a key issue in the Bank’s 10-year strategy and a top priority for DFID’s engagement with the Bank.

Goal 6: Ensure availability and sustainable management of water and sanitation for all – the Bank’s focus on agriculture, water and sanitation is in its 10-year strategy under ‘Feed Africa’ and ‘Improve the quality of life for the people of Africa’ is aligned with Goal 6.

Goal 7: Ensure access to affordable, reliable, sustainable and modern energy for all – energy is a key area for the Bank as evidenced by its High 5 priorities. As such, the UK’s support to the Bank works towards achieving green growth. The Bank has recently approved the New Deal on Energy for Africa to contribute to this.

Goal 8: Promote sustained, inclusive, and sustainable economic growth, full and productive employment and decent work for all – the Bank promotes job creation through its direct investments and by promoting sustainable growth that leads to the structural change and economic transformation that enables the continent to join global value chains.

Goal 9: Build resilient infrastructure, promote inclusive and sustainable industrialisation and foster innovation – as an infrastructure development bank, the Bank aims to scale up infrastructure financing to the continent significantly − not just through its own lending but by leveraging its financial resources.

Methodology

This review considers the contribution of the Department for International Development (DFID) to the Bank, and the Bank’s performance at strategic and corporate-level, and at country level through five country case studies. The review covers the period since 2014, which includes the 13th and 14th replenishments and the negotiation of the 15th replenishment of the African Development Fund (ADF), as well as the Bank’s 6th general capital increase (GCI) and negotiations for a 7th GCI, which provide important context for understanding DFID’s role and the Bank’s performance.

Our methodology included the four components described below. Further detail on the approach and sampling is available in the approach paper.

Figure 1: Overview of review methodology

Component 1: Literature review

We conducted a review of articles and publications by relevant academic experts, donor organisations and international financial institutions. This informed our understanding of the wider multilateral development bank landscape and how it compares to bilateral aid. We examined the role of the Bank in this context by reviewing its instruments and comparative advantage. Finally, we also examined the Bank’s reform priorities and previous recommendations it has received. The literature review is available on the ICAI website.

Component 2: Corporate-level review

We assessed the relevance, effectiveness and efficiency of the Bank’s operations in delivering DFID priorities, reviewing the Bank’s and DFID’s corporate-level documentation and evidence. This included strategies, frameworks and evaluations of the Bank and DFID reviews of the Bank’s operations. We also conducted interviews with key stakeholders in the Bank, including a visit to its headquarters in Abidjan, and in DFID and other UK government departments. The interviews and research allowed us to understand the Bank’s strategy and approach to lending and achieving results. This included looking at which countries and sectors have been targeted, how they align with UK aid objectives, how results are monitored and achieved at portfolio level, and how performance data are gathered. It also allowed us to assess how well the Bank has addressed cross-cutting issues, including: fragility, leveraging third-party capital, and ‘leave no one behind’.

We assessed the relevance, effectiveness and efficiency of the Bank’s operations in delivering DFID priorities, reviewing the Bank’s and DFID’s corporate-level documentation and evidence. This included strategies, frameworks and evaluations of the Bank and DFID reviews of the Bank’s operations. We also conducted interviews with key stakeholders in the Bank, including a visit to its headquarters in Abidjan, and in DFID and other UK government departments. The interviews and research allowed us to understand the Bank’s strategy and approach to lending and achieving results. This included looking at which countries and sectors have been targeted, how they align with UK aid objectives, how results are monitored and achieved at portfolio level, and how performance data are gathered. It also allowed us to assess how well the Bank has addressed cross-cutting issues, including: fragility, leveraging third-party capital, and ‘leave no one behind’.

In assessing the efficiency of the Bank and whether it represents value for money for DFID, we identified publicly available benchmarks and interviewed key stakeholders in other multilateral development banks, as well as stakeholders with a comparative experience. While we did not benchmark the Bank against other multilateral development banks in a precise way, given the significant differences in resources, mandates and areas of focus, we drew comparisons with other multilateral development banks to learn how they have addressed issues relevant to the Bank.

Component 3: Case studies

We conducted five country case studies (Nigeria, Uganda, Tunisia, Kenya and Mali) to gain a detailed understanding of how the Bank works in specific contexts and the effectiveness of its lending operations in those countries. We examined a sample of projects in each country across four of the top sectors receiving Bank funding: agriculture, power, transport, and water, sanitation and hygiene.

Component 4: Country visits

We visited two of our selected case study countries – Nigeria and Uganda – as well as Abidjan, Ivory Coast, which is where the Bank headquarters is located. Our sampling approach is set out in the approach paper. The aim of the visits was to expand on the evidence collected through the corporate-level review and the case studies. Country visits allowed us to conduct interviews with a broader range of stakeholders at country and project levels. This included project sites and people affected by the projects as well as stakeholders beyond the Bank (for example, other donors, other multilateral organisations such as the World Bank Group, sector experts in these countries, investors, and DFID staff).

During the review we interviewed a total of 109 people comprising: 33 staff members in the Bank headquarters and country offices; 27 people working on, or with, Bank projects; 24 staff members in DFID and other UK departments; and 25 other stakeholders (academics, former advisers to the Bank and staff in other multilateral development banks).

Box 2: Limitations to the methodology

Negotiations for the recent 15th replenishment of the ADF and the 7th GCI took place during our review. Policy priorities and reform commitments were agreed for implementation with most reforms expected to be delivered by 2022. While we have aimed to reflect any resulting changes in priorities, it is premature to assess their effectiveness as changes resulting from these agreements have not been set in motion.

Our sample of five out of 54 regional member countries cannot be fully representative of the Bank’s portfolio or its investments.

A lack of documentation, due to confidentiality considerations, in the case of non-sovereign operations, and the Bank’s delays in conducting project completion reports, have affected our ability to make judgements about the Bank’s performance on some of our sampled projects.

Background

History

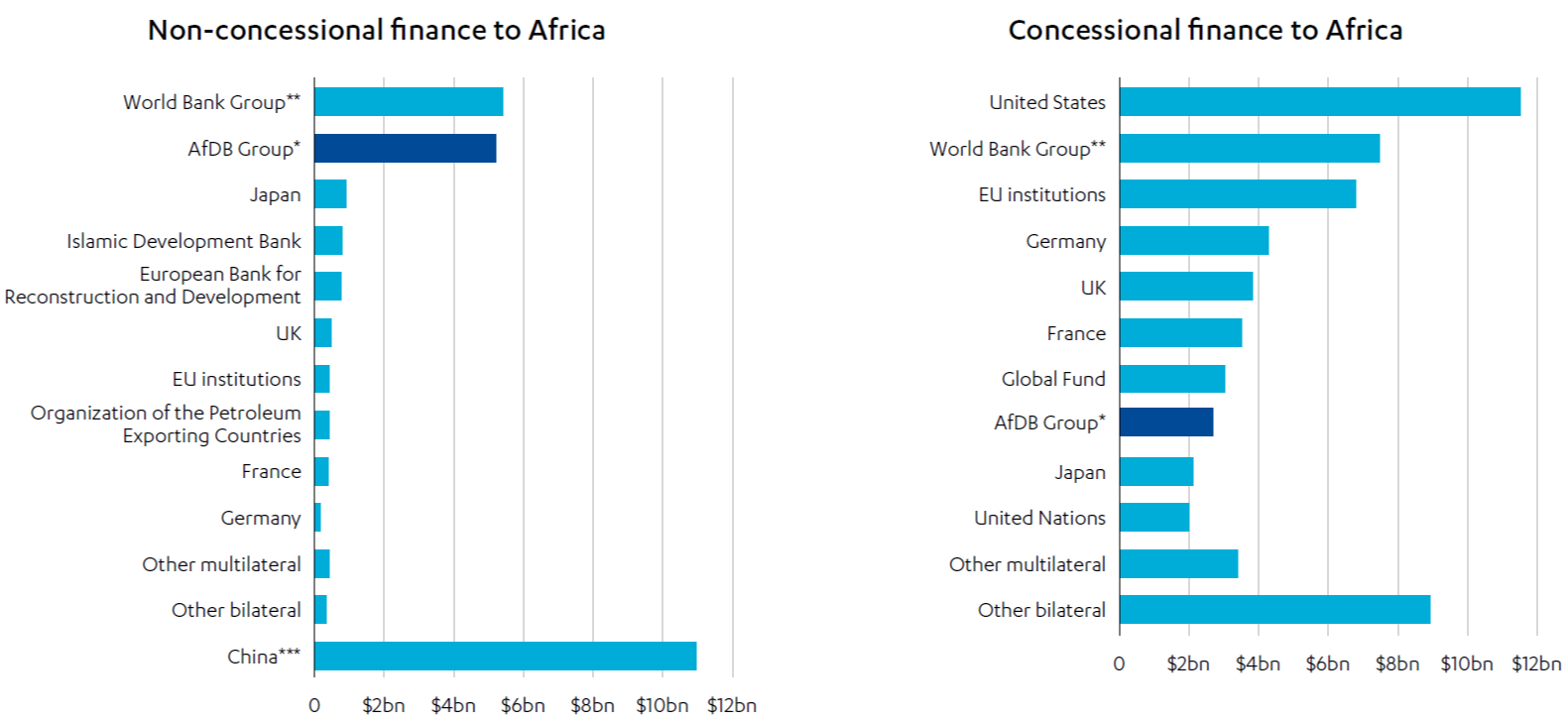

The African Development Bank (AfDB) was founded in 1963 by 23 African nations with an initial authorised capital of $250 million. It is now one of the two largest official non-concessional donors in Africa (see Figure 2) with capital of 80 shareholders and $208 billion. In 1972, the Bank and 13 non-regional countries established the African Development Fund (ADF), which lends to low-income countries on terms that are considerably more concessional (favourable) than market rates. The ADF is an important donor in Africa although smaller than some bilateral donors, including the UK (see Figure 2). In 1976, the government of Nigeria and the Bank established the Nigeria Trust Fund, which also provides funding on below-market terms. Together the AfDB, the ADF and the Nigeria Trust Fund are known as the African Development Bank Group (‘the Bank’).

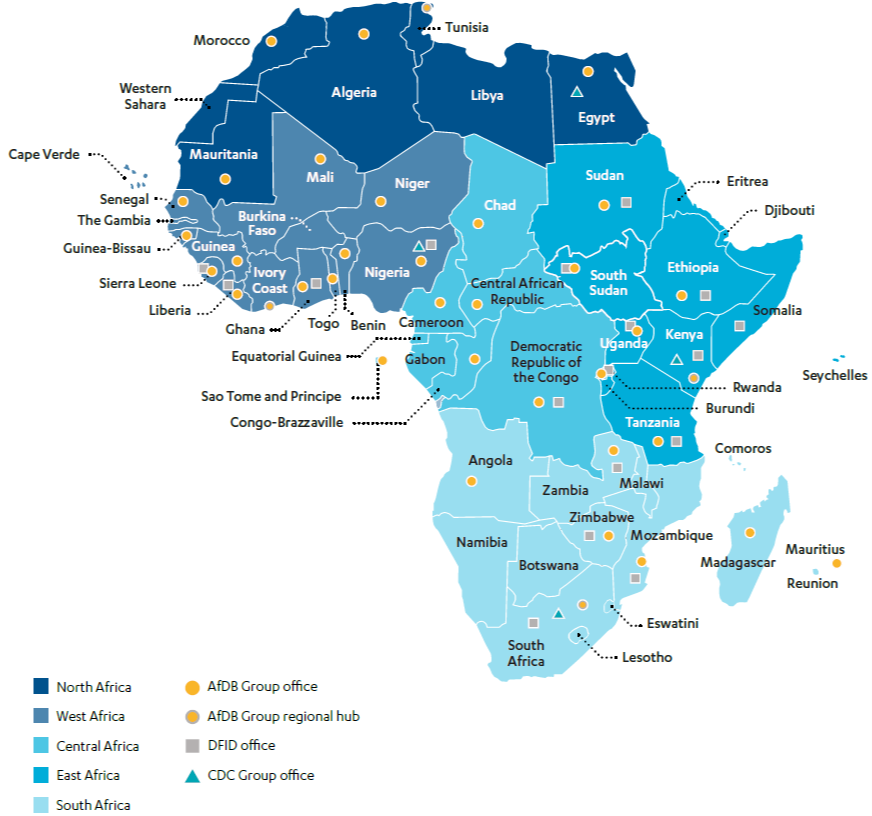

The Bank is headquartered in Abidjan, Ivory Coast, although from February 2003 until late 2013, it relocated to Tunis, Tunisia, due to the political conflict in Ivory Coast. There are 54 regional and 26 non-regional members, and as of 2020 it has a physical presence in 39 regional member countries across Africa (see Figure 3).

Strategy

The overarching objective of the Bank is to spur sustainable economic development and social progress in its regional member countries, thus contributing to poverty reduction. It aims to achieve this objective by mobilising and allocating resources for investment, and providing policy advice and technical assistance to support development efforts. It is also committed to the pursuit of the 2015 Sustainable Development Goals (SDGs).

The Bank’s ten-year strategy (2013-2022) focuses on two objectives: inclusive growth and the transition to green growth. It has also defined five additional priorities known as the High 5 priorities. These comprise Light up and power Africa, Feed Africa, Industrialise Africa, Integrate Africa, and Improve the quality of life for the people of Africa, and are monitored in the Bank’s 2016-2025 Results Measurement Framework. The Bank has linked its priorities to most of the SDGs.

Governance

The Bank is supervised by a board of governors who elect the president and delegate day-to-day operational policy, lending and other business matters to the board of executive directors. There are 20 executive directors of the AfDB with smaller shareholders, such as the UK, sharing executive directors. The ADF has a separate board with 14 members. The president of the Bank Group is elected for a five-year period. As chief executive, they chair meetings of the board of directors of the AfDB and of the ADF. The Bank Group is staffed by international civil servants. The Bank’s regional member countries are divided into five regional groups (North, South, East, West, Central), for each of which a director general is responsible.

Figure 2: How the Bank’s lending compared to other donors in 2017

*Bilateral lending is shown together with institutional lending on both graphs. Bilateral data may also include funding for the AfDB Group.

**World Bank Group includes the International Bank for Reconstruction and Development and the International Development Association.

***Chinese finance to Africa includes total concessional and non-concessional.

Sources: These graphs have been reproduced by the authors using figures from the Fifth Extraordinary Meeting of the Board of Governors – GCI 7,

2019 (unpublished), which drew on data from the OECD, the International Finance Corporation, and the China Africa Research Initiative.

Finance

The AfDB and the ADF are financed in different ways. The AfDB actively borrows in the capital markets. The Bank is able to issue bonds due to the subscription of capital by the Bank’s shareholders in return for their membership. These capital subscriptions are known as general capital increases (GCI). On 31 October 2019, the governors of the Bank agreed the largest GCI in its history (GCI 7) for $208 billion, an increase of almost $115 billion since GCI 6 in 2010. The Bank’s capital, together with its risk management policies, determine the Bank’s credit ratings. As of June 2020, the AfDB has the highest credit rating from all three major credit rating agencies. The AfDB’s high credit ratings signal a low risk of default and enable it to issue securities at attractive interest rates, even in times of market distress.

Figure 3: Distribution of the AfDB Group, DFID and CDC offices across Africa

Sources: The location of the AfDB Group, Department for International Development (DFID) and CDC country offices has been taken from their websites (AfDB Group website, DFID website, CDC Group website).

Of the total subscribed capital, only 6% is actually paid in, with 94% being callable capital that the Bank can demand from its donors if, for example, it requires liquidity to pay back bonds. In 2018, the Bank issued bonds amounting to UA 5.57 billion (approximately £6.18 billion) and had a total debt to usable capital ratio of over 83%. The Bank also issues a variety of specific social, green and other themed bonds. Its recently issued COVID-19 social bond is an example.

Box 3: The 15th replenishment of the African Development Fund in context

The ADF-15 replenishment negotiations, which concluded in 2019, agreed a total resource envelope of $7.6 billion (£6 billion), a 32% increase on ADF-14. ADF-15 marks a reversal of a trend of falling replenishments over the previous three replenishment cycles.

The ADF-14 negotiations, which concluded in 2016, resulted in a replenishment of SDR 4.2 billion (£4.62 billion) compared to SDR 4.8 billion (£5.28 billion) in ADF-13 and SDR 5.8 billion (£6.38 billion) in ADF-12. While the decline from ADF-12 to ADF-13 was driven by rapidly declining internal resources, the further decline in ADF-14 largely reflected a reduction of SDR 0.4 billion (£0.44 billion) in donor contributions. While this was undoubtedly in part caused by the decline of many key donor currencies against the SDR, it is noteworthy that, overall, traditional donors cut their contributions more sharply than those to the International Development Association (IDA). Donors outside the Development Assistance Committee also cut their contributions by a similar overall percentage, while increasing them to both IDA and the Asian Development Fund.

European donors reduced their contributions in ADF-14 by an average of just over 15% in SDR terms, the main reductions coming from the UK (down by 27% from ADF-13), two Scandinavian countries (Norway down by over 20% and Finland by over 50%) and Belgium (down by over 35%). In the cases of the UK and Belgium, these were much larger proportionate cuts than the same donors made to the IDA.

The ADF (the Bank’s concessional window), is funded by donor contributions in three-yearly instalments known as replenishments (see Box 3). The UK remains the largest contributing non-regional member to the ADF in this replenishment period (a position it has maintained in recent replenishment rounds.) Under the 15th replenishment, it is committing £620 million (subject to Parliamentary approval), negotiations for which concluded in December 2019.

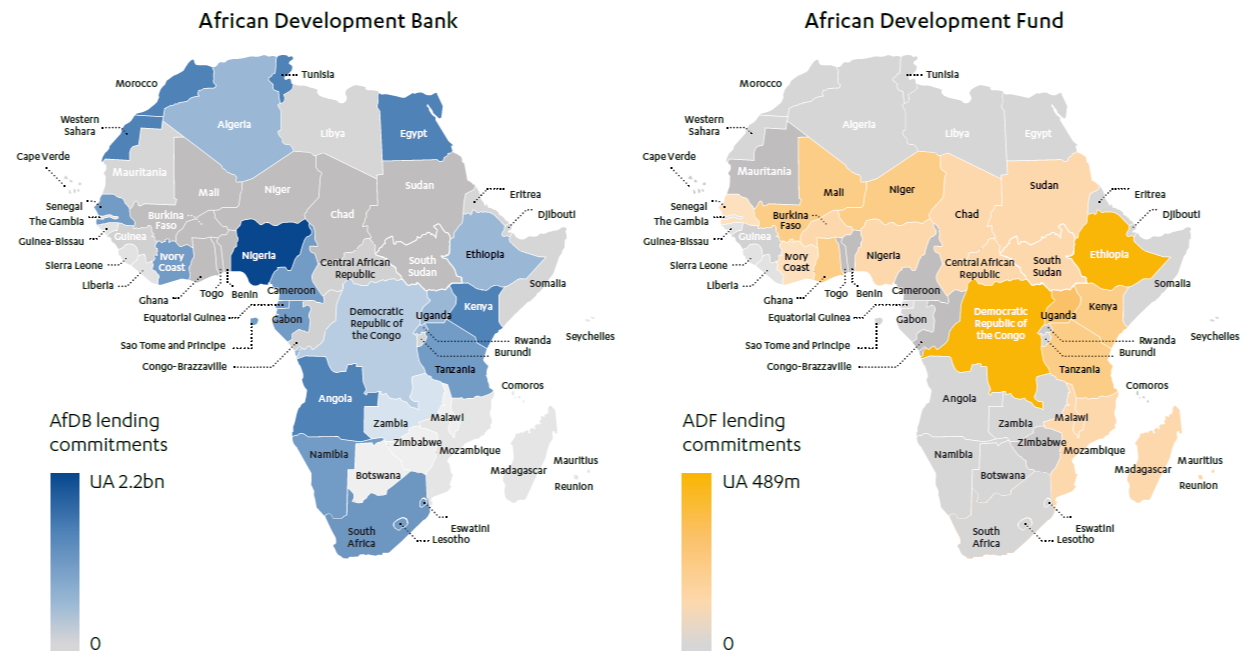

The Bank’s portfolio is dominated by non-concessional lending. During the period from 2014 to 2018, the Bank approved £35.23 billion with £25.3 billion in new lending approved by the AfDB and £6.36 billion in concessional ADF funding. Nevertheless, the share of Bank approvals that are for concessional lending (63%) is greater than the Asian Development Bank (45%) and the World Bank (41%), as is to be expected given the relatively low average income level of regional member countries in Africa. Countries that have received the largest amounts of lending since 2009 are Nigeria and Morocco (8% of the total value of approvals), Kenya (5%) and Tunisia (4%).

The Bank offers a wide range of financial instruments: loans (both sovereign and non-sovereign guaranteed), grants, technical assistance, lines of credit, guarantees and equity. The Bank’s non-concessional loans are provided as either sovereign guaranteed loans (SGLs) or non-sovereign guaranteed loans (NSGLs). SGLs are loans provided to regional member governments or public sector entities that are guaranteed by the regional member governments in whose territory the borrowing entity resides. NSGLs are made to public sector entities that do not require a sovereign guarantee, or to private sector enterprises.

Grants are provided through trust funds and other special funds, often to governments to fund technical assistance activities, or sometimes to non-governmental organisations. Donors transfer money into these funds, which are managed by the Bank, and enable grants to be provided to borrower countries for projects. These funds are separate from the Bank’s capital in that the money is provided to be used for specific purposes that are detailed in each trust fund. Technical assistance grants, provided through the Technical Assistance Fund, are financial support given to regional member countries to improve capacity and financial management.

Figure 4: Total lending commitments by country (2014-19)

Note: Bank transactions are reported in Units of Account (UA), a weighted average of multiple currencies. At the time of publication, the exchange rate was approximately UA 1 = GBP 1.11.

Source: AfDB Group Data portal.

Lines of credit support the development of small and medium-sized enterprises. Guarantees enable eligible borrowers to make use of the Bank’s status as a preferred creditor to borrow from private lenders and capital markets at more generous rates than would otherwise be available to them. The Bank also invests in equities, either directly or indirectly. The aim of the investments is to promote private sector development in the regional member country the Bank is investing in. The specific objective is to be a catalyst for further investment from other actors and lenders.

Sectors

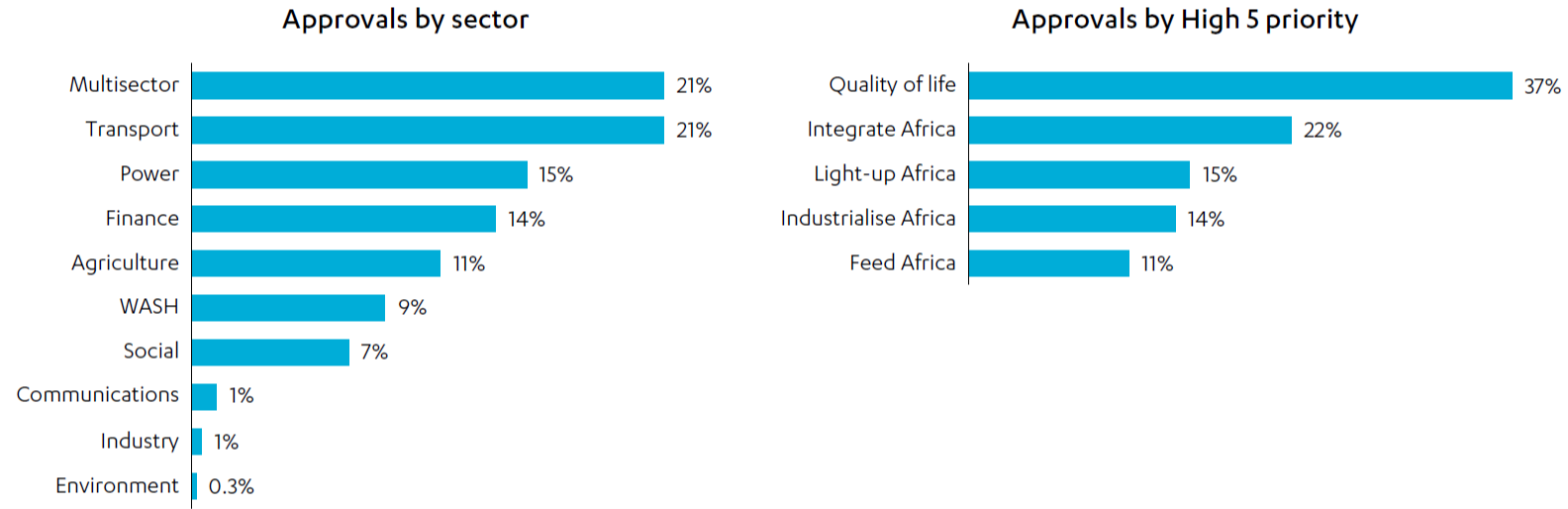

There is a broad consensus that infrastructure is a priority in Africa and just under 50% of Bank disbursements in 2015 were in transport (25.1%) and energy (21.8%) compared with less than 20% in the social sectors (such as education, water, sanitation and hygiene (WASH), and health).

Figure 5: Loan approvals by sector and High 5 priority (2014-19)

Source: AfDB Group Data portal.

The UK’s engagement with the Bank Group

The UK joined the ADF in 1973 and became a member of the Bank in 1983. The UK currently has the smallest shareholding of all G7 countries at 1.72% of total shares (it is the 14th largest shareholder among regional and non-regional members). This small shareholding means that the UK’s vote on all AfDB issues carries less weight than many other shareholders. It also means that the UK is required to share its representation on the board of executive directors with two other small shareholders (Italy and the Netherlands) on a rotating basis. This contrasts with the UK’s contribution to the ADF, where it is the largest donor (12.5% share of the target for donor contributions at the last replenishment). Through DFID, the UK has also contributed to several multidonor trust funds and initiatives (see Box 4).

Box 4: Examples of DFID’s contributions to AfDB Group trust funds and initiatives

- The African Water Facility (£15 million) – established in 2005 to assist African countries to meet the goals and targets for the water sector in line with the African Water Vision and the Framework for Action.

- Infrastructure Consortium for Africa (£1.5 million) – launched at the G8 Gleneagles Summit in 2005 to support the scaling up of investment for infrastructure development in Africa from both public and private sources.

- NEPAD Infrastructure Project Preparation Facility (£6 million) – established in 2005 to support the preparation of bankable regional infrastructure projects in Africa to attract more investment for infrastructure development.

- Congo Basin Forest Fund (£50 million) – established in 2008 to develop the capacity of the people and institutions in the Congo Basin to manage their forests, by helping local communities find livelihoods consistent with the sustainable conservation of forests, and reducing the rate of deforestation.

- Zimbabwe Multi-Donor Trust Fund (£10 million) – established in 2010 for early recovery and development efforts in Zimbabwe (initially water and sanitation, and energy).

- Multi-Donor Trust Fund for Countries in Transition (£2.4 million) – established in 2012 to respond to needs in the North African region after the Arab Spring.

- Somalia Infrastructure Trust Fund ($1.8m) – part of a multipartner initiative to assist Somalia in consolidating peace and moving along a path of long-term development.

- The Sustainable Energy Fund for Africa (£10 million) – established in 2011 to catalyse investments in commercially viable clean energy mini-grids across the continent.

Findings

In this section, we set out our findings on the UK government’s support to the African Development Bank Group in the context of the UK’s broader aid priorities. This includes consideration of the relevance of the Bank’s development objectives to those of the UK, the effectiveness of the Bank in meeting these objectives, and how well the Department for International Development (DFID) ensures the value for money of its contributions to the Bank, including its role as a shareholder of the African Development Bank (AfDB) and contributor to the African Development Fund (ADF).

Relevance: How well aligned is the Bank’s work with the UK’s aid priorities in Africa?

The Bank’s overarching objectives are well aligned with UK development goals.

The Bank’s overarching objectives – inclusive growth and green growth – are well aligned with DFID’s goals, as set out in its 2019 Single Departmental Plan. The Bank’s objectives were set out in its 2013- 2022 strategy, At the Centre of Africa’s Transformation. This defined inclusive growth as “growth that is more inclusive, leading not just to equality of treatment and opportunity but to deep reductions in poverty and a correspondingly large increase in jobs”, and green growth as growth that is “sustainable, by helping Africa gradually transition to ‘green growth’ that will protect livelihoods, improve water, energy and food security, promote the sustainable use of natural resources and spur innovation, job creation and economic development”. They also support key objectives in the UK government’s new cross-departmental approach to Africa (including “promote mutual prosperity, boost economic growth, jobs, trade and development by growing markets… and improving market access”) and DFID’s 2017 Economic Development Strategy (notably the latter’s emphasis on economic inclusion). Although it is not an overarching objective (as it is for the World Bank), poverty reduction and the number of people who are hungry or malnourished, are monitored as high-level (Level 1) indicators by the Bank. The Bank’s four cross-cutting priorities – gender, fragility, climate change and economic governance – overlay its overall objectives. As described in the Bank’s proposal for a seventh general capital increase, these priorities reflect the values of the Bank and its shareholders and link the Bank’s investments to its objectives of promoting inclusive and green growth. They also align well with DFID’s Single Departmental Plan and Economic Development Strategy priorities.

Progress against the Bank’s High 5 priorities is measured in the Bank’s Results Measurement Framework (2016-2025) with targets drawn from a number of sectors as follows: Light up and power Africa (energy sector), Industrialise Africa (finance and transport sectors), Integrate Africa (cross-border energy and transport sectors), Feed Africa (agriculture, transport, and water, sanitation and hygiene sectors), Improve the quality of life for the people of Africa ( jobs, social sectors, and water, sanitation and hygiene). The High 5 priorities support DFID’s sector priorities, and focus on stability, governance and sustainability, as set out in DFID’s 2017 Economic Development Strategy – the department’s overarching strategy for advancing economic development in the poorest countries. Specific sector priorities in this strategy that are directly supported by the Bank’s High 5 include infrastructure, energy and urban development, agriculture, trade, manufacturing and services, and helping countries to capitalise on their extractive potential while increasing transparency. The Bank’s focus on fragile states (termed ‘transition states’ by the Bank) also directly supports DFID’s focus on stability and governance, while its emphasis on building resilience aligns well with DFID’s focus on sustainability and strengthening resilience.

The Bank’s focus on infrastructure (including large, complex cross-regional projects) complements DFID well.

Africa faces critical infrastructure gaps. For example, it currently has a road density (km of road per square km of territory) of 0.04, compared to 1.3 in India and 2.1 in Europe, and infrastructure services for water and energy in Africa cost twice as much on average compared to other developing regions.

Capital markets in developing countries remain incomplete and generally unable to tackle the risks and high transaction costs associated with large-scale infrastructure at the scale required. Most bilateral donors, including DFID, are not able to provide the substantial financing that is required for infrastructure projects. DFID itself does not directly deliver large-scale investments in roads and energy, particularly regional projects. We estimate that DFID’s spending on infrastructure amounts to no more than about 11% of its total spending. In this context, multilateral development banks (MDBs), such as the Bank, which have the capacity to lend large amounts repayable over long periods of time, are well placed to help fill a critical gap in the market for infrastructure finance. Just under half (47%) of Bank loan approvals during 2014-19 were in transport and power. For instance, in the Bank’s strategy for Mali (2015-2019), a country where private capital markets are clearly severely underdeveloped, one of the two strategic pillars is infrastructure development to support economic recovery. During our visit to Nigeria, we found that the Bank clearly has the skills to prepare projects and provide early-stage financing in the infrastructure sector, and hence demonstrate to private investors that such investments are feasible.

The Bank is also well placed to support regional integration in Africa, another DFID priority. Regional integration is a core aspiration of the African Union whose vision includes “an integrated continent, politically united and based on the ideals of Pan Africanism and vision of Africa’s Renaissance”. Promoting regional integration through infrastructure, which includes realising cross-border economies of scale, internalising positive and negative externalities among states, and transferring know-how and investment across borders, requires capabilities and a pan-continental mandate that neither DFID nor most other development partners possess. Regional integration is the specific focus of a separate department in the Bank with responsibility for incorporating regional integration across sectors and ensuring that there are synergies and lesson learning. When asked what the Bank’s biggest contribution to the region had been, Bank staff often mentioned regional integration projects such as roads and bridges. The Bank-financed Road Sector Support Project V in Uganda, which we visited, is an example (see Box 5).

Box 5: Linking Uganda and its neighbours: An example of regional infrastructure

The Bank-financed Road Sector Support Project V in Uganda has financed the upgrading of sections of road from gravel to paved surfaces. The upgraded roads, circled below, are supporting cross-border trade and regional Integration by linking western Uganda with the Democratic Republic of the Congo and eastern Uganda and Kenya at the border of Ishasha and Lwakhakha, respectively. The roads serve the highly productive agricultural areas of Rukungiri and Kanungu (in the west of Uganda), and Mbale and Manafwa (in the east of Uganda). The roads will also support the tourism activities at Queen Elizabeth National Park and Mount Elgon National Park.

The Bank’s standing as the premier African development institution increases the UK’s development impact in Africa, due to its position as a board member and contributor.

A key comparative advantage of the Bank is that it is African-owned. There was a strong and widely shared sense among those we spoke to that the nature of the Bank as an African bank run by Africans, for Africans, is a strength. It confers a legitimacy that no other development finance organisation operating in Africa possesses. Government officials that we met were confident that the Bank has Africa at its heart and no other agenda.

The Bank’s focus on fragile and conflict-affected states in particular fits well with DFID’s emphasis on stability and development in fragile states.

DFID benefits from the Bank’s focus and presence in fragile and conflict-affected states (FCAS), which the Bank calls ‘transition states’. This complements DFID in countries where they are both present, and provides a presence on the ground in a number of fragile states where neither DFID nor CDC are present (see Figure 3). The Bank’s Strategy for Addressing Fragility and Building Resilience 2014-21 (extended due to COVID-19) prioritises rebuilding essential state functions, restoring service delivery and promoting inclusive economic growth in ‘transition states’. Most of this support takes the form of financial support linked to progress in policy reforms. A Transition Support Department (formerly known as the Fragile States Facility) was established in 2008 and coordinates across departments to enhance the Bank’s effectiveness in fragile situations.

The Bank provides funding and technical assistance to ‘transition states’ via three pillars. Pillar One provides supplemental financing predominantly for reconstruction of basic infrastructure, provided they have met specific criteria, which includes a clear plan for phasing out the supplemental financing. Pillar Two covers arrears clearance, drawing on the Transition Support Facility and Post-Conflict Country Facility, to help clear outstanding debt. Pillar Three comprises other forms of targeted support, including technical assistance, such as knowledge management and capacity building.

The Bank has also developed a number of analytical tools to support these objectives, including the Country Resilience and Fragility Assessment tool, which brings new systematic understanding of country fragility and entry points for strengthening resilience. In-depth country and regional fragility assessments have also been instituted, leading to a stronger analytical basis for Bank lending. Fragility assessments are precursors to developing country strategy papers in all ‘transition states’.

There is a tension between the Bank’s ambition to offer a comprehensive menu of development interventions and the need to focus on its core strengths.

The overarching goals of the Bank (inclusive and green growth) and the High 5 constitute a multisector comprehensive set of priorities. However, the High 5 formulation of Bank priorities has been criticised for effectively opening the door to intervention across all areas. This view is shared by those in DFID who are responsible for managing the UK’s relationship with the Bank and who have also urged the Bank to focus on a narrower set of objectives, especially given its limited resources. During the recent negotiations around ADF-15 and the seventh general capital increase (GCI), for example, the UK called on the Bank to be clearer about its comparative advantage, to be more selective when providing financing and to communicate its priorities better. The UK has urged the Bank to focus on areas where it is particularly effective, notably infrastructure, including transport, energy, and water, sanitation and hygiene (WASH).

Our discussions with top management at the Bank made clear that they recognised the need for a clearer statement of the Bank’s comparative advantage. This was subsequently reflected during ADF-15 negotiations, where deputies agreed on the addition of two pillars to sharpen the High 5 priorities: Pillar One would focus on “quality and sustainable infrastructure aimed at strengthening regional integration”, while Pillar Two would focus on “human governance and institutional capacity development for increased decent job creation and inclusive growth”. As noted in the report on ADF-15, in practice the Bank retains considerable latitude under the new twin-pillar formulation to intervene across all sectors by financing hard infrastructure (including schools and hospitals) as well as soft infrastructure; in other words, “building institutional capacity, improving infrastructure procurement, promoting an enabling environment for private sector involvement in infrastructure financing, and enhancing vocational skills development that contributes to decent job creation via infrastructure and its maintenance”.

The Bank treads a fine line between maintaining close relations with its regional members and ensuring objective selection and supervision of projects.

It was apparent from our discussions with a range of stakeholders that the feature of the Bank that is at the core of its distinctiveness – its identity as an African multilateral bank run by African governments for Africa – could in some circumstances also risk undermining its independence. At the AfDB, the board comprises a mix of borrowing and non-borrowing shareholders. The weight of borrowing shareholders is greater (nearly 60% of the total) than in other regional development banks, such as the Inter-American Development Bank and Asian Development Bank, and much greater than the World Bank. This potentially exposes the Bank to greater politicisation of decision-making than in other MDBs. According to this view, the Bank’s comparative advantage as Africa’s bank cuts both ways, as manifested in the Bank’s unwillingness to challenge its regional members sufficiently on issues such as environmental and social safeguards, the need for operations and maintenance spending, and government corruption.

Equally, it is possible that it is precisely because the Bank has a better sense of the environment in which it operates that it is able to succeed in environments that are eschewed by other agencies. However, it is noteworthy, for example, that the Bank has maintained a presence in countries such as Equatorial Guinea, where other multilaterals, such as the International Monetary Fund (IMF) (until recently) and the World Bank, have refused to engage, in part because the macroeconomic pre-conditions for lending were not in place. In addition, the top five shareholders represent a smaller share of total votes than in 22 other multilateral banks, which would tend to reduce the scope for individual shareholders to exert excessive influence. Moreover, 66% of votes are required to ensure approval of loans at the board, in other words, including at least 6% from non-borrowing non-regional countries.

Overall, we found that the Bank does face pressure to align itself with the policies and approach of its larger shareholders – as is the case in all multilateral institutions – many of which are also regional member countries and hence beneficiaries of the Bank’s lending. However, the Bank is also able to understand and potentially mitigate country risk in Africa better than other institutions by virtue of its nature as an African institution.

The African Development Fund is highly rated overall for its transparency, although the Bank as a whole provides less information in relation to non-sovereign operations.

QuODA (an index which measures the quality of official development assistance across 40 bilateral and multilateral organisations) ranks the ADF as the second highest-performing multilateral organisation for transparency and learning. Transparency at the Bank is underpinned by the Disclosure and Access to Information Policy (DAI Policy), which was revised in 2012, and which aims to maximise public access to institutional and operational information. Exceptions to this overall objective include information provided in confidence by private sector entities or third parties, which, in practice, has resulted in limited availability of information on many of the Bank’s non-sovereign corporate loans. Other multilateral banks are also more restrictive in the information they make available for non-sovereign than sovereign loans, and the Bank is broadly in line with them in policy. However, in practice we found that, unlike peers, not all non-sovereign operations approved by the Bank (including recently approved projects) are accompanied by basic project documentation, including environmental and social impact assessments (ESIAs), leading to a lack of transparency in some cases. This includes the extractive sector – one of DFID’s priorities under its transparency objectives. A 2017 decision to disclose ESIAs for all non-sovereign operations does not appear to have been applied retrospectively.

Conclusion on relevance

The Bank’s overarching objectives are well aligned with UK development goals, including key crosscutting priorities such as fragile states and gender. The Bank’s standing as the premier African development institution increases the UK’s development impact in Africa due to its position as a board member and contributor. The Bank also complements DFID well – notably through its financing of infrastructure (including large, complex cross-regional projects). The Bank’s strategy and tools for engaging in ‘transition states’ fit well with the UK’s focus on stability and development in fragile states. However, the Bank is caught between its ambition as Africa’s development bank to provide comprehensive services and pressures to focus on its core strengths.

Overall, we saw a very strong alignment between the Bank’s goals and those of the UK. We, therefore, award a green score for relevance.

Effectiveness: How effective is the Bank at delivering UK aid priorities?

As set out above, there is a very strong alignment between the Bank’s goals and those of the UK. In this section, we examine how effective the Bank has been in delivering against its own goals and hence UK aid priorities. By focusing on the sectors where the Bank lends the most, we throw light on how well the Bank uses the UK’s money. This builds on our findings with respect to relevance and seeks to establish how successfully strategies are being implemented in practice. This section also includes a discussion of how the Bank measures and reports results at sector and project levels in selected case study countries. We also look at how successful the Bank has been in leveraging third-party finance.

Several independent comparative assessments find that the Bank performs better than most other development organisations.

The Bank is one of the most effective multilateral banks. In a recent review of multilateral aid assessments, there were only two multilateral organisations that ranked in the top quartile of organisations for all multilateral aid assessments reviewed, namely the Bank and the World Bank. QuODA ranks the ADF as the third best-performing entity with UK bilateral aid ranking 24th. The Bank scored first under ‘maximising efficiency’.

The Bank has made satisfactory progress towards many of its High 5 priority objectives.

In 2016, the Bank developed a Results Measurement Framework to help it track its development impact across the High 5 priority areas. The framework comprises four levels, each designed to answer a different question:

- Level 1 – What development progress is Africa making?

- Level 2 – How well is the Bank contributing to development in Africa (ie the Bank’s outputs)?

- Level 3 – Is the Bank managing its operations effectively?

- Level 4 – Is the Bank, as an organisation, managing itself efficiently?

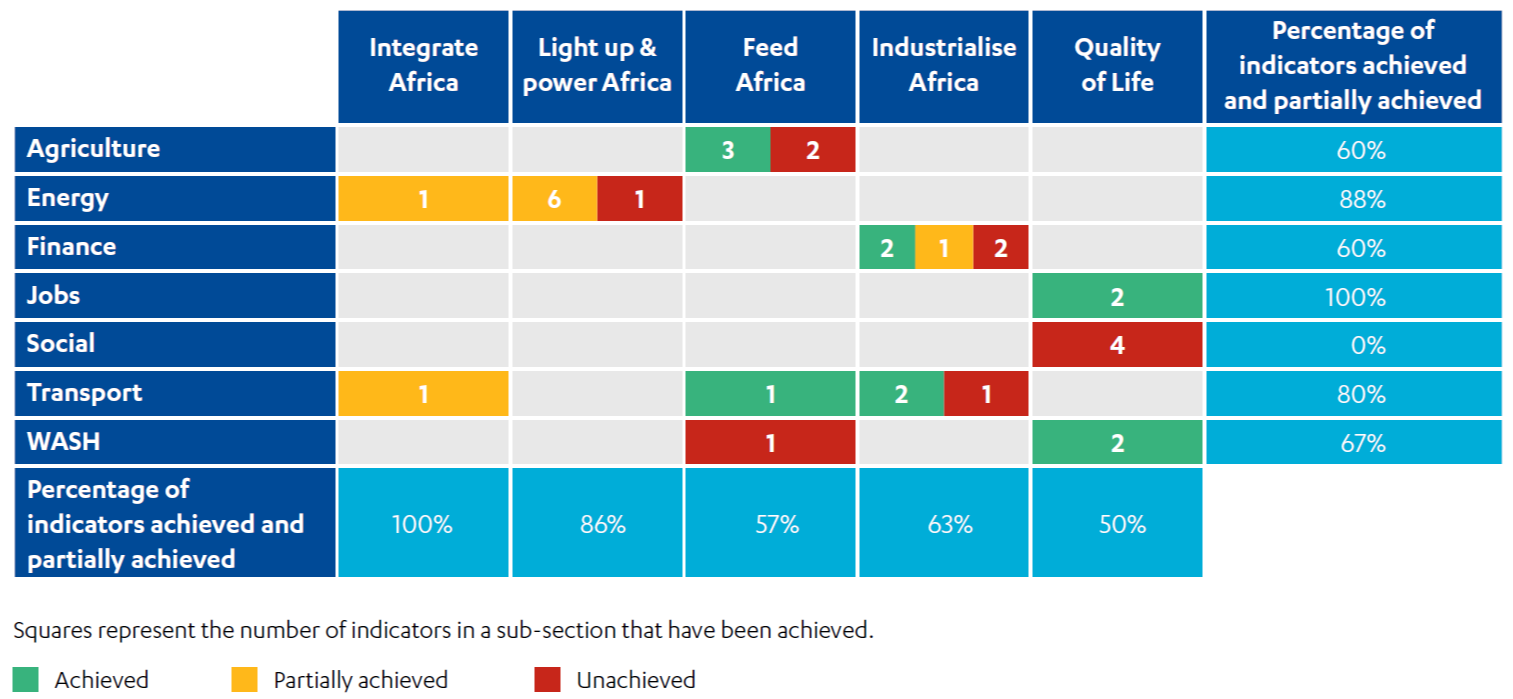

Table 2: High 5 priorities and component sectors

The number of indicators that have been achieved, partially achieved, or not achieved mapped across each High 5 priority and component sector

Source: Annual Development Effectiveness Review, African Development Bank, 2019, and ICAI team calculations.

For each of the High 5 priorities, the new Results Measurement Framework identifies a small set of strategic indicators and targets drawn from the sectors (and associated strategies approved by the board of directors). For example, overall progress towards the Bank’s Feed Africa objective is measured by indicators and targets drawn from the agriculture, transport and WASH sectors (see Table 2).

The Bank’s Annual Development Effectiveness Report shows the Bank’s (both AfDB and ADF) progress towards 2018 and 2025 targets from a 2015 baseline. The Bank assesses its own performance using a traffic light system, like the World Bank Group’s Independent Evaluation Group (IEG). It gives a green light to targets that are 95% achieved or better, amber if targets are less than 95% achieved and red if results are below the baseline value. There is some evidence that the Bank has tended to set overambitious targets. For example, the Bank’s 2025 targets envisage an exponential increase in results across most indicators relative to 2018, without a corresponding increase in financing or change in operating approach that might justify this. Clearly, this creates a significant risk for the future of apparent under-delivery, generated by unrealistic target setting rather than any underlying under-performance. However, ranking the High 5 priorities based on the share of indicators that have so far achieved either a green or amber rating shows that in no case does the share of indicators rated green or amber dip, as measured in 2018, below 50%. The two High 5 priorities for which the Bank is recognised to have a comparative advantage, namely Integrate Africa, and Light up and power Africa, are rated highest, with Quality of life rated lowest. Driving these results are the relatively strong performances of the energy and transport sectors as well as the Bank’s jobs targets, while its performance in the social sectors (primarily relating to education) has been weakest.

There are no comparable operational data for the Africa region alone at the World Bank that track progress against targets. However, the World Bank’s IEG ratings for projects satisfactorily completed in the Africa region during 2014-2017 ranged between 60% and 75%. The AfDB Group’s Independent Development Evaluation (IDEV) unit found that 77% of operations completed at the Bank during 2016-17 (the most recent data cited in the 2019 IDEV report) were independently rated as ‘satisfactory’ or above.

The Bank’s investments are creating jobs through multiple channels. Our interviews with people living and working near two AfDB-financed road projects, and with managers of a power generation facility in Uganda, helped illustrate how these benefits are generated.

Like others, the Bank has struggled to have an impact in fragile and conflict-affected environments, although there is some evidence of inconsistent focus from senior management.

In our case studies, we found evidence that the Bank was clearly seeking to understand the needs of fragile contexts in order to design and deliver projects. The AfDB’s 2014 fragility assessment of Mali helped identify several dimensions of fragility facing the country, including security, political and economic governance, social fragility, environmental fragility, and sub-regional fragility. These carried through to project-level design. For instance, the Integrated Development Project to Build Climate Resilience by the Niger Delta assesses how fragility in Mali is affected by drought. While Nigeria is not classified as a ‘transition state’, we learned during our visit to Nigeria that the Bank’s country office is delivering important projects in northern Nigeria and the River States, where poverty and conflict are high. In practice, however, the Bank has sometimes struggled to be effective on the ground. DFID’s 2016 Multilateral Development Review gave the Bank a rating of ‘weak’ (2 out of 4) for its record in assisting fragile states. Our interviews with DFID suggested that in Somalia the Bank had been unable to raise financing for a trust fund, perhaps because of perceived problems with delivery.

We identified three principal factors preventing the Bank from having greater impact in FCAS. First, operating in FCAS is, objectively, more challenging than in other contexts. The policy and institutional environment is considerably weaker in fragile countries. For example, according to the World Bank’s Country Policy and Institutional Assessment Index, the score for fragile countries in sub-Saharan Africa is 2.8 compared with 3.4 in non-fragile sub-Saharan countries. This reflects a number of factors, including a weaker public sector, economic, financial and budgetary management capabilities. For these reasons, other MDBs have also struggled to have an impact in FCAS. While 72% of country strategy development outcomes at the World Bank were rated ‘satisfactory’ during 2014-18, this figure fell to 46% in the case of FCAS.

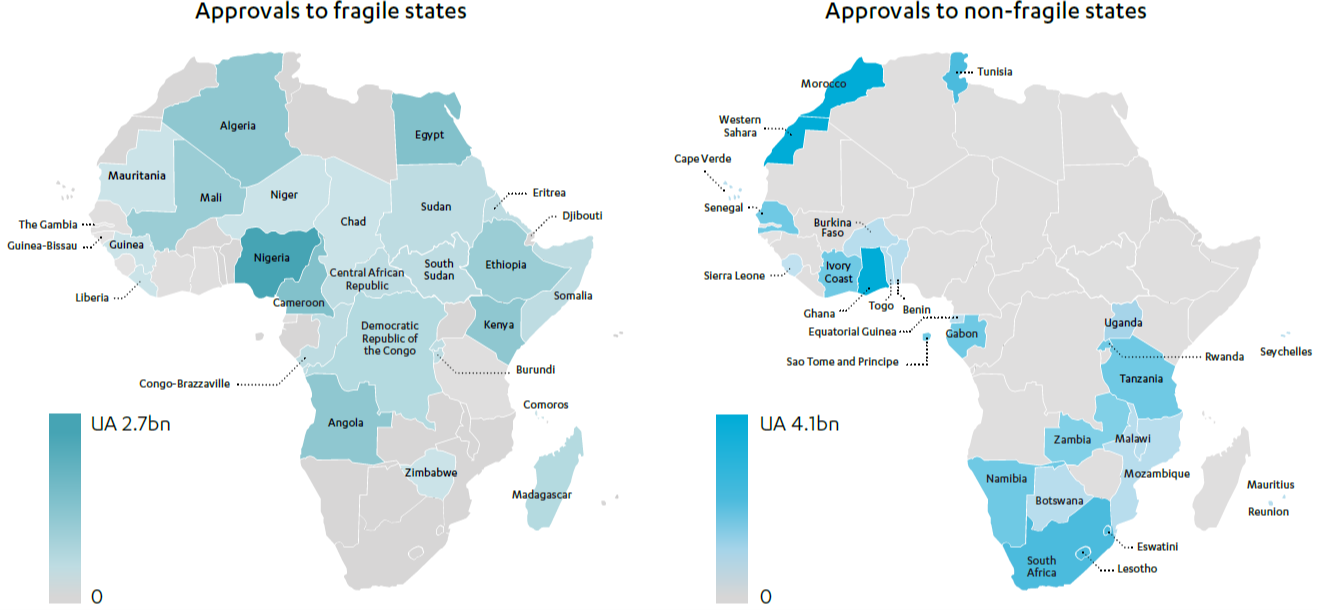

Second, the Bank has faced challenges in recruiting the right mix of skilled staff for field offices in fragile states in its efforts to decentralise its operations. Again, however, the Bank is not alone in facing this challenge. The World Bank, for example, has recently launched a drive to recruit a further 150 staff to work in FCAS, reflecting the difficulty it has faced in posting staff in these difficult environments. Third, there is some evidence that the Bank has not pursued this agenda as energetically as other peer organisations, such as the World Bank. We heard that the Bank’s senior leadership is not as engaged with the issue of FCAS as in the past and has lost momentum in this area. Bank approvals in fragile states during 2014-19 varied over time. Total approvals by volume in fragile states since 2017 have increased. However, the share of total approvals has dipped in recent years, although it is too early to draw firm conclusions from this.

Figure 6: AfDB Group lending to DFID fragile states (2014-19)

Note: We use DFID’s definition of a fragile state. Libya is the only fragile state not to receive any AfDB Group funds over the period.

Source: DFID Methodology note, and AfDB Group Data portal.

There is scope to improve the quality of project management both during preparation and implementation of projects.

In October 2018, the Bank’s Independent Development Evaluation unit published two reports covering the quality of the Bank’s identification, preparation and appraisal of projects (known as quality at entry), and the quality of Bank project supervision and exit. The evaluations benchmarked the Bank against a number of other organisations, including the World Bank in Africa and the Inter-American Development Bank.

Project preparedness

IDEV found that the Bank’s project preparedness was deficient when assessed against some criteria. It found that the Bank adopted the same review process for projects irrespective of risk. It also found that the Bank’s approach lacked mechanisms to ensure contestability of project owners’ assertions, as well as verification and independent review. More generally, IDEV found that the Bank’s main tool for assessing the preparedness of projects, known as the Readiness Review, did not include a number of key determinants of project success, notably evaluability and implementation readiness. The Bank has acknowledged these shortcomings and through its Integrated Quality Assurance Plan aims to improve the design, implementation and monitoring of projects.

IDEV found that a combination of these two factors was able to explain 31% of the variance in project performance and that, on average, projects achieving a composite score of 2.75 had a 65% chance of being high performing. Using this approach, IDEV found that in only one year (2017) did more than half (eight out of 15, or 53%) of projects meet the benchmark composite score of 2.75. However, these results are broadly comparable with the Independent Evaluation Group’s own independent assessment of project preparedness at the World Bank (Africa region), which shows that only 55% of projects were satisfactory in this respect in 2017. IDEV further found that country context, project complexity and the strength of project implementation units in the country all affected the likelihood of projects reaching the benchmark.

Box 6: Generating local economic benefits through road upgrading

In May 2014, the Bank approved a loan of UA 82 million to finance an upgrade of the Rukingiri–Kihihi–Ishasha/Kanungu and Bumbobi–Lwakhakha roads in south-west and east Uganda, respectively. Local traders and householders described how the road is bringing economic benefits to their localities:

“There is less dust from the road and customers can find transport easier… before the road there were lots of potholes but now I can return [from buying goods] to my shop quicker.”

Local store owner

The local store owner also said that the transport fare for his local trip had fallen from $1.36 to $0.82 since the road was made.

“The number of customers has increased and also the number of Kenyans that we see is increasing. Every Wednesday during the market we see more than we did before.”

Woman selling kitchenware by the side of the road

“This road has brought lots of development to the area. I now have more customers, and the land prices around the road have increased.”

Woman selling clothes by the roadside

“School enrolment increased. The competition for becoming a teacher in the local school increased. The population of students in the secondary school has increased three times over since the roads came [children are being brought to school on motorbikes]. The medical centre is now receiving patients late at night and also transporting patients to Mbale.”

Member of the local Grievance Redress Committee

Project supervision and completion

Project supervision and exit at the Bank has got better but there is still ample scope for improvement. IDEV’s report on Bank project supervision and exit was somewhat more positive than its conclusions on quality at entry. It found that the Bank’s project supervision policies and tools were broadly relevant and clear. However, it further found that: (i) the lack of an integrated data system was an obstacle preventing effective project management, (ii) projects were not always well aligned with the gender and fragility priorities of the Bank, (iii) reporting on environmental and social safeguards was weak, (iv) mid-term reviews were insufficiently used as an opportunity to take stock and adjust projects where necessary, and (v) there was a persistent backlog in delayed project completion reports (PCRs). The Bank has made efforts to address this by greater decentralisation of monitoring and project design through the Development Business Delivery Model (DBDM) and greater coordination through the Integrated Quality Assurance Plan. Completion of good-quality PCRs that capture results and draw lessons at the end of a project is a critical component of corporate monitoring and evaluation. Among those validated by IDEV, the share of satisfactory PCRs rose from 74% in 2014 to 77% in 2017. The World Bank equivalent of the Bank’s PCRs are ICRs (implementation completion reports). Like the Bank, these are produced by project or country teams and a selection is then validated by IEG, the World Bank’s independent evaluation team. IEG assesses the quality of over 85% of World Bank ICRs to have been satisfactory since 2015.

Our examination of project documentation in our case study countries illustrated some of the weaknesses in the Bank’s preparation of project completion reports and implementation project reports (IPRs). In our case study of Kenya, we looked at IPRs of the Last Mile Connectivity Project (approved in March 2017), and found that only 50,000 customer connections had been completed, well short of the 314,000 connections targeted for September 2017. Slow progress was attributed to delays in processing invoices in the Ministry of Energy and the Treasury. At the time of the final review in September 2017, the issue had still not been resolved. Despite this, the final review reported that the two outputs of length of low-voltage distribution constructed, and number of customers connected, were ‘progressing well’ and the project maintained a score of 3 (‘satisfactory’). Indeed, the summary of findings across all three annual reviews (September 2016, March 2017 and September 2017) was limited to one-word sentences stating that the project was ‘satisfactory’ or ‘on track’. The project has since improved, but the 2019 IPR still did not provide sufficient explanation as to why certain targets were missed. This suggests that there has been little improvement since a 2015 IDEV review found that PCRs often provide little information about the quality of projects. The same review also found that the Bank’s independent validation of PCRs was akin to undertaking a piece of detective work. The 2019 IDEV review scored PCR quality at 2.8 out of 4 and found that there was still a need for further improvement.

Despite some progress, the Bank has struggled to instil a culture of quality and results.

The Bank has struggled to instil a culture of quality and results in the organisation, and this has held back a more effective implementation of corporate policies and procedures. The IDEV evaluation of Bank supervision and exit found that staff incentives required further attention, and that the ongoing process of decentralisation likewise was incomplete: the share of operations staff based in country offices, which had risen from 29% to 50% between 2011 and 2014, fell back during 2014-16 but rose again in 2017 to 58%. In 2016, the Bank’s senior management committed to addressing the staff incentive structure in response to recommendations by IDEV’s Comprehensive Evaluation of Development Results. The DBDM launched in 2016 was a significant improvement on earlier reforms, partly because it focused on how to train and incentivise managers. From DFID’s perspective, the DBDM and subsequent reform and quality assurance plans are leading to a clearer approach that more succinctly explains how to deliver better results on the ground. The improved approach is also helping to ensure that people are in the right positions, better training is available for managers and that approvals are not the sole focus of KPIs as well as helping to right-size the Bank. If implemented well it should lead to improvements.

However, in several interviews with managers, inside and outside the Bank, we heard the Bank’s culture is characterised as excessively rule-bound, with insufficient weight placed on accountability through results. Our interviews clearly showed that for many it feels like form over function and rules over accountability. Management is seen as risk averse and afraid of staff making mistakes. The share of staff from different member countries has been the subject of controversy, as it is in most multilateral organisations, which has sometimes hampered efficiency, and enhanced the attention to rules as the basis for recruitment or promotion. There may also be specific ‘pinch points’ in the Bank’s overall management resources devoted to supervision and oversight. We heard from senior management at the Bank that oversight capacity and resources are most stretched at the level of middle management, yet donors, including DFID, have not been sufficiently attuned to this.